Billionaire Investors Shift Focus to Banking as AI Stocks Cool Off

While many investors become attached to their stock picks, the most successful ones stay objective. They often buy struggling companies at appealing prices, sell strong companies at inflated prices, or invest in exceptional companies at reasonable valuations.

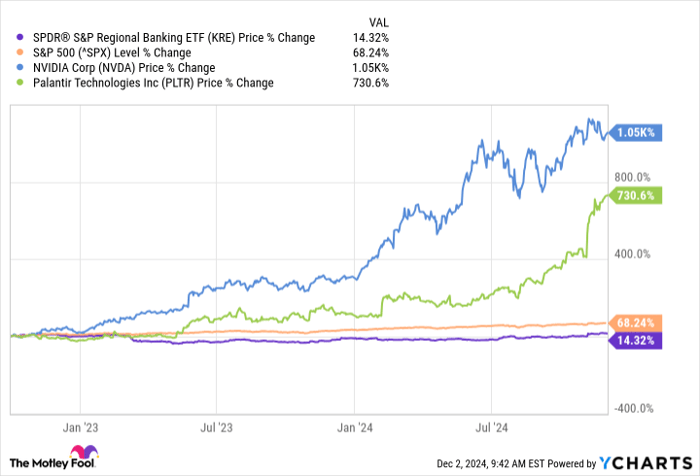

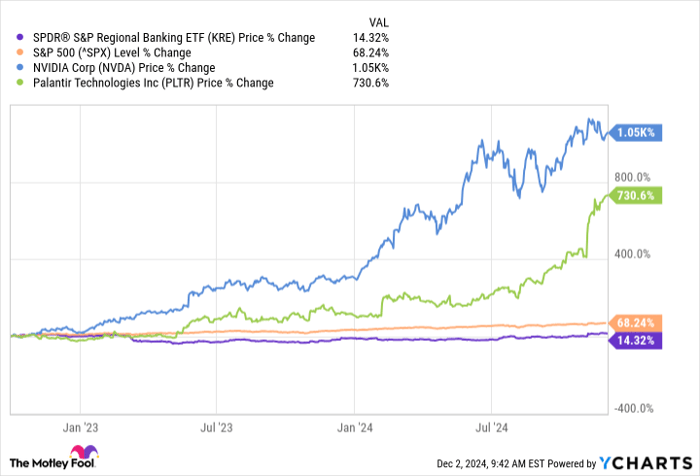

This strategy was evident in the third quarter of the year as billionaires managing sizable funds began to pull back from soaring artificial intelligence stocks like Nvidia (NASDAQ: NVDA) and Palantir (NASDAQ: PLTR). Instead, they turned towards more traditional sectors that many might consider dull compared to the excitement of AI and tech growth. Some of these investors moved into a sector that had been overlooked for the past two years amid a bull market. Let’s explore this trend.

Shifting Toward Traditional Investments

Artificial intelligence has spearheaded the current bull market, with many believing that AI represents the next major technological leap since the internet. As companies heavily invest in AI capabilities, investors have eagerly bought up stocks that showcase any AI potential, regardless of clarity regarding market size and practical applications.

On the contrary, banks have largely flown under the radar. The sector often feels commoditized, facing challenges such as an inverted yield curve, strict regulations, a slowdown in M&A activities, and several bank failures in 2023 that had lingering effects on their reputation. These factors contributed to the lack of interest from investors. Even after a recent uptick, banking stocks have significantly lagged behind their AI counterparts and the broader market over the bull market period.

KRE data by YCharts.

During the third quarter, some billionaires expressed skepticism towards AI valuations and began contemplating the potential for banks. The Federal Reserve commenced lowering interest rates, a move that began to ease the inverted yield curve. Generally, banks prefer a steep yield curve since they borrow at short-term rates and lend at long-term rates. Additionally, the election of President-Elect Donald Trump seemed to enhance optimism for banks, with expectations of a more favorable regulatory environment, increased M&A activity, and overall economic growth.

In Q3, which concluded on September 30, several prominent hedge fund managers made notable moves, selling off AI stocks while acquiring bank shares. It’s important to note that many of these billionaires manage large funds or “pod shops” where smaller teams make investment decisions, meaning these billionaires may not be the sole decision-makers. Furthermore, the actions are not mutually exclusive; some funds sold both AI stocks and bank shares or bought stakes in both sectors.

AI Stock Sales and Bank Stock Buys

AI Sales

- Stanley Druckenmiller of Duquesne Family Office exited Nvidia and reduced his Palantir position by 95%.

- Israel Englander’s Millennium Management trimmed its Nvidia stake by 13% and cut its Palantir position by 90%.

- Ray Dalio’s Bridgewater Associates reduced its position in Nvidia by 27%.

- Philippe Laffont’s Coatue Management also decreased its Nvidia position by 27%.

Bank Purchases

- Druckenmiller acquired over 2.05 million shares of the SPDR S&P Regional Banking ETF (NYSEMKT: KRE), positioning it as a top-ten holding in Duquesne’s portfolio.

- Billionaire Ken Griffin’s Citadel Advisors bought over 948,000 shares of KRE, along with more than 10.6 million shares in New York Community Bancorp.

- Billionaire Louis Bacon’s Moore Capital Management purchased 950,000 shares of KRE.

Will the Rally in Bank Stocks Last?

In recent months, bank stocks have experienced significant gains, raising questions about whether this upward trend can sustain itself. The KRE ETF is currently above levels seen earlier in 2023 but remains below peaks reached in early 2022. A key factor for bank stock performance will be the state of the yield curve, which briefly inverted again recently. As mentioned, banks typically favor a steep yield curve. Nevertheless, factors such as a more favorable regulatory environment, a rebound in investment banking, and improved loan growth could further support the sector.

Current conditions call for astute stock picking within banking. Opportunities still exist, as some banks remain fairly priced. Conversely, others, such as JPMorgan Chase, are nearing valuations not seen since the Great Recession, raising concerns about their price attractiveness.

A Second Chance to Invest Wisely

Do you ever feel you missed the opportunity to invest in successful stocks? You may want to pay attention now.

Occasionally, our experienced analysts recommend a “Double Down” stock for companies they believe are on the verge of significant gains. If you’re worried about having passed up your chance to invest, now could be the perfect time to act. The performance history speaks volumes:

- Nvidia: An investment of $1,000 since our 2009 recommendation would have grown to $376,143!*

- Apple: A $1,000 investment since 2008 would now be worth $46,028!*

- Netflix: A $1,000 investment since 2004 would have reached $494,999!*

Currently, we’re issuing “Double Down” alerts for three outstanding companies, and another opportunity like this may not come soon.

View 3 “Double Down” stocks »

*Stock Advisor returns as of December 2, 2024

JPMorgan Chase is an advertising partner of Motley Fool Money. Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.