Baird Elevates Booking Holdings with Outperform Rating

On November 27, 2024, Baird began coverage of Booking Holdings (SNSE:BKNG), giving it an Outperform rating, reflecting positive market expectations for the company.

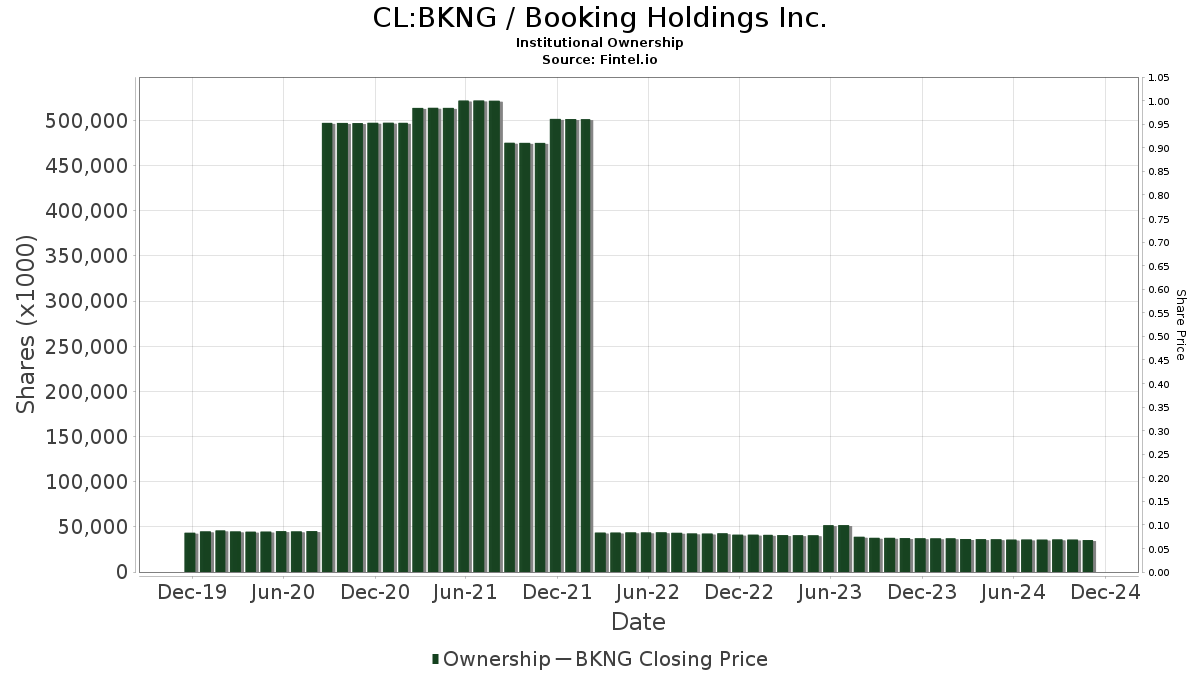

Fund Sentiment: A Closer Look

Currently, 2,945 funds and institutions report positions in Booking Holdings. This represents an increase of 47 funds, or 1.62%, over the last quarter. The average portfolio weight for all funds invested in BKNG has risen by 13.59% to 0.54%. However, total institutional shares owned dropped by 3.65% in the past three months, totaling 35,142K shares.

Activity Among Major Shareholders

BlackRock owns 2,408K shares, equating to 7.27% of the company. Previously, they held 2,414K shares, indicating a slight 0.24% decrease. Their overall portfolio allocation for BKNG declined by 1.62% in the last quarter.

Capital World Investors holds 1,252K shares, or 3.78% ownership, down from 1,500K shares, marking a significant 19.82% reduction and a 15.64% decrease in their allocation to BKNG.

The Vanguard Total Stock Market Index Fund (VTSMX) has 1,062K shares, representing 3.21% ownership. This is a minor decline from 1,071K shares, reflecting 0.86% less interest in BKNG.

Price T Rowe Associates currently holds 1,048K shares, which is a 3.17% ownership share. This is an increase from their previous 996K shares, but they still reduced their portfolio allocation in BKNG by 46.30% in the last quarter.

JPMorgan Chase owns 926K shares, translating to 2.80% ownership. They reported a decrease from 1,042K shares, indicating a 12.58% decline and a drastic reduction in their allocation by 94.10% over the previous quarter.

Fintel provides extensive investment research tools for individual investors, traders, financial advisors, and small hedge funds. Our platform offers comprehensive coverage, including fundamentals, analyst reports, ownership data, fund sentiment, insider trading information, and much more.

Discover more about our services.

This article was originally published by Fintel.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.