Bill Ackman Bets Big on Uber: A Look into the Ride-Hailing Giant’s Future

A Strategic Move into Uber Technologies

Bill Ackman, the founder and CEO of Pershing Square, manages a hedge fund with approximately $12.9 billion in assets under management. His portfolio includes substantial investments in major companies like Alphabet, Nike, and Chipotle Mexican Grill.

On Friday, Feb. 7, Ackman announced via the social media platform X (formerly Twitter) that Pershing Square has acquired 30.3 million shares of Uber Technologies (NYSE: UBER), which leads the world in ride-hailing services. With Uber’s stock closing at $74.60 on Friday, this position is now valued at $2.2 billion, making it Pershing’s largest investment.

The Case for Uber’s Growth Potential

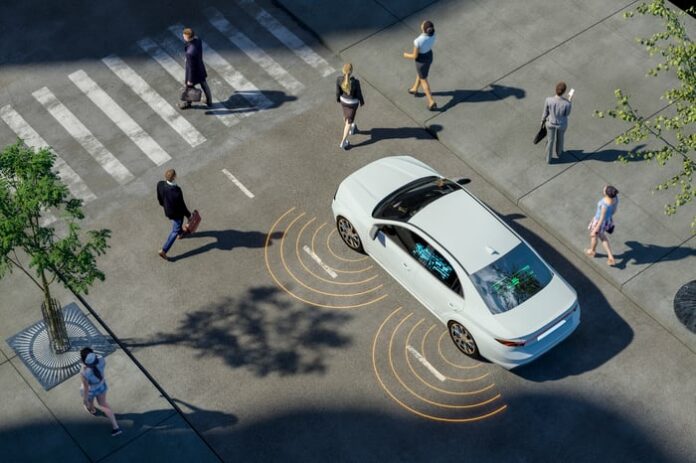

Ackman asserts that Uber is currently undervalued compared to its true worth. The company’s potential for growth is significantly tied to the advent of autonomous vehicles. These self-driving technologies could reshape Uber’s business model and enhance profitability by reducing operational costs.

Image source: Getty Images.

Uber’s Ambitious Valuation of the Autonomous Market

Uber caters to over 171 million users monthly through its ride-hailing, food delivery, and trucking services. In 2024, the company reported gross bookings of $162.7 billion, which reflects the total revenue generated from these activities.

Despite this impressive figure, Uber drivers earned $72.5 billion in 2024, the largest portion of the gross bookings. After accounting for driver expenses and restaurant fees for food orders, Uber’s revenue plummeted to $43.9 billion.

If Uber successfully eliminates the hefty costs associated with drivers, its revenue could rise significantly, allowing the company to retain a larger portion of its gross bookings. This explains Uber’s aggressive pursuit of autonomous vehicle technology for its various services.

Even with a switch to autonomous driving, some expenses would still exist, such as fees to companies providing the self-driving technologies. Nonetheless, self-driving cars can operate continuously at lower costs, enhancing profitability compared to human drivers.

Uber could potentially purchase and manage its fleet of autonomous vehicles, hence absorbing the entire gross booking amount per ride. Tesla plans to sell its Cybercab robotaxi for around $30,000, presenting an interesting option for Uber, although it would mark a significant departure from its usual business model of relying on drivers with personal vehicles.

Nonetheless, CEO Dara Khosrowshahi suggests that the autonomous vehicle market could represent a staggering $1 trillion opportunity for Uber in the U.S. alone.

Collaborations with Industry Leaders

Khosrowshahi highlights that Uber is heavily invested in its autonomous strategy, even if widespread deployment is still years away. The company has partnered with several firms dedicated to autonomous technology such as Waymo, WeRide, Motional, Serve Robotics, and Nvidia.

Currently, Waymo leads with over 150,000 paid autonomous trips conducted each week in cities like Phoenix, San Francisco, and Los Angeles, many of which are facilitated through Uber. By the end of this month, riders in Austin will soon have the option to request a Waymo autonomous vehicle, with plans to expand to Atlanta by 2025.

Additionally, Uber has collaborated with Serve Robotics to deploy over 2,000 autonomous food delivery robots in California and Texas for Uber Eats. Starting in the fourth quarter of 2024, the company began offering autonomous food delivery in Austin and Dallas through another partner, Avride.

An intriguing development arose when Uber partnered with Nvidia in January. Having facilitated over 12 billion trips last year, Uber possesses a wealth of data that can assist in training the AI models central to autonomous software. It plans to utilize Nvidia’s platforms to analyze this data, potentially expediting its partners’ paths to commercialization.

The quicker autonomous vehicles hit the market, the sooner Uber can reap significant cost savings. Moreover, they may discover a new revenue stream by monetizing their valuable data.

Implications of Ackman’s Investment on Uber’s Future

After deducting operating expenses from the $43.9 billion in revenue, Uber realized a net income of $9.8 billion in 2024, translating to an earnings per share (EPS) of $4.56. This results in a price-to-earnings (P/E) ratio of 16.3, which is 51% lower than the P/E ratio of the Nasdaq-100 tech index, which sits at 33.6.

From this angle, Uber’s stock appears highly undervalued, clarifying Ackman’s rationale behind his interest. However, due to one-time tax benefits amounting to $5.7 billion in 2024, the actual earnings were considerably lower. Wall Street forecasts that Uber’s EPS could decline by 46% this year to $2.44 as these benefits phase out.

Consequently, Uber’s stock could face a forward P/E ratio of 30.5, still an attractive figure. Assuming the Nasdaq-100’s P/E ratio remains steady, Uber’s stock must gain 10% by 2025 just to align with its tech counterparts. Moreover, analysts anticipate a 36% growth in EPS for Uber by 2026, signaling further upside for the stock.

Ultimately, the opportunity presented by autonomous driving may indeed be the strongest argument for holding Uber stock long-term. If the expected $1 trillion opportunity materializes, the stock could be significantly undervalued now.

Should You Consider Investing in Uber Technologies?

Before jumping into an investment in Uber Technologies, consider this:

The Motley Fool Stock Advisor analyst team has identified what they regard as the 10 best stocks to invest in now, with Uber Technologies not among them. These selected stocks may yield substantial returns in the upcoming years.

For perspective, consider when Nvidia made it onto this list on April 15, 2005… an investment of $1,000 at that time would now be worth $813,868!*

Stock Advisor equips investors with a straightforward guide to success, featuring insights on portfolio construction, regular updates, and two new stock picks each month. The Stock Advisor service has outperformed the S&P 500 more than four times since 2002*.

Learn more »

*Stock Advisor returns as of February 7, 2025

Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board. Anthony Di Pizio does not hold positions in the mentioned stocks. The Motley Fool has investments in and endorses Alphabet, Chipotle Mexican Grill, Nike, Nvidia, Serve Robotics, Tesla, and Uber Technologies. The Motley Fool recommends the following options: short March 2025 $58 calls on Chipotle Mexican Grill. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.