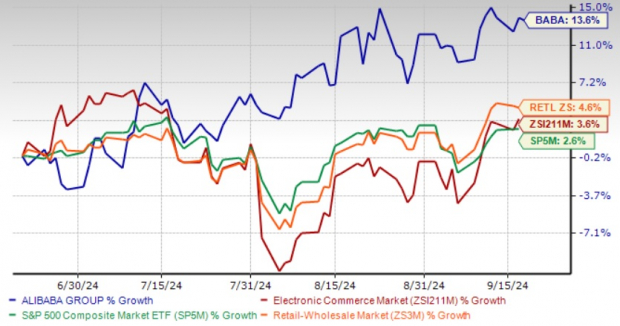

An Upward Journey: BABA Gain of 13.6% in 3 Months

In the last three months, Alibaba (BABA) shares have soared, outperforming not just the Zacks Internet-Commerce industry but also the S&P 500. The driving force behind this impressive surge has been the Alibaba International Digital Commerce Group (AIDC), encompassing key entities like Lazada, AliExpress, and more.

The Tug-of-War: Risks and Rewards

Despite this upward trajectory, global uncertainties and market volatility cast a shadow over BABA stock. The escalating US-China tensions add fuel to the fire, challenging Alibaba’s position amidst competitors like Amazon and eBay. Investors find themselves at a crossroads, balancing Alibaba’s growth prospects with the risks it confronts.

AIDC’s Role in Transforming Alibaba’s Fortunes

AliExpress, Trendyol, and Alibaba.com have become pillars of strength for Alibaba’s international e-commerce segment. Strategic partnerships, localized experiences, and AI-driven innovations are propelling growth in this sector. The introduction of Alibaba Guaranteed for global SMEs and a focus on enhanced user experiences are paving the way for a brighter future.

Bright Prospects: Growth Estimates for BABA

Analysts predict a rosy future for Alibaba, with projections indicating promising revenue and earnings growth in the years ahead. The nurturing of a robust international commerce business and the integration of AI technologies are key factors driving this positive outlook.

Financial Fortitude: A Testament to BABA’s Resilience

Alibaba’s sturdy balance sheet and impressive cash flow generation paint a picture of stability and resilience. The company’s commitment to shareholder-friendly initiatives, such as share repurchases and dividend payments, underscores its dedication to creating value for investors.

A Glint of Hope: Attractive Valuation for BABA

Trading at a discount compared to industry peers, Alibaba presents an appealing investment opportunity with a favorable Value Score. The current valuation metrics suggest that there is untapped potential for growth, making BABA an intriguing option for investors seeking value.

Alibaba’s journey towards sustained growth is marked by both promise and peril. While uncertainties loom large, the company’s solid foundation and strategic initiatives position it well for the future. Investors must tread cautiously, waiting for the right entry point while keeping an eye on Alibaba’s evolving narrative.

For those already invested, Alibaba’s long-term potential offers a beacon of hope amidst turbulent seas. The story of BABA stock is one of resilience, adaptation, and the enduring quest for growth in a dynamic marketplace.

As the saga of Alibaba continues to unfold, investors are reminded of the delicate balance between risk and reward in the ever-evolving landscape of e-commerce.