Navigating the Fine Line Between Confidence and Caution in Investment

It seems like the consensus is that there’s no recession in sight, but is that truly the case?

While Chief Economist Torsten Sløk indicates a positive outlook citing various economic indicators, it’s crucial to remain vigilant, as history teaches us about the importance of protecting our investments. Legendary investors like Paul Tudor Jones and Benjamin Graham emphasize the significance of defense over mere returns – a perspective worth pondering in today’s volatile market landscape.

Indeed, staying alert to potential risks is vital, not merely resting on laurels of economic prosperity.

So, where might we see signs of trouble that warrant our attention?

Spotting Warning Signs Pointing Towards a Recession

Examining the job market reveals a concerning trend.

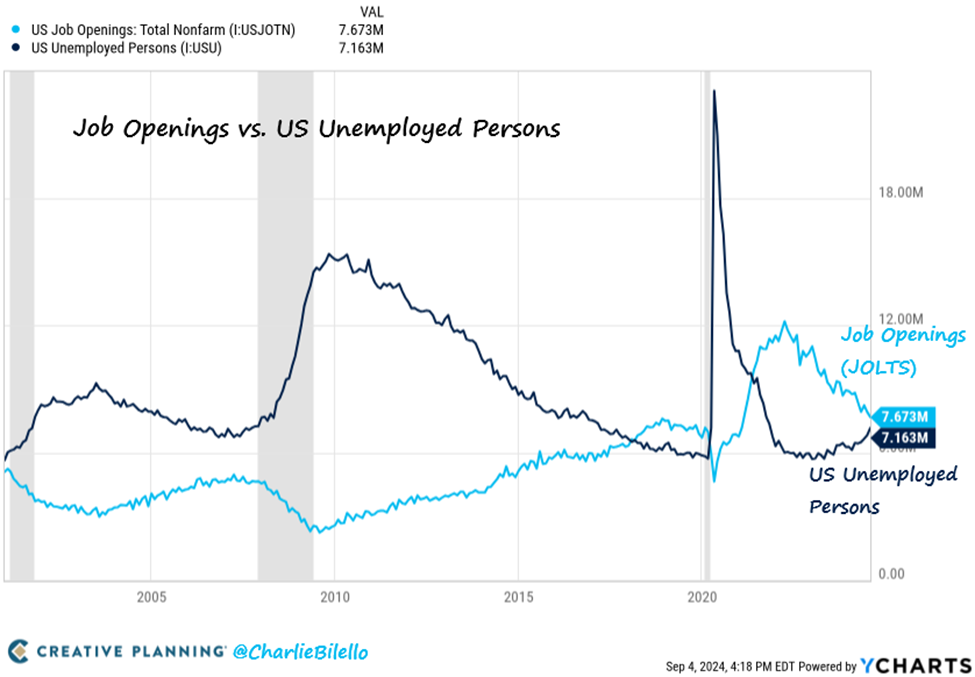

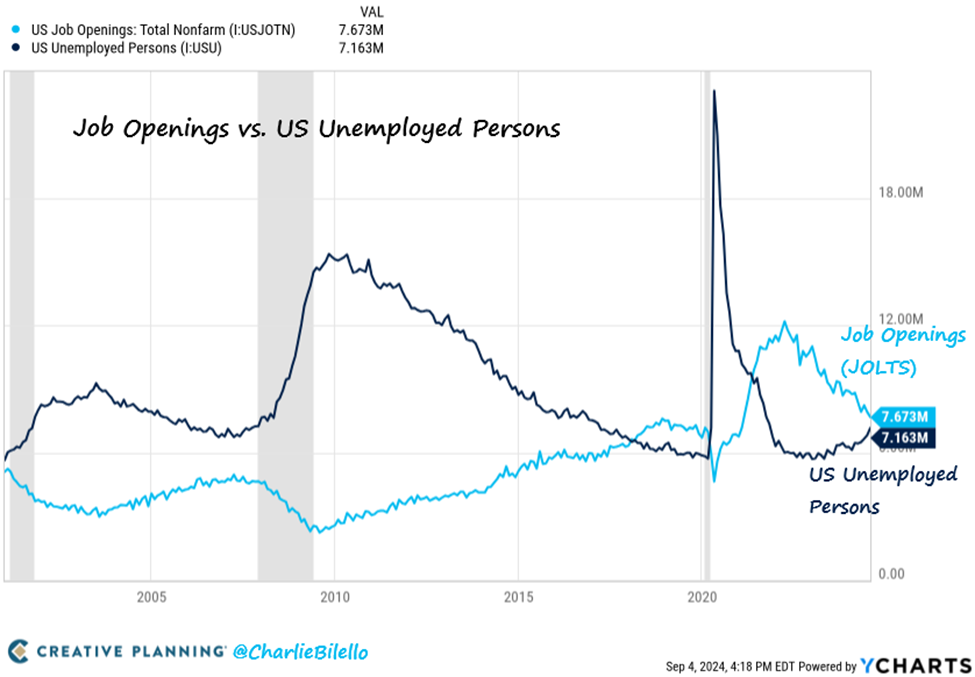

Data from analyst Charlie Bilello suggests a narrowing gap between job openings and unemployment – a pattern that has historically heralded economic downturns. While not a foolproof predictor, this trend begs consideration.

Moreover, corporate hiring and firing trends offer additional insight. Recent announcements of significant job cuts and dwindling hiring plans underscore a potential shift in the employment landscape.

Turning Attention to Manufacturing

MarketWatch reports a continued downturn in the manufacturing sector – a crucial component of the economy.

The Institute for Supply Management’s recent data indicates a fifth consecutive month of contraction, with key indices signaling a bleak outlook for the industry. Long-term data paints a similarly grim picture, with parallels drawn to past recessions.

