Snap (NYSE: SNAP) is on the verge of revealing its fiscal Q4 2023 results on Tuesday, February 6, 2024 (after market close). There’s an air of anticipation around the stock’s ability to surpass revenue and earnings consensus estimates, given its impressive track record in the last quarter. With a 5% year-on-year surge in revenues to $1.19 billion and a 12% year-on-year growth in average daily active users (DAU), the company is expected to continue this trajectory into Q4. The rise in the user base is projected to be the primary driver of Q4 results. To dig deeper into Snap’s potential post-Q4, check out our interactive dashboard analysis on Snap’s Earnings Preview for more insights.

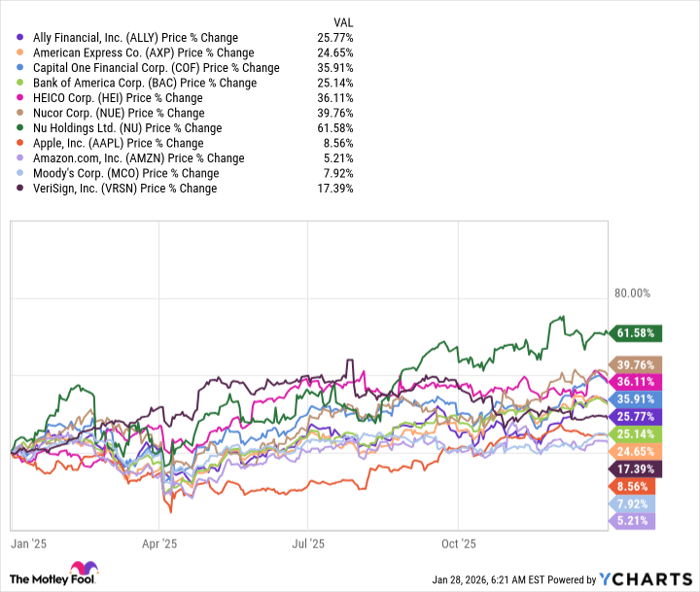

Snap stock has witnessed a tumultuous decline of 70% from about $50 in early January 2021 to around $15 currently, compared to an approximate 30% surge for the S&P 500 over a similar timeframe. However, the dip in SNAP stock has been anything but consistent. The returns for the stock were -6% in 2021, -81% in 2022, and a notable 89% in 2023. Comparatively, the returns for the S&P 500 stood at 27% in 2021, -19% in 2022, and 24% in 2023 – underscoring the fact that SNAP underperformed the S&P in 2021 and 2022. Surprisingly, consistently outperforming the S&P 500 has been challenging in recent years, not just for individual stocks but even for titans in the Information Technology sector like MSFT, AAPL, and NVDA, as well as megacap stars GOOG, TSLA, and AMZN. Contrastingly, our Trefis High Quality (HQ) Portfolio, comprising 30 stocks, has trumped the S&P 500 every year during that period. What sets it apart? As a collective, HQ Portfolio stocks offered superior returns with lower risk as compared to the benchmark index, resulting in a less tumultuous ride, evident in the HQ Portfolio performance metrics. Given the current uncertain macroeconomic landscape with soaring oil prices and elevated interest rates, could SNAP face a situation similar to that of 2021 and 2022 and underperform the S&P over the next 12 months – or is a recovery on the horizon?

Our forecast suggests that Snap’s valuation stands at $14 per share, representing an 18% decline from the current market price of around $17.

(1) Exceeding Revenue Estimates Expected

Snap’s revenues were down 2% year-on-year to $3.24 billion in the first nine months of 2023. Despite registering an increase in daily active users (DAU) year-on-year, there was an adverse drop in average revenue per user due to challenging macroeconomic conditions that led to reduced advertising spending. Overall, we anticipate Snap’s revenues to reach $4.63 billion for FY2023.

Trefis estimates that Snap’s fiscal Q4 2023 net revenues will hover at around $1.39 billion, slightly above the $1.38 billion consensus estimate.

(2) Outperforming Earnings Estimates Anticipated

Snap’s adjusted earnings per share (EPS) for Q4 2022 is expected to amount to $0.07 based on Trefis analysis, comfortably surpassing the consensus estimate of $0.06. The company’s net loss dropped from $1.14 billion to $1.07 billion in the first three quarters of 2023, primarily due to increased interest and other income, offsetting the adverse impact of rising operating costs as a percentage of revenues. We project an improvement in the net income margin in Q4, leading to an anticipated annual GAAP EPS of -$0.80 for FY 2023.

(3) Valuation Lags the Current Market Price by 18%

Snap’s valuation is determined using a revenue per share (RPS) estimate of approximately $2.87 and a P/S multiple of just under 5x in fiscal 2023. This yields a price of $14, signifying an 18% deficit relative to the current market price of $17.

Note: P/E Multiples are based on Share Price at the end of the year and reported (or expected) Adjusted Earnings for the full year

| Returns | Feb 2024 MTD [1] |

Since start of 2023 [1] |

2017-24 Total [2] |

| SNAP Return | 7% | 91% | 17% |

| S&P 500 Return | 2% | 29% | 121% |

| Trefis Reinforced Value Portfolio | 1% | 39% | 614% |

[1] Returns as of 2/5/2024

[2] Cumulative total returns since the end of 2016

Engage with Trefis Market-Beating Portfolios

Explore all Trefis Price Estimates

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.