Emblazoned with vigor and resilience, Bitcoin (BTC) surged 13% this week, triumphantly reclaiming the $70,000 milestone amidst the echo of regulatory rumbles impacting exchanges like Coinbase and KuCoin, coupled with the jailing of FTX founder, Sam Bankman-Fried.

A Bitcoin Surge and a Global Crypto Boom

Gleaming with renewed vitality, the crypto market pivoted positively this week, rebounding from the tremors of $800 million Bitcoin ETF outflows in the prior week.

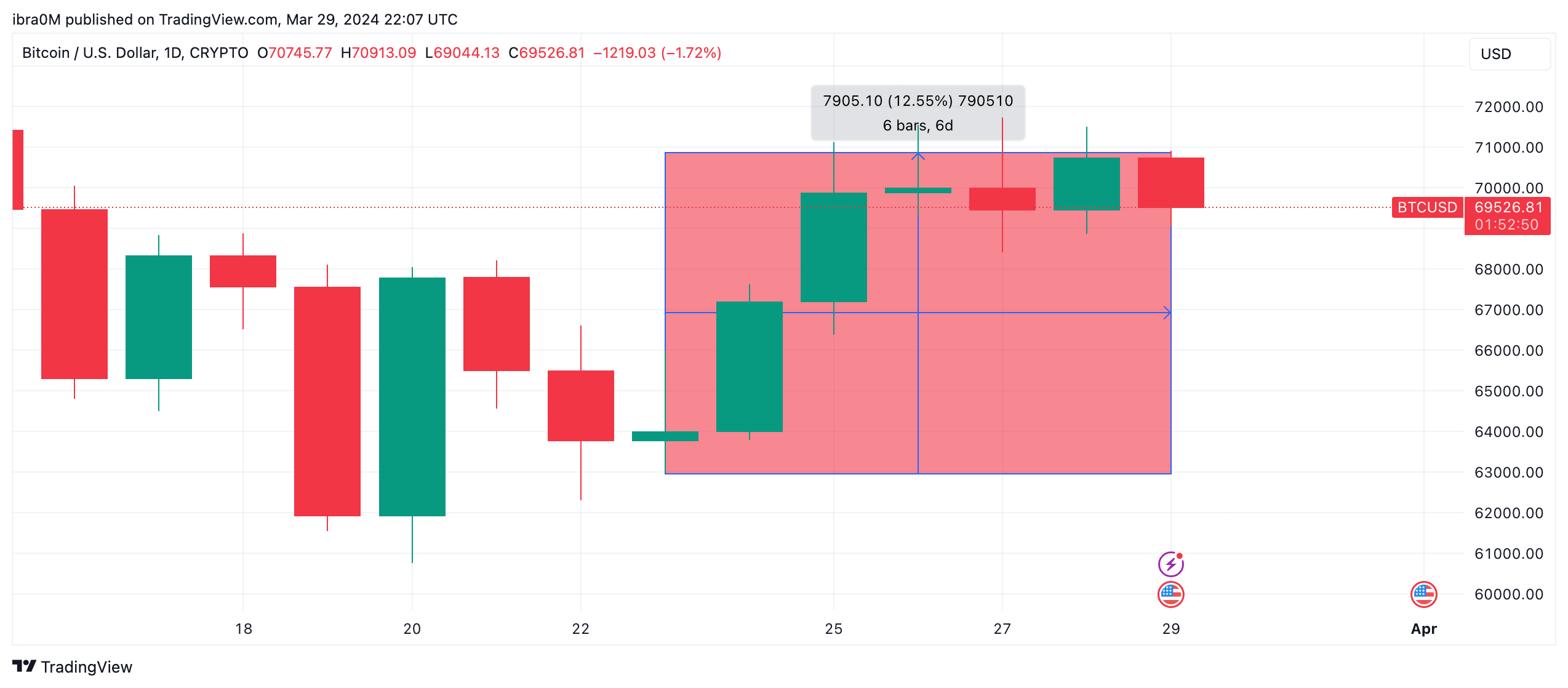

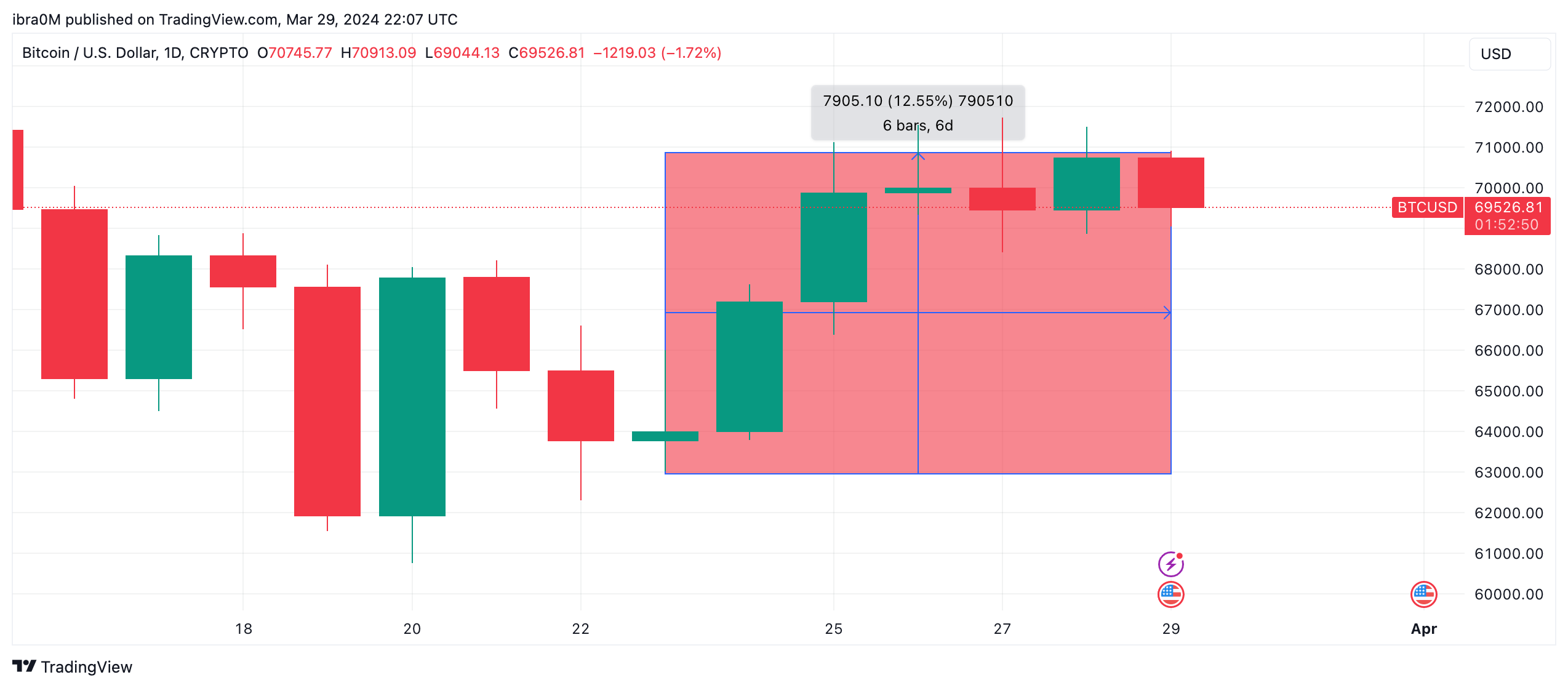

In a dazzling ascent, Bitcoin peaked at $71,726, marking a resplendent 13% surge as per TradingView data.

Bitcoin (BTC) price action | March 23 – March 29 2024 | Source: TradingView

Bitcoin (BTC) price action | March 23 – March 29 2024 | Source: TradingView

Stoking the bullish flames were a fervor for ETFs and Bitcoin miners easing sell-pressure, opting instead to amass their reserves in anticipation of the halving.

Surveying the broader crypto landscape, the bulls steadfastly asserted their dominance throughout the week.

Crypto Market 7-day Chart | March 2024 | Source: Coingecko

Crypto Market 7-day Chart | March 2024 | Source: Coingecko

As the week unfurled on March 24, the global crypto market cap stood at $2.5 trillion. Yet, in a dazzling crescendo by Friday, March 29, the market valuation had surged past $2.78 trillion, courtesy of Coingecko data.

Effectuating a staggering rise, the global crypto market cap bloomed by $265 billion between March 23 and March 29.

Dancing in the euphoria, other major cryptocurrencies such as Ethereum (ETH), Binance Coin (BNB), Dogecoin (DOGE), and Litecoin (LTC) each shone on the top gainers’ roster, delivering weekly gains of 8.11%, 6.15%, 44.7%, and 25.3% respectively by March 29.

Regulatory Fervor: KuCoin and Coinbase in the Limelight

Beyond the price theatrics, the week unfurled a saga of legal and regulatory upheavals embroiling the cryptocurrency realm.

