Devon Energy (NYSE: DVN) stands tall as a financial champion post its game-changing union with WPX Energy in early 2021. This strategic move sparked a remarkable upsurge in the company’s free cash flow, propelling it to deliver immense value to investors through dividends, stock buybacks, debt settlements, and strategic acquisitions. Since sealing the merger, Devon Energy has roared ahead with an impressive total return of nearly 190% (or 40.6% annually), effortlessly surpassing the S&P 500‘s roughly 40% return (at 11.4% annually) during the same period.

This oil giant is poised to continue its growth trajectory in lavishing shareholders with value. Here’s an insightful look at the driving forces behind this optimistic outlook.

Fruitful Outcomes of Transformational Transaction

The synergy created by Devon Energy’s merger with WPX Energy in early 2021 paved the way for substantial growth in generating free cash flow. Echoing this view, Devon’s executive chairman Dave Hager stated during the merger, “This transformational merger enhances the scale of our operations, builds a dominant position in the Delaware Basin and accelerates our cash-return business model that prioritizes free cash flow generation and the return of capital to shareholders.”

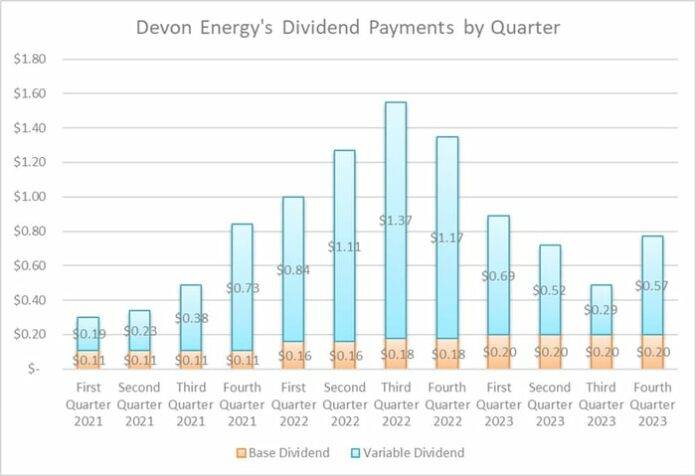

Utilizing the merger as a launchpad, Devon introduced the industry’s pioneer fixed-plus-variable dividend structure. This innovative framework comprised a fixed base dividend with incremental annual increases and up to 50% of excess free cash earmarked for variable dividends. Since its inception, Devon hiked its base dividend rate significantly while showering investors with substantial variable dividends:

Data source: Devon Energy. Chart by the author.

Riding on the wave of rising oil prices and subsequent cash flows, the company’s variable payment surged in the early half of 2022. Notwithstanding periodic fluctuations in oil prices impacting cash flow, Devon continues to amass substantial liquidity to sustain its dividend commitments.

Apart from dividend payouts, Devon efficiently channels its robust cash flows into share buybacks, debt repayments, and strategic acquisitions:

Image source: Devon Energy.

To further solidify its financial ground, Devon repurchased over $2.1 billion in stock post late 2021, retiring 6% of its outstanding shares. Further, it slashed down $1.5 billion in debt post-merger closure, swiftly reducing its leverage ratio to below 1.

Subsequently, Devon embarked on two lucrative acquisitions. The first involved a payment of $865 million to acquire the leasehold interests and related assets of RimRock Oil & Gas in mid-2022. This highly profitable move enabled Devon to boost its base dividend by a staggering 13%. Following this, Devon clinched a $1.8 billion deal for Validus Energy by the end of 2022, endowing it with additional resources to fulfill variable dividend commitments amidst the backdrop of oil price fluctuations.

Continual Dividend Payout Potential

Buoyed by a strong cash generation forecast, Devon Energy anticipates churning out a projected $3.2 billion in free cash flow this year, based on an average oil price of around $80 per barrel. This marks a robust 20% surge from the previous year, fueled by minimized service costs and strategic focus on high-yielding drilling locations.

The company eyes returning 70% of its free cash flow back to shareholders this year through incremented base dividends, share buybacks, and variable dividends. With Devon currently trading at an approximately 11% yield on free cash flow (over 50% cheaper than broader market indexes), the company is likely to prioritize buybacks over variable dividends in the immediate horizon. The remaining 30% will be dedicated to debt repayments and fortifying its financial structure.

While actively scouting for transformative mergers, Devon Energy’s prior acquisition targets have entered agreements with other suitors. Nonetheless, numerous potential merger prospects linger on the horizon. A strategic deal at a favorable valuation could further enhance its cash flow generation potential, continuing the legacy of dividend commitments.

Post the monumental merger with WPX Energy, Devon Energy has evolved into a cash-generating powerhouse. Leveraging this financial prowess, the company funnels its resources into dividends, share repurchases, debt management, and acquisitions. The company stands at the cusp of sustained growth in shareholder value, with potential to capitalize on the ongoing M&A spree in the oil sector to culminate another transformative deal.

Should you invest $1,000 in Devon Energy right now?

Before delving into Devon Energy stock, weigh this:

Motley Fool Stock Advisor analysts recently unearthed the 10 best stocks for investment opportunities, excluding Devon Energy. The cherry-picked 10 stocks are poised to provide substantial returns in the upcoming years.

Stock Advisor offers investors a roadmap to success, with insights on portfolio construction, frequent updates from analysts, and two fresh stock recommendations monthly. Since 2002, Stock Advisor service has outperformed the S&P 500 return by threefold*.

Discover the 10 stocks

*Stock Advisor returns as of February 20, 2024

Matt DiLallo has no position in any stocks mentioned. The Motley Fool has no position in any stocks mentioned. The Motley Fool abides by a disclosure policy.

Opinions expressed are solely those of the author and not a reflection of Nasdaq, Inc.’s views.