Surprising Stock Market Stars: Uncovering 2024’s Hidden Gems

There’s no denying 2024 has been a remarkable year for the stock market. As of now, the S&P 500 has risen nearly 28% year to date. However, some stocks have outperformed this already impressive gain.

Leading the pack are notable performers like Nvidia, which has surged 180%, and Palantir Technologies, boasting over 300% growth. These companies are well-known, but let’s explore three other S&P 500 members that may not be on your radar, yet have exceeded market expectations this year.

1. Walmart

Founded over 60 years ago, Walmart (NYSE: WMT) is recognized worldwide as a leading brick-and-mortar retailer. Surprisingly, Walmart’s stock has jumped an impressive 82% year to date, defying expectations for a company of its size.

It’s important to note that Walmart’s stock price increase has outpaced its underlying business growth, indicating a shift in valuation. Although sales growth has been modest, increased profitability has supported a higher stock price.

Walmart’s progress in digital retail has significantly contributed to this success. As e-commerce gains traction, the company has capitalized on higher-margin opportunities, particularly in areas like digital advertising. Furthermore, its recent acquisition of Vizio, a smart-TV company, is expected to enhance this trend.

While it might not see another staggering 82% price increase in 2025, Walmart appears poised for continued growth, driven by its digital expansions. This presents a strong case for shareholders to remain invested.

2. Deckers

Unlike tech giants, Deckers Brands (NYSE: DECK) specializes in footwear. This seemingly simple business has experienced remarkable success, with its stock price rising over 660% in the past five years, including an 85% increase this year alone.

It’s worth mentioning that Deckers’ valuation has shifted from reasonable to relatively high for a shoe company. However, its growth has been exceptional, with operating profit margins increasing significantly over time.

In the first half of its fiscal 2025, ending in September, Deckers reported an operating margin exceeding 20%. Several years prior, this margin was below 10%. This demonstrates that the company is earning considerably more profit on the same sales volume.

Moreover, Deckers’ sales have surged, particularly benefiting from its Hoka and Ugg brands, which are showing promising growth projected in the coming fiscal year.

In summary, Deckers’ popularity signals strong demand for its products, leading to higher sales and profits. Continued success in this trend positions Deckers stock as a solid investment, despite its recent substantial gains.

3. GoDaddy

Nearly two decades after its iconic Super Bowl commercial, GoDaddy (NYSE: GDDY) has remained a significant player. Investors might assume its best days are behind it, but the stock has surged 95% in 2024, challenging that notion.

Known primarily for domain registration, GoDaddy has diversified its offerings to help businesses flourish online. This shift is key to its growth strategy, as selling additional products can lead to sustainable free cash flow increases.

Recently, GoDaddy launched new AI software that is accelerating the adoption of its products. Management highlights that tasks that once took months can now be completed in seconds, driving additional spending from current customers and boosting free cash flow.

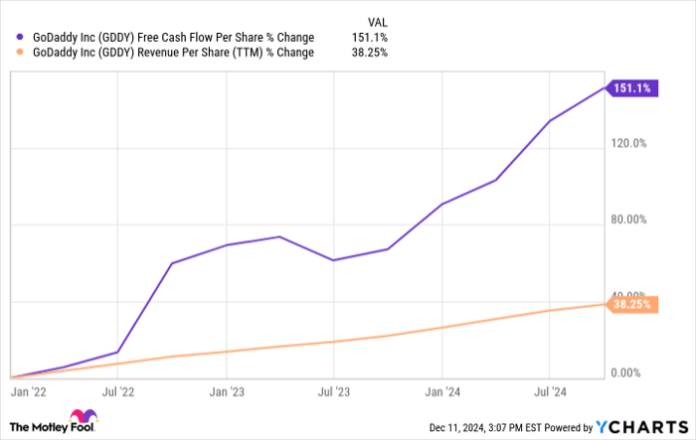

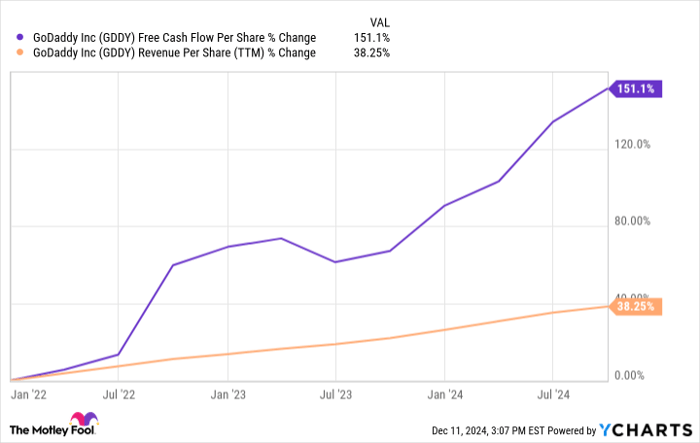

This trend is evident, as GoDaddy’s free cash flow per share is now increasing at a much faster rate than its revenue.

GDDY Free Cash Flow Per Share data by YCharts.

While GoDaddy’s stock price has risen significantly in recent years, its increase aligns closely with its free cash flow growth. This indicates that its valuation remains relatively stable, trading at 24 times its free cash flow.

If the AI software continues to drive adoption, GoDaddy may see substantial growth again in 2025, as many customers have yet to utilize it fully.

The stocks that excelled this year may offer valuable insights for identifying next year’s potential winners. Companies’ business trends often have lasting effects, making the best performers from 2024 worthy of further investigation. Therefore, Walmart, Deckers, and GoDaddy are stocks worth evaluating more closely.

Of this trio, I personally favor GoDaddy. Its reasonable valuation, coupled with prospects for rapid growth over the next year, makes it an appealing option.

Don’t Miss This Second Chance at a Potentially Lucrative Opportunity

Have you ever felt like you overlooked the chance to invest in top-performing stocks? If so, you might want to pay attention.

Our experienced analysts occasionally recommend “Double Down” stocks—companies they believe are about to experience significant growth. If you’re concerned you might have missed your opportunity, now could be the best time to invest before it’s too late. The results speak volumes:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $348,112!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,992!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $495,539!*

Right now, we’re offering “Double Down” alerts on three exceptional companies, and this may be a rare opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 9, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia, Palantir Technologies, and Walmart. The Motley Fool recommends GoDaddy. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.