Bitcoin’s Volatile Journey: Can It Regain Its Momentum?

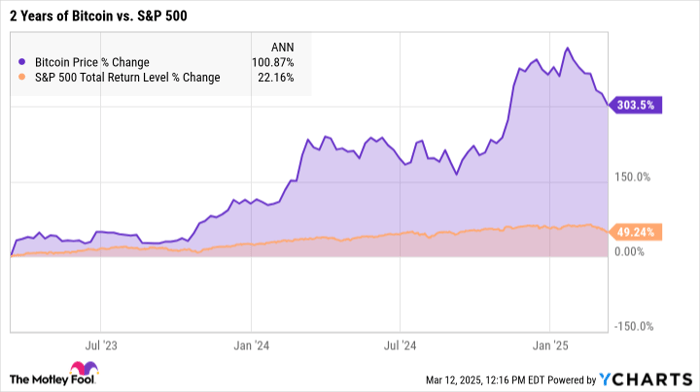

The Bitcoin (CRYPTO: BTC) market has been exceptionally volatile as of late. After reaching an all-time high of $106,182 per coin in January, Bitcoin experienced a decline of 25.8% over the following seven weeks. While this drop was significant, it follows a period where Bitcoin’s value more than quadrupled in two years. For context, the S&P 500 (SNPINDEX: ^GSPC) index, during the same timeframe, recorded a total return of just 49%.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Bitcoin Price data by YCharts

Bitcoin recently dropped below $80,000 per coin for the first time since November. Now, the question remains: Can it bounce back or has the bullish trend ended?

The Bearish Perspective

To start with, many investors view Bitcoin as lacking intrinsic value. Warren Buffett famously stated he wouldn’t purchase all Bitcoin for $25 because “it isn’t going to do anything.” Unlike equities, real estate, or farmland, Bitcoin’s value is not underpinned by tangible assets, meaning its worth relies solely on finding buyers willing to pay higher prices.

From this viewpoint, the cryptocurrency appears overdue for a correction, especially since its current market capitalization stands at $1.62 trillion, far exceeding $25.

Even for those who value Bitcoin, there are concerns about overvaluation. The year 2024 brought potentially transformative events for Bitcoin, like the introduction of exchange-traded funds (ETFs) tied to spot Bitcoin, the upcoming fourth halving of Bitcoin mining rewards, and a more favorable regulatory environment in the U.S. With these events behind us, the question arises: Is there room for further gains in 2025?

Moreover, worries about advancements in quantum computing contribute to investor anxiety. This next-generation technology is expected to compromise current encryption methods, such as SHA-256, which secures Bitcoin transactions. Major companies like Alphabet (NASDAQ: GOOG) and Microsoft (NASDAQ: MSFT) have made significant strides in quantum computing, raising fears that illicit actors may soon be capable of exploiting vulnerabilities in Bitcoin’s infrastructure.

The Bullish Argument

Proponents of Bitcoin liken it to physical gold. Instead of investing in mining equipment, Bitcoin miners allocate resources toward data centers and energy. Whether gold or Bitcoin, both processes yield valuable, limited resources. Gold serves practical purposes in various sectors like jewelry and electronics, while Bitcoin provides a reliable transaction ledger. Buffett’s reticence towards gold clarifies his skepticism about Bitcoin.

Prior to the launch of Bitcoin ETFs, the mere anticipation of these financial products led to a 72% increase in Bitcoin prices from early October 2023 to January 12, 2024. As rumors turned into reality, the most prominent ETF, the iShares Bitcoin Trust ETF (NASDAQ: IBIT), now boasts $47.4 billion in Bitcoin, custodied by Coinbase Global (NASDAQ: COIN). The influx of funds signals the beginning of a long-term trend as more institutional investors gain access via ETFs, circumventing the complexities of cryptocurrency brokerage accounts.

While the Trump administration’s approach to cryptocurrency regulation is still unfolding, its evolution could influence Bitcoin’s landscape. Although the Strategic Bitcoin Reserve may not fulfill expectations of a large-scale Bitcoin acquisition, it serves as a discreet alternative to traditional gold reserves. A less restrictive regulatory environment could enhance Bitcoin’s adoption, though meaningful regulation may take years.

Concerns about quantum computing may sound foreboding, yet Bitcoin remains under active development. The cryptocurrency is likely to strengthen against potential attacks before quantum technology becomes a tangible threat. As of now, even the most optimistic projections suggest that quantum computers will remain in the experimental stage for at least five more years, allowing time for enhanced encryption protocols to be adopted.

The Long-Term Perspective

Ultimately, the current halving cycle mirrors past patterns. While historic performance is not a reliable indicator of future success, halvings significantly influence Bitcoin mining economics by cutting rewards in half. This model relies on sustained price increases to remain viable. These events often phase out weaker or overextended miners, leaving robust producers to thrive.

Looking ahead, the current halving phase appears consistent with previous cycles. Following the second and third halvings, Bitcoin prices soared by thousands of percent approximately 18 months after each event. If the upcoming halving aligns with this trend, peak prices may be anticipated in late 2025, potentially followed by another market downturn. While outcomes could differ, historical pricing patterns provide valuable insights.

Why the Bitcoin Bull Run Is Not Over

While bearish arguments persist, proponents make compelling points. Regardless of halving impacts, Bitcoin is establishing itself as a digital gold standard for value storage. Even if not used for everyday purchases, Bitcoin’s potential to replace traditional savings accounts is notable. This market, worth trillions, is primed for innovation on a global scale.

Consequently, I expect Bitcoin to continue increasing in market value, possibly spurred by a short-term price surge later this year. I view Bitcoin as a strong long-term asset. As such, the recent price dip is merely another transient blip in Bitcoin’s ongoing narrative.

Don’t miss this second chance at a potentially lucrative opportunity

If you’ve ever felt you missed out on investing in top-performing stocks, now could be your chance.

Occasionally, our team of analysts issues a “Double Down” Stock recommendation for companies seen as poised for significant growth. If you’re anxious about missing your investing moment, the present is an ideal time to consider buying before opportunities pass. The statistics are telling:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $299,728!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $39,754!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $480,061!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, and opportunities like this are rare.

Continue »

*Stock Advisor returns as of March 10, 2025

Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board of directors. Anders Bylund has interests in Alphabet, Bitcoin, and Coinbase Global. The Motley Fool holds positions in and recommends Alphabet, Bitcoin, Coinbase Global, and Microsoft. The Motley Fool advocates for specific options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein represent the author’s perspective and do not necessarily reflect those of Nasdaq, Inc.