Bausch Health Soars on Strong Q3 Performance and Upgraded Revenue Forecast

Shares of Bausch Health Companies Inc. (BHC) surged 12.6% following the release of its impressive third-quarter earnings report on October 30. The company also increased its revenue guidance for the year.

Adjusted earnings per share of $1.12 exceeded the Zacks Consensus Estimate of $1.03. This figure improved from $1.03 during the same quarter last year, owing to a rise in revenues.

Total revenues reached $2.5 billion, reflecting a 12% year-over-year increase. This result also surpassed the Zacks Consensus Estimate of $2.4 billion.

When excluding the effects of $9 million from foreign exchange, $96 million from acquisitions, and $16 million from divestitures and discontinuations, organic revenue growth was 9%.

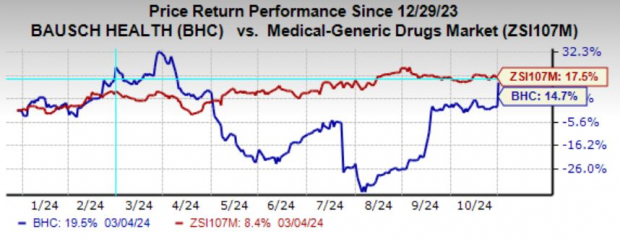

Year to date, BHC shares have climbed 14.7%, while the industry overall has risen by 17.5%.

Image Source: Zacks Investment Research

Stay informed on all quarterly releases: Check the Zacks Earnings Calendar.

Key Highlights from Bausch Health’s Third Quarter

Bausch Health reports revenues from five segments: Salix, International, Diversified Products, Solta Medical, and Bausch + Lomb.

Salix generated revenues of $642 million, marking a 5% improvement over last year. Xifaxan sales rose 7%, driven by increased underlying demand. Revenues from Relistor and Trulance also each gained 9%.

Xifaxan 550 mg tablets are used to reduce the risk of overt hepatic encephalopathy recurrence and treat IBS-D in adults.

Salix revenues exceeded both the Zacks Consensus Estimate of $590 million and our own estimate of $583.9 million.

International revenue reached $291 million, a 6% year-over-year increase, boosted by double-digit organic growth in Canada and steady growth in Latin America. This also topped the Zacks Consensus Estimate of $281 million and our model estimate of $269.9 million, with 8% organic growth.

Diversified Products reported revenues of $269 million, a 4% rise from the previous year, largely due to neurology sales improvements.

Neurology experienced a robust 25% increase year-over-year, supported by Wellbutrin and Aplenzin, while dermatology sales remained unchanged. However, sales from the dentistry sector fell by 8% year-over-year, and the generics sector saw a decline of 58%.

Diversified Products revenues surpassed the Zacks Consensus Estimate of $248 million and our estimate of $252.1 million.

Solta Medical posted revenues of $112 million, showing a 35% increase year-over-year. This too exceeded the Zacks Consensus Estimate of $100 million and our estimate of $101.9 million, achieving 36% organic growth, primarily due to strong performance in South Korea and China.

Bausch + Lomb brought in revenues of $1.19 billion, a 19% rise from last year. However, it fell short of both the Zacks Consensus Estimate and our estimate of $1.2 billion. Bausch + Lomb’s revenues grew 10% organically on a year-over-year basis, thanks to advancements across all business segments.

Advancements in Pipeline Development

In Q3, the company received approval for Cabtreo, a fixed-dose topical treatment for acne vulgaris, launched in October 2024.

Enrollment for a phase II study on amiselimod, a new oral S1P receptor modulator aimed at treating mild to moderate ulcerative colitis (UC), has concluded. BHC has also submitted a draft protocol for a phase III study targeting patients with moderate to severe UC. Furthermore, plans are underway for a phase II study on amiselimod for Crohn’s disease.

The phase III studies within the RED-C program focused on rifaximin for preventing the first episode of hepatic encephalopathy are currently in the treatment phase.

BHC is also progressing with its Clear and Brilliant Touch program, a laser device for skin rejuvenation, while awaiting regulatory feedback in Europe and planning submissions in Asia Pacific markets and Canada.

Bausch Health Updates 2024 Revenue Guidance

BHC has revised its revenue expectations for 2024, now forecasting a range between $9.5 billion and $9.675 billion, an increase from the previous estimate of $9.4 billion to $9.650 billion. Excluding Bausch + Lomb, revenues are expected to be between $4.775 billion and $4.850 billion, up from the previous range of $4.7 billion to $4.850 billion. Bausch + Lomb’s revenue is projected to be between $4.725 billion and $4.825 billion, compared to earlier guidance of $4.700 billion to $4.800 billion.

Analysis of BHC’s Q3 Results

Bausch’s third-quarter performance was impressive, with sales and earnings surpassing expectations, and the updated guidance is another positive signal. The Salix segment has continued its momentum, particularly with the strong demand for Xifaxan.

Recently, BHC’s shares rose following reports of refinancing its debt in preparation for the spin-off of its eye care division, Bausch + Lomb. Management emphasized that fully separating Bausch + Lomb will remain a strategic priority.

Zacks Rank and Other Notable Stocks

Currently, Bausch holds a Zacks Rank #3 (Hold). Other healthcare stocks to consider include Amicus Therapeutics (FOLD), Teva (TEVA), and Amarin (AMRN). Amicus has a Zacks Rank #1 (Strong Buy), while both Teva and Amarin hold a Zacks Rank #2 (Buy). A complete list of today’s Zacks #1 Rank stocks can be found here.

In the last 90 days, estimates for Amicus Therapeutics’ 2024 earnings per share have risen from 20 to 22 cents. EPS estimates for 2025 remained stable at 53 cents during this same timeframe. FOLD’s earnings surpassed estimates in three of the last four quarters, averaging a surprise of 23.96%.

Estimates for Teva’s EPS have increased by a cent to $2.44 over the past 30 days. Teva also exceeded estimates in three of the last four quarters, achieving an average surprise of 8.62%.

Amarin’s 2024 loss per share estimate has tightened by 2 cents in the past 90 days. The company has consistently beaten earnings estimates over the last four quarters, delivering an impressive average surprise of 118.75%.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.