Investment Insights: The Strategic Moves of Ken Griffin

Understanding the strategies of top investors can sharpen your investment skills. But how do you learn from them effectively?

The Securities and Exchange Commission mandates that institutional investors managing over $100 million submit a 13F form quarterly. This document is like an itemized receipt that details the trades made by leading Wall Street investors during the quarter.

One noteworthy investor is Ken Griffin, billionaire co-founder of the Citadel investment firm. Recent data from Citadel’s 13F reveals that the firm has been gradually reducing its stake in Microsoft (NASDAQ: MSFT) while increasing its investments in chip giant Taiwan Semiconductor Manufacturing (NYSE: TSM).

Below is an analysis of the factors behind these decisions and my perspective on Griffin’s choices.

Why Is Citadel Selling Microsoft Now?

Microsoft was a pioneer in spurring the artificial intelligence (AI) revolution, highlighted by its substantial $10 billion investment in OpenAI, the creator of ChatGPT. This significant investment allowed Microsoft to embed AI into various services, including the Office suite, Azure cloud services, LinkedIn, and more.

Despite Microsoft’s leadership in AI, questions about its dominance have emerged. The agreement with OpenAI has intensified competition among major tech players.

Competitors like Amazon and Alphabet responded by investing in the rival start-up, Anthropic. Furthermore, Salesforce is set to launch a competing service to Microsoft’s Copilot AI.

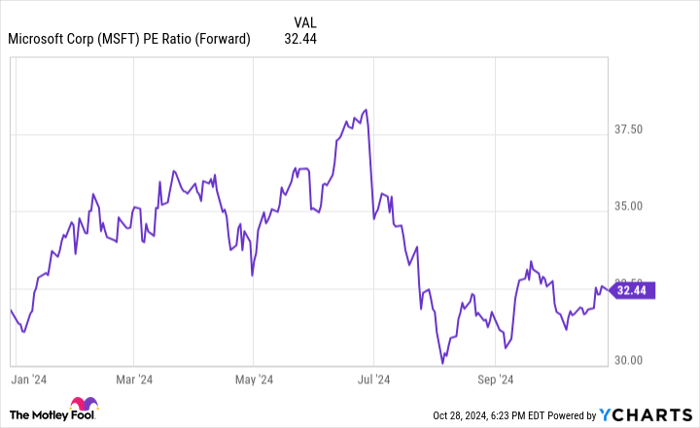

Recently, Microsoft’s stock has seen some valuation declines, yet its forward price-to-earnings (P/E) ratio remains high at 32.4, compared to an average P/E of 22.7 for the S&P 500.

MSFT PE ratio (forward), data by YCharts.

Citadel’s position in Microsoft has been consistently shrinking over recent quarters:

- Q2 2023: 3.4 million shares

- Q3 2023: 5 million shares

- Q4 2023: 4.2 million shares

- Q1 2024: 2.9 million shares

- Q2 2024: 1.2 million shares

While I find Microsoft to be an interesting player in AI, I share concerns about its competitive edge. There’s not enough clarity to make a definitive assessment at this stage.

Given this context, I believe Citadel’s strategy to take profits in Microsoft while maintaining slight exposure is a wise decision amidst the current market dynamics and lofty valuation.

Why Invest in Taiwan Semiconductor Now?

In my opinion, Taiwan Semiconductor (or TSMC) represents one of the best long-term opportunities in the chip sector. Although Nvidia draws much of the spotlight in semiconductors, TSMC plays a crucial role in its success.

TSMC manufactures chips not only for Nvidia but also for several others, including Advanced Micro Devices, Amazon Web Services, Broadcom, Qualcomm, and Sony.

As the demand for chips continues to rise, TSMC benefits from a diverse clientele and specialized skills, positioning it well in a growing market.

Image Source: Getty Images

The Bottom Line

Forecasting which cloud computing platform or AI technology will lead the market is quite challenging at this point. However, it’s reasonable to predict that big tech will continue its substantial investments in AI infrastructure.

Investing in Microsoft requires a strong belief that it will outperform rivals like Amazon, Alphabet, and Salesforce. This necessitates specific insights that are difficult to ascertain right now.

Conversely, investing in TSMC capitalizes on the robust demand for chips, which forms a significant part of the AI narrative. For this reason, I find it logical to consider swapping Microsoft stock for Taiwan Semiconductor.

Should You Invest $1,000 in Taiwan Semiconductor Manufacturing Now?

Before purchasing shares of Taiwan Semiconductor, it’s essential to keep the following in mind:

The Motley Fool Stock Advisor analyst team has identified what they consider to be the 10 best stocks to invest in currently, and Taiwan Semiconductor is not among them. The selected stocks have potential for significant returns in the coming years.

For instance, if you had invested $1,000 in Nvidia when it made this list on April 15, 2005, your investment would have grown to $813,567!*

Stock Advisor provides investors with straightforward strategies for success, including tips on portfolio building, regular analyst updates, and two new stock recommendations each month. Since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500*

See the 10 stocks »

*Stock Advisor returns as of October 28, 2024

It’s worth noting that John Mackey, former CEO of Whole Foods Market, and Suzanne Frey, an executive at Alphabet, serve on The Motley Fool’s board of directors. Additionally, Adam Spatacco holds positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool maintains positions and recommendations for Advanced Micro Devices, Alphabet, Amazon, Microsoft, Nvidia, Qualcomm, Salesforce, and Taiwan Semiconductor Manufacturing. Recommendations also include Broadcom and involve options related to Microsoft. A full disclosure policy applies.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.