Barclays Lowers Bath & Body Works Outlook Amid Mixed Institutional Sentiment

On November 8, 2024, Barclays downgraded Bath & Body Works (WBAG:BBWI) from Equal-Weight to Underweight.

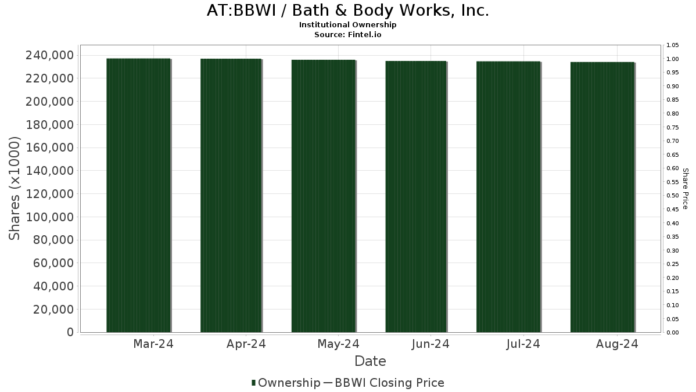

Fund Sentiment Overview

A total of 1,074 funds and institutions are currently holding positions in Bath & Body Works. This marks an increase of 5 funds, or 0.47%, from the previous quarter. The average portfolio weight of these funds invested in BBWI is 0.18%, showing a significant rise of 11.75%. Additionally, institutional shares have climbed 4.12% over the past three months, now totaling 240,193K shares.

Institutional Holdings Update

Third Point currently holds 11,975K shares, which represents 5.47% of the company. This is a decrease from their last filing where they reported 12,850K shares, reflecting a drop of 7.31%. Their allocation in BBWI has seen a significant reduction of 34.66% recently.

Lone Pine Capital has increased its holdings, owning 11,316K shares or 5.16% of the company, up from 9,768K shares previously. This represents a 13.68% increase, although their portfolio allocation in BBWI decreased by 7.05% over the last quarter.

T. Rowe Price Investment Management holds 9,826K shares, constituting 4.48% ownership. Their previous report indicated ownership of 11,810K shares, which marks a reduction of 20.19%. Their allocation in BBWI also fell drastically by 33.00% in the past quarter.

Jpmorgan Chase owns 8,181K shares, amounting to 3.73% of Bath & Body Works. They previously held 6,956K shares, showing a 14.98% increase, yet they reduced their overall allocation in BBWI by an astounding 93.99% during the last quarter.

Price T Rowe Associates currently holds 7,107K shares, accounting for 3.24% of the firm. They reported 7,133K shares previously, which is a slight decrease of 0.36%. Their portfolio allocation in BBWI diminished by 24.06% over the recent quarter.

Fintel is a key investing research platform that provides extensive data for individual investors, traders, financial advisors, and small hedge funds. Our resources encompass fundamentals, analyst reports, ownership data, options sentiment, insider trading, and more, utilizing advanced models to enhance profitability.

This article originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.