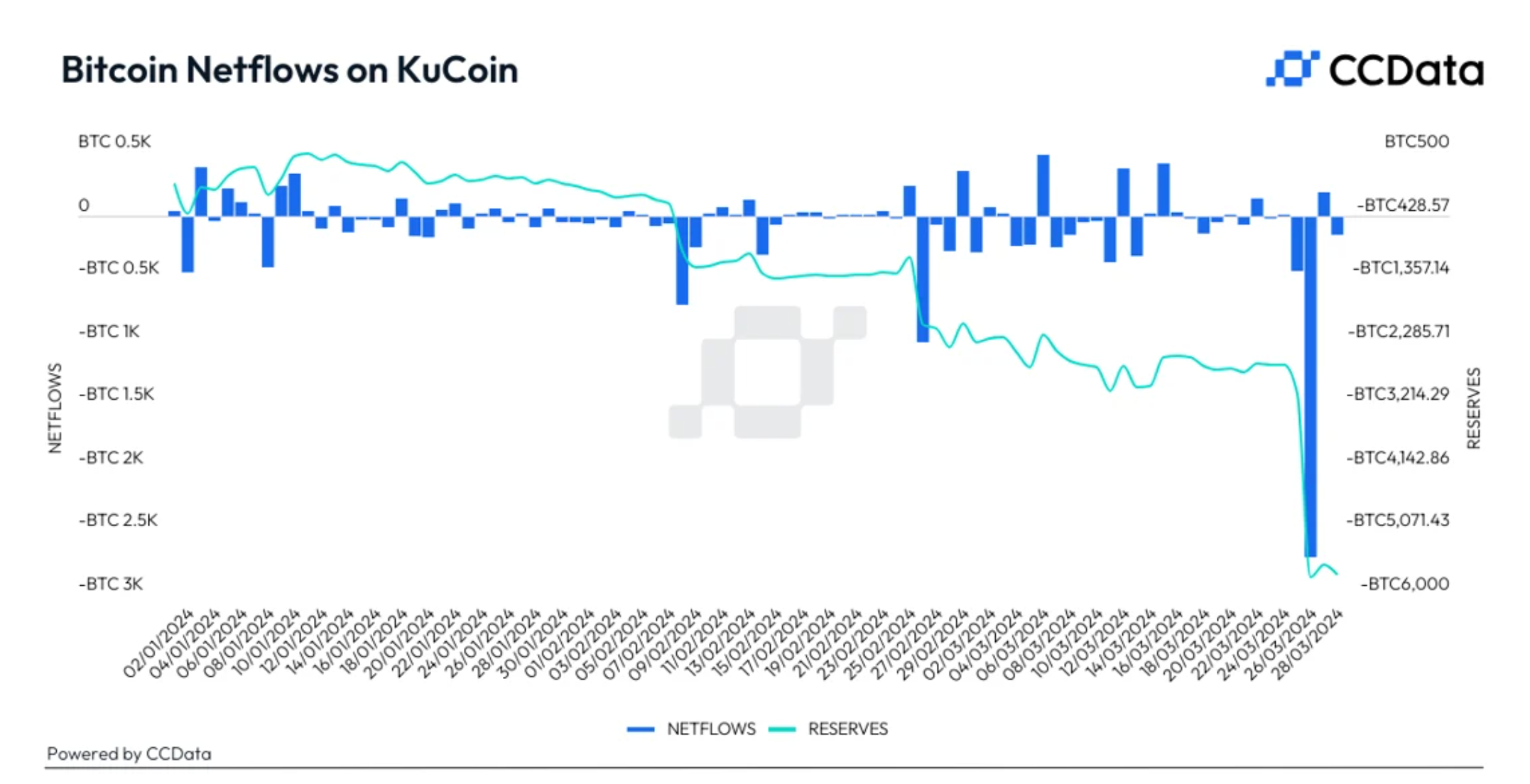

KuCoin stirred an upheaval in investor sentiment, witnessing over $1 billion in withdrawals within 24 hours, navigating legal probes from U.S. authorities who slapped charges on the exchange and its two founders for breaching anti-money laundering laws.

Bitcoin (BTC) price forecast | Source: CCdata

Bitcoin (BTC) price forecast | Source: CCdata

KuCoin’s plight wasn’t solitary, with the SEC scoring a legal triumph in its tussle with Coinbase, leveling allegations since June 2023 that the exchange operated as an unregistered broker and platform, seeking a permanent injunction against such practices.

Across the Atlantic, the U.K.’s Financial Conduct Authority (FCA) wielded its regulatory baton, warning that social media influencers dabbling in crypto content could fall under financial promotion regulations.

This fosters a broadened scope of financial counsel and promotion, particularly within the influential domain of social media, shaping investor sentiment and behavior.

This article was originally posted on FX Empire

More From FXEMPIRE:

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.