Source: Charlie Bilello / Creative Planning

The Brewing Storm: Assessing the Economic Landscape

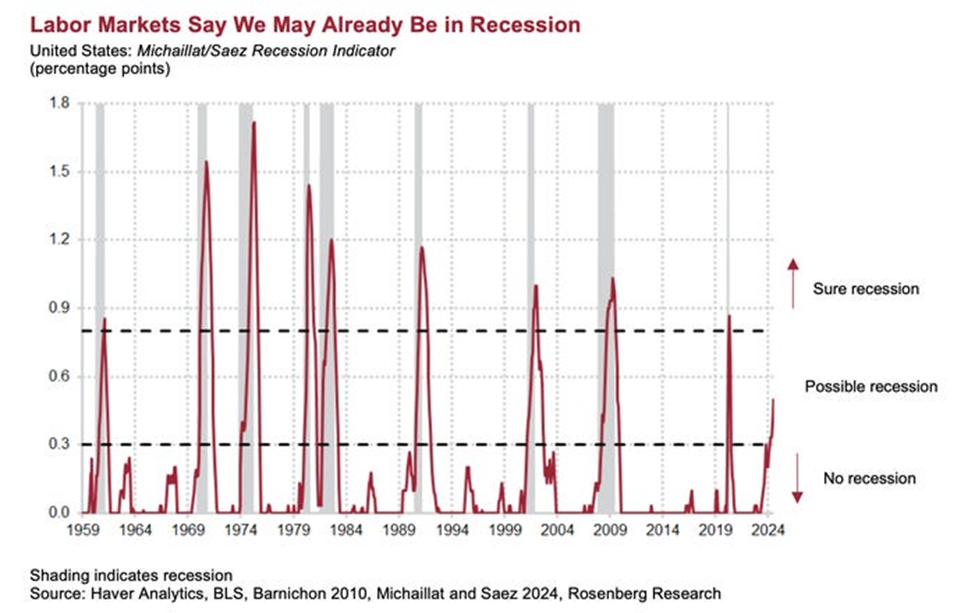

Source: Global Markets Investor / Charles-Henry Monchau

Troubled Waters Ahead: What the Numbers Reveal

A stark reality faces the U.S. economic landscape as indicators paint a troubling picture. The ISM Manufacturing PMI has been in contraction for 21 out of the last 22 months, a rare occurrence only paralleled by the recession era of 1989-91. Corporate bankruptcies surged in August, with 63 filings reported, marking a notable increase from the previous month. The financial woes of small and mid-sized businesses play a significant role in this uptick, as illustrated by the sharp decline in seasonally-adjusted small business earnings since 2020.

The Tumultuous Road to Recession?

Further adding to the ominous signs, the Conference Board Leading Economic Index hit its lowest level in over a year, with five consecutive monthly declines. While some pundits argue against an impending recession, several critical indicators suggest otherwise. The inverted yield curve, which has historically been a reliable recession predictor, has recently normalized. Oil prices languish around the mid-$60s, hinting at subdued economic demand akin to a mild recession scenario.

Reading the Signs: A Brewing Storm

Moreover, the Sahm Rule+, considered a robust recession indicator, suggests that the economy hovers in “possible recession” territory, with levels reminiscent of past economic downturns. While proponents argue for a unique circumstance this time around, history warns against complacency with the infamous saying, “it’s different this time.”

Assessing Cautiously: Hope Amid the Storm

Despite these ominous signals, the future remains uncertain. While a recession is possible, it is by no means inevitable. Balancing caution with optimism is crucial in navigating these uncertain times. As the economic clouds gather, it’s prudent to heed the wisdom of seasoned investors and approach the storm with calculated tact and strategic foresight.

Mastering Market Investment: Balancing Risk and Exposure

As investors, we constantly teeter between the realms of “too much risk” and “not enough risk.” The key lies in skillfully adjusting our exposure levels, strategically choosing where to place our bets in the market. Investing is not a black-and-white decision; it’s more like turning a dimmer knob, gradually tweaking our risk to align with our unique investment style and objectives.

