BlackRock Expands List of Authorized Participants

BlackRock, the titan of asset management, has enlisted Citi, Citadel, Goldman Sachs, and UBS as authorized participants for its spot Bitcoin ETF, elevating the fleet to a total of nine key players.

This momentous decision unfolded through an amendment attached to the ETF’s Form S-1, dutifully submitted to the Securities and Exchange Commission (SEC) on April 5.

While BlackRock and other industry titans reshaped their Bitcoin ETF applications, a ripple of anticipation coursed through Wall Street. Notably, on Jan. 8, pivotal players like BlackRock, Ark Invest/21Shares, VanEck, WisdomTree, Invesco, Fidelity, and Valkyrie meticulously revised their S-1 forms, ushering the proposals towards SEC’s nod of approval.

The amended S-1 filings delved into sponsor fees and strategic overhauls, shedding light on the financial bedrock underpinning these potential Bitcoin ETFs.

Strategic Financial Insights Unveiled

Within this financial symphony, BlackRock struck a harmonious chord, pegging its sponsor fee at 0.3%. The rate dwindles to 0.2% for the inaugural year or until the ETF scales the $5 billion asset summit. In contrast, VanEck unveiled a cutthroat sponsor fee of 0.25%, while WisdomTree opted for a more aggressive 0.5% margin.

Meanwhile, ARK Invest and 21Shares graciously pledged to forsake their 0.25% fee for the initial $1 billion in transactions, offering a gratifying economic incentive for potential investors.

Authorized participants carry the baton of liquidity in the ETF terrain, crafting and redeeming ETF shares in tune with market dynamics. This pivotal dance guarantees that ETF prices sway in tandem with the net asset value of the underlying assets. Their role stands tantamount to the lifeblood that maintains the market’s pulse with efficiency and reliability.

BlackRock’s muse dances with its chosen authorized participants in the Bitcoin ETF sphere, signaling a remarkable stride in the U.S. Bitcoin ETF saga. The impending chapters hold the allure of destiny, promising insights into these applications’ fates and the ripple effects cascading through the cryptocurrency realm.

Blackrock Boasts $17.7 Billion Worth of BTC Holdings

As the curtains lifted on April 2024, Bitcoin ETFs languished in a flat opening act, with Grayscale’s GBTC reigning over a week marred by massive outflows.

