Barclays Boosts CRH Coverage with an Overweight Rating

Fintel reports that on October 29, 2024, Barclays initiated coverage of CRH (LSE:CRH) with a Overweight recommendation.

Analysts Predict a Price Surge

As of October 22, 2024, analysts project a one-year price target average of 8,118.91 GBX/share for CRH. This forecast spans from a low of 6,960.44 GBX to a high of 10,130.55 GBX, reflecting a potential increase of 12.54% from its most recent closing price of 7,214.00 GBX/share.

See our leaderboard of companies with the largest price target upside.

Revenue and Earnings Outlook

CRH’s projected annual revenue stands at 35,995MM, marking an increase of 2.84%. Furthermore, the anticipated annual non-GAAP EPS is 4.04.

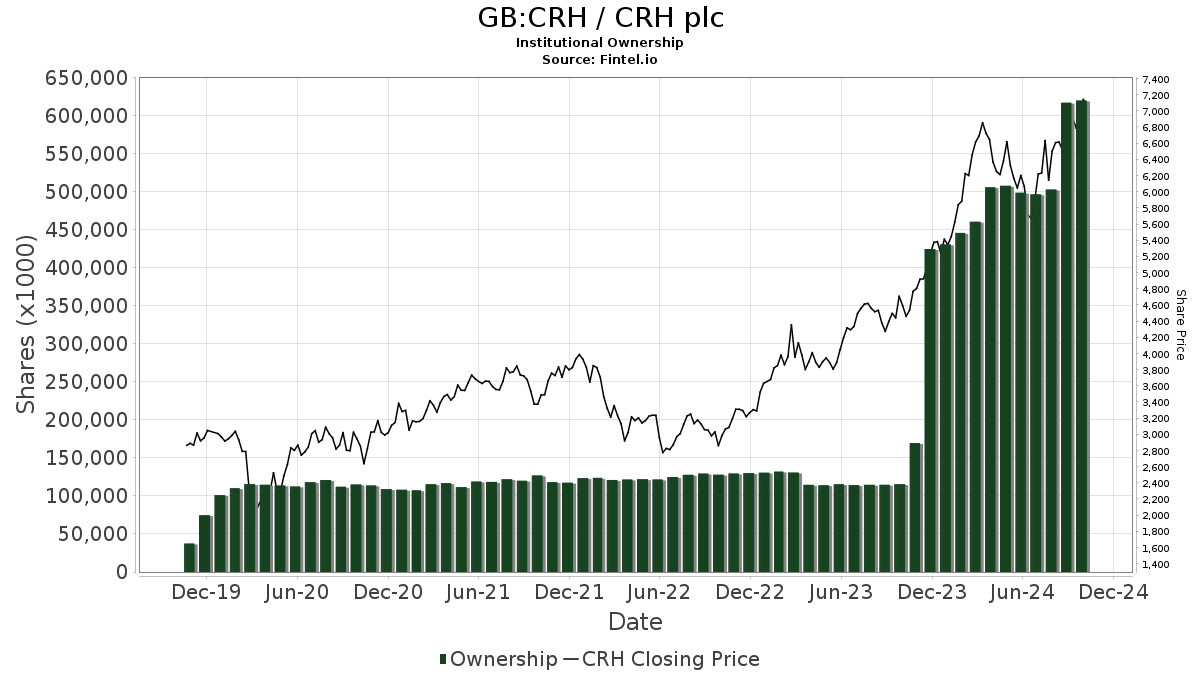

Growing Institutional Interest

There are currently 1,413 funds and institutions with positions in CRH, an increase of 186 or 15.16% from the previous quarter. The average portfolio weight of all funds dedicated to CRH has risen to 0.70%, up 16.15%. During the last three months, total shares owned by institutions climbed by 25.79% to 619,604K shares.

Key Shareholder Activities

Barclays now holds 29,146K shares, translating to a 4.29% ownership stake. Previously, it reported owning 3,453K shares, indicating a substantial increase of 88.15%. Over the last quarter, Barclays has expanded its portfolio allocation in CRH by 545.09%.

Norges Bank has acquired 16,127K shares, now representing 2.37% ownership, up from 0K shares in its last filing, reflecting a full 100.00% increase.

Conversely, DZ BANK AG Deutsche Zentral Genossenschafts Bank, Frankfurt am Main, holds 15,724K shares (2.31% ownership). This represents a slight decline of 1.62% from its prior total of 15,978K shares, resulting in a 75.76% decrease in portfolio allocation over the past quarter.

Select Equity Group has reduced its holdings from 14,758K shares to 14,612K shares, which is a 1.00% decrease, revealing a 4.23% cut in its portfolio allocation in CRH.

Cevian Capital II GP has also decreased its shares from 15,825K to 13,357K, reflecting an 18.48% drop in ownership and a 14.28% reduction in its portfolio allocation.

Fintel is a leading investing research platform serving individual investors, traders, financial advisors, and small hedge funds.

Our comprehensive data includes fundamentals, analyst reports, ownership data, fund sentiment, insider trades, and more, designed to enhance investment decision-making.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.