Cautious Optimism in Today’s Market

While caution is prudent, the current market landscape presents a compelling case for active participation. Historical data underscores the positive outcomes of investing post-interest rate cuts. However, this optimism must be tempered with a clear risk management strategy. Unforeseen variables loom on the horizon, capable of disrupting the bull market and imperiling overexposed portfolios.

Fine-Tuning Your Investment Approach

To navigate the complexities of today’s market, reflection is crucial. Determine your desired market exposure based on your financial goals, retirement timeline, and risk threshold. Identify specific sectors, trends, and asset classes where you wish to concentrate your investments. Whether it’s AI technologies, small-cap stocks, or precious metals, align your portfolio with emerging opportunities.

Anticipate future market moves by establishing clear triggers for increasing or decreasing your investments. By addressing these considerations, you can refine your investment strategy and inch closer to your financial objectives while maintaining peace of mind.

Striking the Right Balance

Amidst whispers of a looming recession, the bullish undertones in the market cannot be ignored. The challenge lies in finding the optimal setting for your personal investment “dimmer knob,” harmonizing resilience in a bear market and growth in a bull market. It is crucial to strike a delicate balance between safeguarding your investments and seizing lucrative opportunities.

Navigating Today’s Market Landscape

On the note of a burgeoning bull market, industry experts advocate for a diversified portfolio with exposure to premier AI companies. Drawing parallels between the current market and previous bullish phases, such as 1995, 1998, and 2019, sheds light on the immense potential for growth and profitability.

As you contemplate your investment strategy, remember to heed the insights of seasoned professionals like Luke Lango. Embrace a proactive stance towards market dynamics, leveraging historical trends to inform your portfolio decisions effectively.

Embark on your investment journey with prudence and optimism, positioning yourself for success in the ever-evolving market landscape.