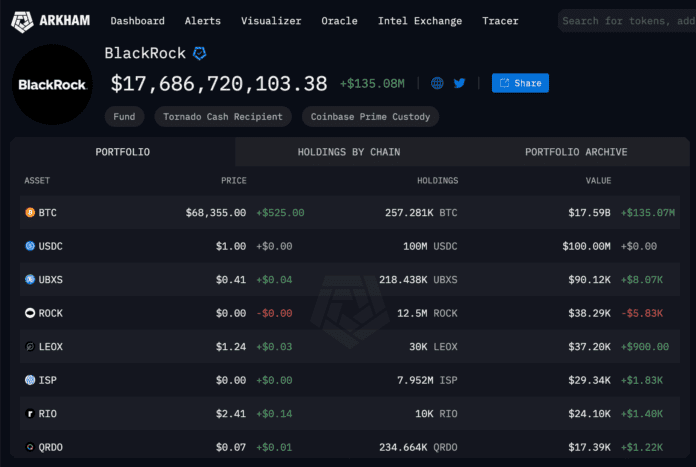

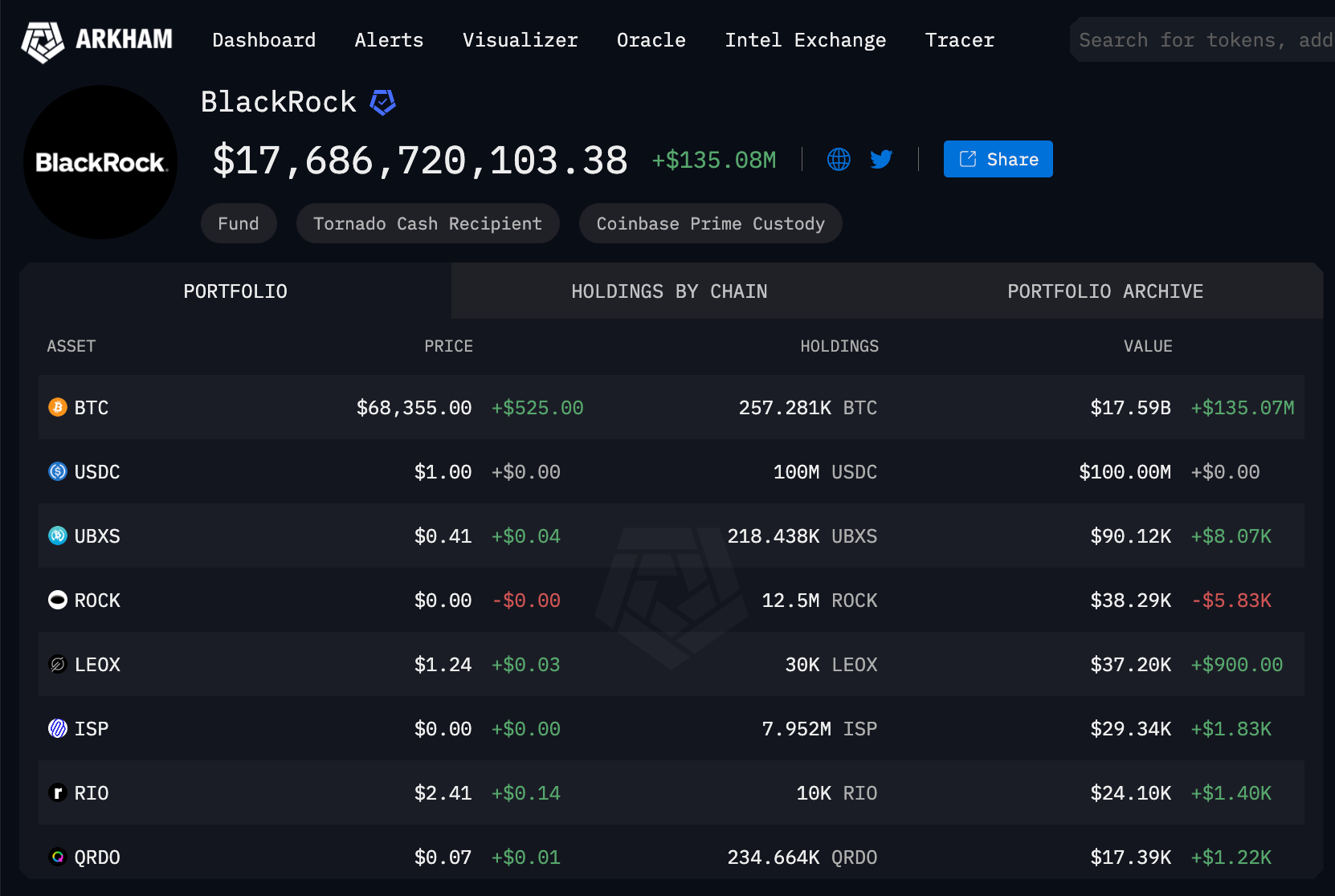

Blackrock (IBIT) BTC Holdings, April 6, 2024 | Source: Arkham Intelligence

Blackrock (IBIT) BTC Holdings, April 6, 2024 | Source: Arkham Intelligence

Adrift from Grayscale’s adversity, Blackrock rode a wave of optimistic net flows, steered by a balance sheet that now hoists 257,281 BTC valuing at approximately $17.7 billion upon the April 6 threshold.

A titanic leap forward places Blackrock at the acme, leading the realm of publicly-traded U.S. corporations with the most extensive Bitcoin stash, eclipsing even Michael Saylor’s MicroStrategy, whose BTC treasury stands at $14.6 billion, as per the latest reckoning.

This article was initially published on FX Empire

More From FXEMPIRE:

The perspectives and notions depicted herein are the thoughts and reflections of the author and do not necessarily mirror the sentiments of Nasdaq, Inc.