“`html

Millennium Management Adjusts AI Investments: A Closer Look at Microsoft and Meta Platforms

Each quarter, institutional investment firms managing over $100 million must file a form 13F with the Securities and Exchange Commission (SEC). These 13Fs serve as detailed receipts showcasing which stocks Wall Street firms are buying and selling.

While reviewing the third quarter filings from Millennium Management, led by billionaire investor Israel Englander, an interesting detail emerged. The hedge fund reduced its stake in Nvidia by 12.6%, marking its fourth consecutive quarter as a net seller of Nvidia shares.

Now, let’s explore two notable investments in the artificial intelligence (AI) sector that Millennium has recently made, signaling a strategic shift away from Nvidia.

1. Microsoft: A Rising Star in AI

During the third quarter, Millennium Management purchased 1.6 million shares of Microsoft (NASDAQ: MSFT), increasing its investment in the company by 51.4%.

Microsoft has played a pivotal role in the AI revolution, particularly since its $10 billion investment in OpenAI shortly after the release of ChatGPT in November 2022. This partnership allowed Microsoft to integrate cutting-edge generative AI technology across its various services.

The launch of Microsoft’s Copilot product suite is a result of this collaboration. According to CEO Satya Nadella, “Nearly 70% of the Fortune 500 now use Microsoft 365 Copilot, and customers continue to adopt it at a faster rate than any other new Microsoft 365 suite.”

Nadella’s assertion shouldn’t be overlooked. By being one of the first major players in AI, Microsoft has been able to develop and market these services efficiently. The swift uptake of Copilot among large businesses over the past two years suggests a strong future outlook. Nadella hints that Copilot’s growth is still in its early stages.

As noted by fellow Fool.com contributor Danny Vena, Microsoft’s Azure cloud business saw a 12-point contribution from AI services, which will be essential for the company moving forward.

Microsoft remains a dominant player in the cloud space, competing primarily with Amazon and Alphabet. As the market evolves, it’s critical for investors to track Azure’s growth relative to these competitors, while also understanding how much of that growth is driven by AI initiatives.

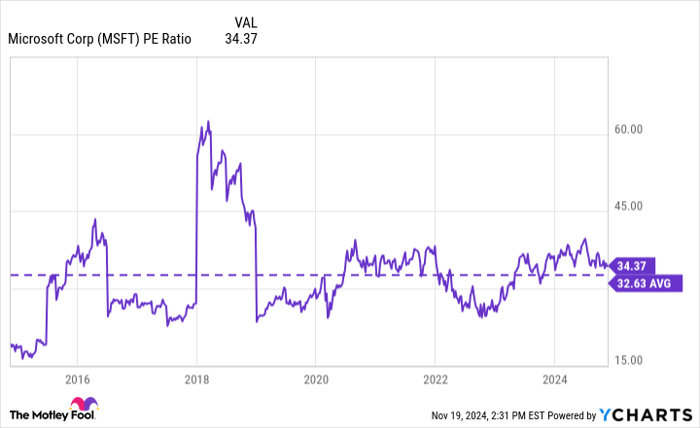

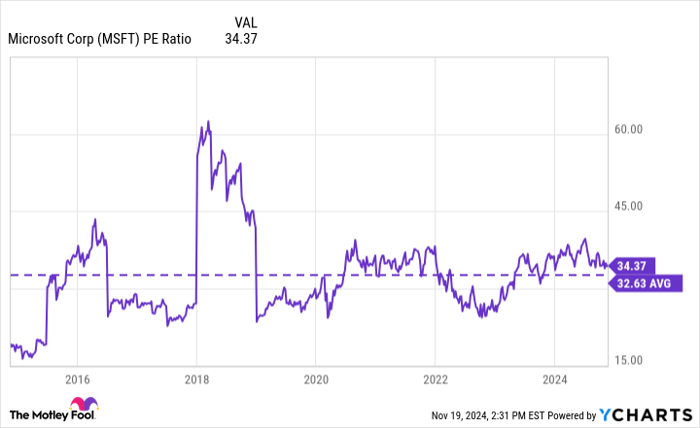

MSFT PE Ratio data by YCharts

Microsoft’s robust presence in AI is likely a factor in Englander’s decision to invest in the stock. Currently, Microsoft shares have a price-to-earnings (P/E) ratio of 34.4, higher than the S&P 500‘s average of 27.9. However, this figure aligns closely with Microsoft’s 10-year average P/E ratio.

In fact, Microsoft might be undervalued at this moment. The company has expanded significantly over the last decade, and as the AI landscape continues to grow, Microsoft’s trajectory appears promising.

I believe Microsoft presents a compelling investment opportunity right now, making Millennium’s decision to buy the stock potentially wise.

2. Meta Platforms: Cautiously Moving Forward

Another AI stock that Englander has invested in during the third quarter is Meta Platforms (NASDAQ: META). The table below illustrates Millennium’s stock activities in Meta over previous quarters.

| Metric | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 |

|---|---|---|---|---|---|

| Shares Owned | 2.3 million | 2.0 million | 2.5 million | 1.2 million | 1.3 million |

Data source: Hedge Follow.

The data reveals that Millennium has fluctuated its position in Meta stock throughout the quarters. Notably, the fund reduced its holdings significantly between Q1 and Q2, only to increase its investment again in the latest quarter.

Understanding Meta’s position in AI has posed challenges. While the company boasts extensive advertising operations, platforms like Facebook and Instagram must contend with tough competition from Google, YouTube, TikTok, and others, including Pinterest and Snap.

Meta’s early AI efforts produced mixed outcomes. Although its ventures into virtual and augmented reality remain uncertain, its generative AI model, called Llama, is beginning to rival offerings from major competitors like Amazon, Google, and OpenAI.

As discussed in a previous article, integrating AI into Meta’s products could enhance user engagement across its social media platforms. Management confirmed during the third-quarter earnings call that AI applications are starting to increase user time on Facebook and Instagram.

If Meta can leverage these rising engagement rates to boost its advertising revenue, the additional funds could be reinvested into further AI advancements, contributing to a more robust business strategy.

While Meta still has much to prove, there are signs of a positive shift, which might be influencing Englander’s decision to cautiously reinvest in this stock.

Should You Invest $1,000 in Microsoft Right Now?

Before you consider investing in Microsoft, reflect on this:

The Motley Fool Stock Advisor analyst team has recently highlighted what they believe are the 10 best stocks for investors to consider now, and Microsoft is not included in that list. The selected stocks have the potential to deliver significant returns in the near future.

Consider this: When Nvidia was recommended on April 15, 2005, a $1,000 investment at that time would now be worth $869,885!*

Stock Advisor provides a straightforward roadmap for investors, featuring portfolio-building guidance, regular analyst updates, and two new stock picks each month. Since its inception in 2002, the Stock Advisor service has more than quadrupled the return of the S&P 500.*

View the 10 stocks »

*Stock Advisor returns as of November 18, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Pinterest. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`