In 2023, the artificial intelligence (AI) market exploded, leading businesses across a wide range of industries to enter the sector. At first, the rush of interest in AI seemed almost like a temporary trend that would eventually fade. However, multiple companies have begun seeing significant gains from AI, suggesting the technology boom is here to stay.

In fact, the AI market was worth just under $200 billion of total revenues last year, with the figure expected to hit close to $2 trillion by 2030. Spending in the industry is rising quickly, and it’s not too late to invest.

Microsoft (NASDAQ: MSFT) and Advanced Micro Devices (NASDAQ: AMD) are two attractive options, with one leading the way in AI software services and the other taking on a crucial role in chips.

So, let’s examine these tech giants and determine which is the better stock to invest in AI.

Microsoft

Microsoft shares popped 5% in extended trading on April 25, when the company posted its third quarter of 2024 earnings. The quarter saw revenue rise 17% year over year to $62 billion, beating Wall Street forecasts by $1 billion.

During the quarter, the company enjoyed the biggest gains in its Intelligent Cloud segment, which includes income from its AI-focused cloud platform Azure. The segment posted revenue growth of 21% year over year, highlighting just how lucrative Microsoft’s AI push could be.

Microsoft was an early investor in AI, sinking $1 billion into ChatGPT developer OpenAI in 2019. That investment has since grown to about $13 billion, granting Microsoft access to some of the most advanced AI models in the industry.

The Windows company has integrated OpenAI’s technology across its product lineup, including new offerings in its Office productivity suite, cloud platform Azure, and search engine Bing. Microsoft’s vast financial resources, significant user base, and OpenAI’s technology could prove a powerful combination and see the company become one of the biggest threats in AI.

Advanced Micro Devices

Shares in AMD have climbed 83% in the last 12 months, with growth primarily based on the company’s long-term potential in AI rather than concrete results.

AMD was slightly late to the AI party, with its rival Nvidia getting a head start. However, AMD will release its first-quarter 2024 earnings on April 30, which could finally show signs that its investment in AI is paying off. Over the last year, the company has pivoted its business to the industry, launching its MI300X, an AI graphics processing unit (GPU) meant to compete directly with Nvidia’s offerings. Meanwhile, Microsoft, Oracle, and Dell are already using AMD’s new chips in their systems.

As a result, all eyes will be on growth in AMD’s data center segment in Q1 2024. Investment research firm Zacks projects AMD’s data center revenue to be $2.28 billion in the quarter, rising 76% year over year. If AMD can meet expectations, the company’s stock could pop.

Moreover, the chipmaker is expanding into AI-powered personal computers, seeking to lead its own subsector of AI. Research from IDC forecasts that AI PCs will account for nearly 60% of all PC shipments by 2027, indicating AMD’s venture into the industry could be a smart long-term move.

Chip stocks are some of the best ways to invest in AI, as these companies are developing the hardware that makes the market possible. AMD likely has a bright future in the industry in the coming years and could be worth investing in before it’s too late.

Is Microsoft or AMD the better AI stock?

Microsoft and AMD have made significant progress in AI and will likely be crucial figures in the industry’s development over the next decade. Meanwhile, these companies are benefiting from each other’s success, with Microsoft utilizing AMD’s chips in its network.

However, Microsoft is potentially the more reliable buy, thanks to the potency of its services and its second-largest market share in cloud computing. The company attracts billions of users with its Office and Azure platforms, indicating it could become a leading driver in commercial and public adoption of AI.

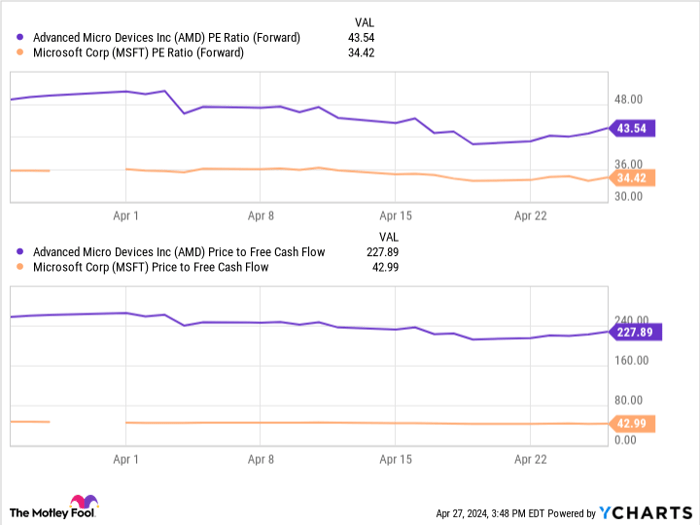

Data by YCharts

Additionally, this chart shows that Microsoft’s stock is trading at a significantly better value than AMD’s. Microsoft’s forward price-to-earnings (P/E) ratio and price-to-free cash flow are far lower than the same metrics for AMD, suggesting that shares in Microsoft give you more bang for your buck.

Microsoft’s stock trades at 34 times its earnings, which isn’t exactly a bargain. However, it is preferable to AMD’s 43. The same goes for the companies’ price-to-free cash flow ratios. In fact, Microsoft’s free cash flow hit $70 billion last year compared to AMD’s just over $1 billion, illustrating that Microsoft is better equipped to continue investing in its AI technology and keep up with its rivals.

Microsoft’s glowing quarterly results, quickly expanding cloud business, and vast financial resources make it worth its high valuation. In my eyes, it’s a better AI investment than AMD right now.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Microsoft made the list — but there are 9 other stocks you may be overlooking.

See the 10 stocks

*Stock Advisor returns as of April 30, 2024

Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, Nvidia, and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.