Preparing for Trump 2.0: Shifting Focus to Dividend Growth Stocks

As income investors gear up for a new era under Trump 2.0, it’s essential to reassess our investment strategies. The market landscape is poised for change, potentially leading to significant opportunities as well as risks.

It’s time to focus on stocks that stand to gain the most from the upcoming presidency. While equities were once out of favor and bonds drew our attention fifteen months ago, the narrative has shifted.

Back then, many financial experts were skeptical of fixed income. Investors who chose to buy bonds despite the prevailing negativity were rewarded. Today, however, the fixed income market appears to be losing steam. With inflation pressures mount, bonds may face downward pressure for the next four years.

What, then, is the best investment strategy for the new administration? Dividend growth stocks are the answer.

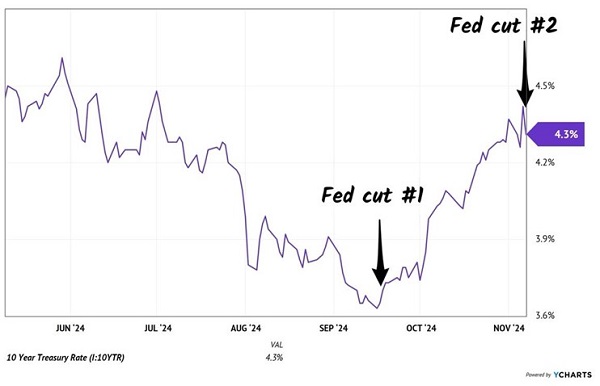

The reasoning is straightforward. The 10-year Treasury yield rose sharply following recent actions by Federal Reserve Chair Jay Powell, who cut rates in September by 50 basis points. However, this only impacted the shorter end of the yield curve, while the 10-year yield surged from 3.7% to 4.4% within weeks.

Bond market insiders, known as “bond vigilantes,” have returned, signaling that inflation remains a concern. Despite this, Powell opted to cut rates yet again last week.

The S&P 500 responded positively to these rate cuts, reflecting investor enthusiasm for easy money. However, Powell’s recent actions may resemble those of a poker player increasingly desperate to win.

The current environment places Powell in a challenging position. With Trump indicating disapproval of Powell’s actions, it raises questions about the Fed Chair’s future. Powell maintains he will not resign, as he is not directly accountable to the President.

As it stands, we can expect Powell to continue implementing measures supporting liquidity. This, in turn, benefits stock values by boosting consumer spending and driving up prices. The three expected pillars of Trump 2.0—economic growth, tariffs, and reduced immigration—could further fuel inflation and higher prices.

In this context, traditional bonds, especially U.S. Treasury bonds, are less appealing. Given the circumstances, would you lend money to the government for a decade when the return is just 4.3% annually?

Moreover, rate-sensitive stocks, such as utility companies with high levels of debt, could face challenges in this environment. Companies that resemble bonds may also diminish in attractiveness as borrowing costs rise. As such, it’s prudent to scrutinize both fixed income and bond-like stocks.

Instead, I propose embracing growth-hungry investments that can keep up with inflation while providing substantial returns. A growth boom is anticipated, and here at Contrarian Outlook, we’ve been preparing for this scenario long before it became a trend. The recent election results only reinforced our belief that inflation is returning, accompanied by rising rates.

To hedge against this inflation and capitalize on growth, consider a high-return investment like EOG Resources (EOG). As economic activity increases, so do energy prices. EOG holds a leading position in drilling permits in the industry.

The company has a remarkable track record of dividend growth, increasing payouts by an average of 22% per year since inception. In fact, just last Friday, EOG announced an additional 7% dividend increase:

The Permit King’s 22% Per Year Payout Growth

Source: Income Calendar

Historically, EOG has managed to reduce the oil price needed to achieve a 10% return on capital from $86 per barrel in 2014 to just $42 last year:

Oil Price EOG Needs for 10% ROC

Consequently, any increase in oil prices translates to enhanced cash flow for EOG. The company returns approximately 75% of its cash flow to shareholders through regular and special dividends each year, a figure that is set to grow further with rising energy prices. CEO Ezra Yacob has confirmed that EOG aims to return all free cash flow to shareholders in the near future.

Being the leader in drilling permits has its advantages.

EOG’s stock has already appreciated by 8% since I recommended it as a top buy last month. With its robust dividend, it is likely to continue to climb.

FedEx (FDX) serves as another strong candidate for this growth investment scenario. I keep a close eye on this stock, searching for favorable buying opportunities. It benefits directly from the ongoing growth in e-commerce, which has become increasingly important in today’s market. FedEx’s cash flow and dividends have a consistent upward trajectory:

Special Delivery Dividends

Source: Income Calendar

Interestingly, e-commerce’s share of total retail sales has steadily increased for 20 years, experiencing a significant surge in 2020. After a brief cooldown, e-commerce sales are now surpassing previous highs:

E-Commerce Sales as % of Total Retail Sales

Though FedEx recently delivered cautious guidance for 2025, pressing their stock price downwards, I viewed this dip as an opportunity. I anticipated an upward surprise from the company based on the overall economic scenario. Following my recommendation, FDX has gained 7% since.

As we transition into Trump 2.0, bond investments lose their allure, while the package delivery sector looks promising. The surge in e-commerce is set for another boost.

If you’ve been holding underperforming bonds and stocks, now is the perfect moment to pivot towards the investments that can thrive under Trump 2.0. My favorite options come from my “3X Dividend Solution“, where I identify high-potential winners for the upcoming administration. Click here and I’ll share my research on my five favorites.

Also see:

– Warren Buffett Dividend Stocks

– Dividend Growth Stocks: 25 Aristocrats

– Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.