Contrasting Investment Strategies: Yass vs. Griffin on Nvidia

Jeff Yass and Ken Griffin, leading figures in finance, have showcased differing investment tactics regarding Nvidia. Yass is the co-founder and managing director of Susquehanna International Group, and Griffin serves as CEO of Citadel, a well-known hedge fund. Their quarterly filings provide insight that many investors closely monitor.

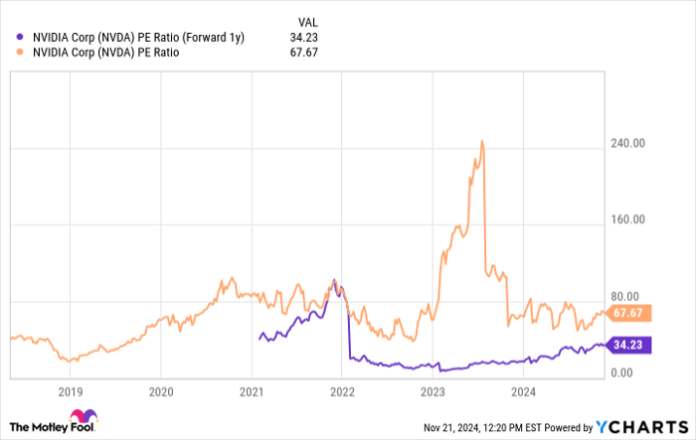

In the third quarter, Susquehanna International Group reduced its ownership of Nvidia by selling off 29% of its shares. Additionally, Yass’s firm scaled back its positions in Nvidia options. Although Yass has not publicly shared his thoughts on Nvidia, it seems the decision may stem from valuation concerns rather than a lack of faith in the company’s potential.

NVDA PE Ratio (Forward 1y) data by YCharts.

Typically, when a stock is highly valued, it becomes increasingly challenging for a company to meet the soaring expectations of investors. For instance, Nvidia recently posted impressive third-quarter earnings with a 94% year-over-year revenue growth. However, its softer guidance for the next quarter led to a slight drop in its stock price following the earnings announcement. High past achievements can create high expectations, making it tough for future performance to keep pace.

Citadel’s Bold Bet on Nvidia

Contrastingly, Citadel significantly increased its stake in Nvidia during the same quarter, nearly tripling its holdings. This bullish stance typically indicates that the firm is more focused on the company’s long-term potential rather than immediate valuation concerns. Unlike most hedge funds that aim for shorter-term targets, Citadel may believe Nvidia’s growth trajectory remains strong.

During Nvidia’s recent earnings call, management highlighted their new Blackwell architecture AI chips, which reportedly offer significant improvements in efficiency and speed compared to previous models. The demand for these chips appears high, with 13,000 samples sent out in the last quarter, suggesting a bright future as major customers prepare to implement them.

Given the robust economy and potential shifts in political leadership and interest rates, Citadel may expect that Nvidia can sustain momentum. Analysts, too, have reflected optimism, issuing favorable ratings and increasing earnings projections for Nvidia. Should the company manage to maintain its valuations, its stock could well continue to rise.

Evaluating Investment Decisions: A Mixed Perspective

While my outlook aligns more with Yass and Susquehanna’s cautious approach, it’s worth noting that many who sold Nvidia have faced losses. This context explains why investor interest in Nvidia persists despite its high valuation.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.