Strong Q1 Performance for BILL Holdings with Robust Revenue Growth

Financial Results Exceed Expectations

BILL Holdings (BILL) reported earnings of 63 cents per share in the first quarter of fiscal 2025, surpassing the Zacks Consensus Estimate by 28.57% and increasing 43.2% compared to the previous year.

Revenues rose to $358.5 million, representing a 17.5% increase year over year, and exceeded the consensus estimate by 3.01%. This growth was driven by an impressive 18.8% rise in BILL’s core revenues.

During the reported quarter, the company processed $79.9 billion in total payment volume (TPV), which is a 13.8% year-over-year increase. The TPV included $72.8 billion from its Integrated Platform, up 12.7%, and $7.1 billion from Embedded & Other Solutions, which saw a significant rise of 26.8%.

By the end of the fiscal first quarter, BILL Holdings served 476.2K businesses, marking an increase from 471.2K in the prior year. This customer base included 192.5K clients from its Integrated Platform (up 10.8%) and 283.7K from Embedded & Other Solutions (down 4.6%).

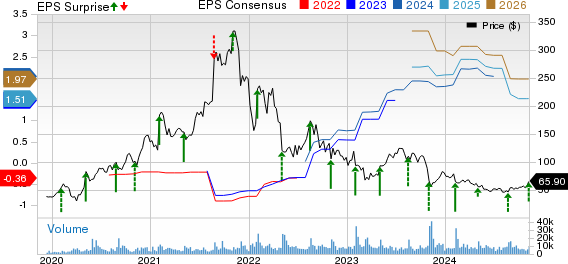

BILL Holdings, Inc. Price, Consensus, and EPS Surprise

BILL Holdings processed 29 million transactions in the first quarter, reflecting a 16% year-over-year increase.

Despite a year-to-date decline of 6.4% in BILL shares, underperforming the Zacks Computer & Technology sector’s return of 28.5%, shares gained 1.82% in pre-market trading, fueled by stronger core revenue growth and positive guidance.

A Closer Look at BILL Holdings’ Quarter

In this quarter, core revenues—comprising subscription and transaction fees—totaled $314.9 million.

Subscription fees, accounting for 21.4% of core revenues, were $67.4 million, showcasing an increase of 8% year over year. Meanwhile, transaction fees made up 78.6% of core revenues, totaling $247.5 million, which marks a 22.1% rise compared to the same period last year.

Revenues from the Integrated Platform—encompassing BILL AP/AR and BILL Spend and Expense segments—reached $294.9 million, up 18.2% year over year, contributing 93.6% to core revenues and 82.3% to overall revenues.

Embedded & Other Solutions brought in $20.1 million, marking a 28% increase year over year and contributing 6.4% to core revenues and 5.6% to total revenues.

Float revenues, primarily from interest on held customer funds, stood at $43.5 million, reflecting a 9.2% year-over-year increase.

BILL’s Operating Performance

In the first quarter, non-GAAP gross profit amounted to $307 million, representing a year-over-year increase of 16.9%. However, the gross margin declined by 50 basis points (bps) from the prior year, settling at 85.6%.

Adjusted research and development expenses for the quarter totaled $54.7 million, down 10.6% year over year. Adjusted sales and marketing expenses rose by 10.6% to $115.4 million, while adjusted general and administrative expenses decreased by 5.2% to $49.1 million.

BILL Holdings reported a non-GAAP operating income of $67.1 million, which is a remarkable increase of 100.9% from the previous year. The operating margin grew by 780 bps, reaching 18.7%.

Financial Health of BILL Holdings

As of September 30, 2024, the company held cash, cash equivalents, and short-term investments totaling $1.47 billion, down from $1.59 billion as of June 30, 2024.

Cash flow from operations was $88.6 million in the first quarter, a rise from $78.6 million in the preceding quarter.

During the fiscal first quarter, BILL repurchased 3.7 million shares of common stock at a cost of $200 million.

BILL Holdings’ Optimistic Guidance

For the second quarter of fiscal 2025, BILL anticipates revenues between $355.5 million and $360.5 million, indicating year-over-year growth of 12-13%. Non-GAAP earnings per share are expected to range between 44 cents and 48 cents.

For the entire fiscal year 2025, the expected revenues are between $1.44 billion and $1.46 billion, implying similar growth of 12-13% year over year. Non-GAAP earnings per share estimates stand between $1.65 and $1.83.

Zacks Rank and Recommended Stocks

Currently, BILL Holdings has a Zacks Rank of #3 (Hold).

CyberArk Software (CYBR), NVIDIA (NVDA), and Bilibili (BILI) are among better-ranked stocks in the Zacks Computer and Technology sector. As of now, CyberArk Software holds a Zacks Rank of #1 (Strong Buy), while NVIDIA and Bilibili maintain a Rank of #2 (Buy). For a complete list of today’s #1 Rank (Strong Buy) stocks, visit Zacks’s website.

CyberArk Software shares are up 34.6% year to date and is scheduled to report its third-quarter 2024 results on November 13.

NVIDIA shares have skyrocketed 200.3% year to date, with third-quarter fiscal 2025 results being reported on November 20.

Bilibili shares gained 98.6% year to date and are set to release third-quarter 2024 results on November 14.

Explore Investment Opportunities

Investors may take interest in emerging opportunities as infrastructure spending is projected to rise significantly. With a robust allocation of federal funds aimed at upgrading America’s infrastructure, investors are poised to benefit.

Discover five key stocks positioned to thrive from this upcoming spending wave by downloading our free report today.

For the latest investment recommendations from Zacks Investment Research, download the report on 5 Stocks Set to Double.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

CyberArk Software Ltd. (CYBR): Free Stock Analysis Report

Bilibili Inc. Sponsored ADR (BILI): Free Stock Analysis Report

BILL Holdings, Inc. (BILL): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.