Millennium Management Adjusts Strategy: Selling AI Stocks and Betting on Electric Air Taxis

Billionaire hedge fund manager Israel Englander co-founded Millennium Management in 1989 with $35 million. Today, Millennium has over $70 billion in assets under management and ranks among the largest hedge funds globally. With an impressive track record, Englander is known for his exceptional investing acumen. Investors often look forward to Millennium’s quarterly 13F filing, which the Securities and Exchange Commission (SEC) requires that reveals a fund’s holdings.

A Unique Investment Approach

Millennium operates as a “pod shop,” allocating capital to various teams, known as “pods,” each pursuing distinct strategies independently. This means an investment may not directly originate from Englander, yet as CEO, he influences key decisions and trusts his portfolio managers. While it’s wise not to blindly follow these managers, they can provide valuable insights and spur new ideas.

Shifting Away from AI Favorites

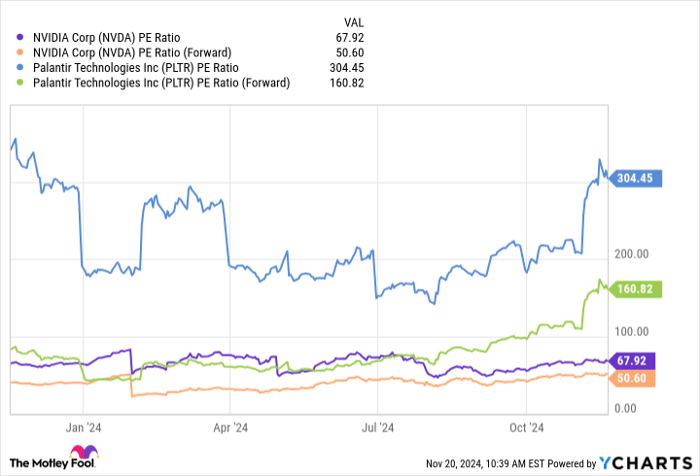

In the third quarter, Millennium significantly reduced its positions in popular AI stocks Nvidia (NASDAQ: NVDA) and Palantir (NYSE: PLTR), following a broader trend witnessed among large funds. Millennium sold 13% of its stake in Nvidia but still retains 11.15 million shares and options. In a more drastic move, it divested 90% of its Palantir shares while increasing its options on the stock, possibly indicating a straddle strategy. These sales seem to stem from concerns about high valuations in a market viewed as overheated, largely driven by tech and AI themes over the past couple of years.

NVDA PE Ratio data by YCharts

Valuations for these stocks are notably high, raising awareness of the importance of investment valuation—even in promising sectors like AI. While potential remains strong, buying at inflated prices poses risks. A striking example is Nvidia, whose recent earnings report displayed almost double sales year-over-year; despite that, the stock price fell following guidance that failed to impress investors.

Exciting New Venture in Electric Aviation

During the third quarter, Millennium acquired over 3.2 million shares in electric aircraft manufacturer Archer Aviation (NYSE: ACHR) for about $9.8 million, securing its position as the 11th-largest shareholder of the company.

Archer aims to launch air taxis in select U.S. cities, offering a novel solution to traffic problems. Their Midnight electric aircraft can operate consecutive 20- to 50-mile flights with minimal downtime, accommodating up to four passengers plus a pilot, all while producing little noise.

So far, Archer has hit several regulatory milestones, such as obtaining final airworthiness criteria from the Federal Aviation Administration (FAA) and completing 400 test flights ahead of schedule. In August, the plan for a new air taxi network in Los Angeles could transform lengthy drives into quick flights lasting just 10 to 20 minutes. The company has also partnered with Southwest Airlines to advance its network. While the timeline remains uncertain, commercial flights could commence by 2025.

Analysts are optimistic about Archer’s potential, assigning an average price target of $9.38, suggesting an 88% upside from current levels. The most bullish analyst predicts a target of $12.50, representing an impressive 151% upside. However, it’s crucial to remember that investing in firms like Archer is akin to backing a late-stage startup, as profitability remains elusive. Still, with favorable risk-reward dynamics, investors could reap substantial gains if Archer succeeds in capturing market share.

Seize Your Chance for Potentially Profitable Investments

Have you ever felt you missed out on investing in successful stocks? Well, here’s your chance to catch up.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies they believe are on the verge of significant growth. If you think you’ve missed your moment, now may be the perfect time to invest before opportunities slip away:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $368,053!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $43,533!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $484,170!*

We are currently recommending “Double Down” alerts for three remarkable companies, and this could be your last chance for a while.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.