It’s easy to mistake the similarities between two behemoth home improvement retailers, Lowe’s Companies (NYSE: LOW) and Home Depot (NYSE: HD), at first glance. But for savvy investors, the devil is truly in the details. And in this showdown, there is a clear winner: Home Depot. Here’s why.

Home Depot and Lowe’s: Different Strokes

While both Lowe’s and Home Depot will continue to weather their respective storms in the retail landscape, the preference leans heavily towards Home Depot for discerning investors right now.

Begin with Lowe’s, which runs 1,746 stores exclusively in the United States. In the past fiscal year, the company clocked in a respectable $86 billion in revenue, with a significant portion coming from everyday consumers. On the flip side, Home Depot operates 2,335 stores sprawled across North America, including Latin America. Despite having fewer physical locations, Home Depot’s revenue dwarfs Lowe’s at an impressive $153 billion. Notably, half of Home Depot’s earnings come from catering to professional contractors – a detail not to be overlooked.

A Glint of Hope: Rising Demand on the Horizon

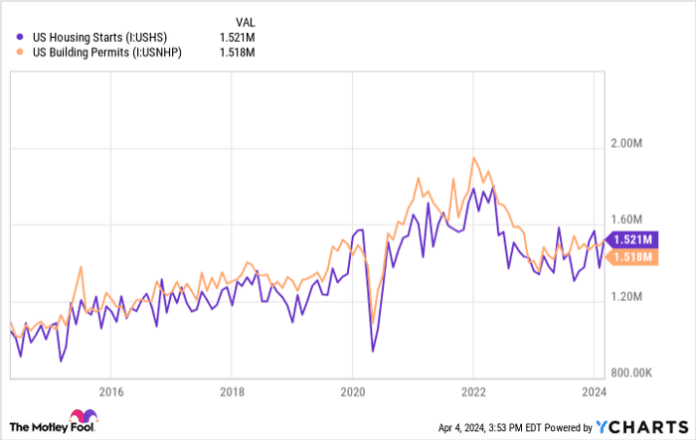

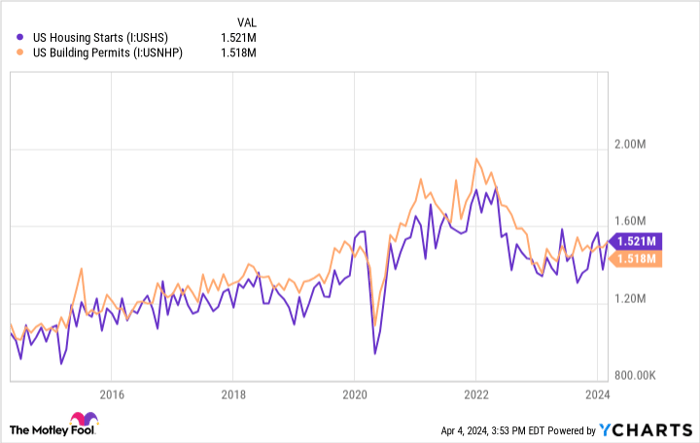

While Home Depot did face the brunt of market struggles in 2022 and 2023, largely due to the real estate sector woes impacting new home constructions, there is a silver lining that investors ought to focus on. The housing market’s anticipated rebound, driven by anticipated interest rate cuts and a renewed zest for home buying, is imminent. The National Association of Home Builders/Wells Fargo Housing Market Index is a robust 40% higher since December, signaling a promising outlook for homebuilders.

Moody’s analysis predicts a housing deficit of 1.5 – 2 million homes by year-end, even with strong construction activity. This gap is expected to persist, posing a long-term growth opportunity for Home Depot. According to Harvard University’s Joint Center for Housing Studies, the slowdown in home renovations is likely to plateau in the near future.

The Financial Landscape

Home Depot’s superiority doesn’t just stem from its contractor-centric approach. Its robust financials and expansive reach also contribute to its allure. With a staggering $15.1 billion in net income in 2023, far exceeding Lowe’s $7.7 billion, Home Depot’s profitability and scalability are evident. This translates to a continuous stream of investments in growth initiatives.

Since 2018, Home Depot has been funneling billions into technological advancements, strengthening supply chains, bolstering e-commerce platforms, and harmonizing in-store and online experiences. Recent moves to allocate $1 billion towards employee wages and a hefty $15 billion stock repurchase program underscore Home Depot’s commitment to enhancing shareholder value.

Furthermore, Home Depot’s strategic acquisition of SRS Distribution, a provider of construction supplies to contractors, complements its existing clientele base, emphasizing its agility and foresight in anticipating market needs.

While Lowe’s is not incapacitated from making such investments, its smaller scale could potentially pose challenges compared to its larger counterpart.

Seeing the Bigger Picture

If you are currently holding Lowe’s, there’s no cause for alarm. But for investors eyeing long-term growth, Home Depot’s myriad advantages – from its extensive reach to its customer base and strategic investments – present a compelling case. As the housing market revives, Home Depot stands poised to reap the rewards of recovery. Additionally, Home Depot’s higher dividend yield of 2.5% overshadows Lowe’s at 1.8%, accentuating its attractiveness for investors looking to maximize returns.

Remember, in the stock market, every little detail counts and compounds over time. Home Depot’s strategic positioning and continuous innovation make it a stalwart contender in the realm of retail giants.

Should You Invest in Home Depot Right Now?

Before diving into Home Depot stock, consider this: the Motley Fool Stock Advisor team has unearthed the top 10 stocks for investors to capitalize on currently – and Home Depot is notably absent from the list. These 10 chosen stocks are projected to deliver substantial returns in the forthcoming years.

The Motley Fool’s Stock Advisor service offers a comprehensive roadmap for success, providing insights on portfolio construction, analyst updates, and two fresh stock picks monthly. Since 2002, the service has outperformed the S&P 500 by a triple-fold*.

Explore the top 10 stocks today

*Stock Advisor returns as of April 4, 2024

Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Home Depot and Moody’s. The Motley Fool recommends Lowe’s Companies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the author’s own and do not necessarily reflect those of Nasdaq, Inc.