The Immediate Growth Spurt

News flash: Bitcoin is making waves once again. After a stellar 2023, Bitcoin has carried its momentum forward into 2024. In the last month alone, this premier cryptocurrency skyrocketed by over 40%, hitting a record high of $73,000. Such impressive numbers prompt the question – is it too late to invest?

Unraveling the Short-Term Potential

With Bitcoin currently standing firm above $67,000, it’s evident that the days of massive gains from its $16,000 crypto winter lows are behind us. Yet, this doesn’t invalidate its investment prospects today. A holistic view of its current position amidst past market cycles reveals that Bitcoin’s resurgence is only just commencing, indicating significant room for growth.

Metrics and Insights

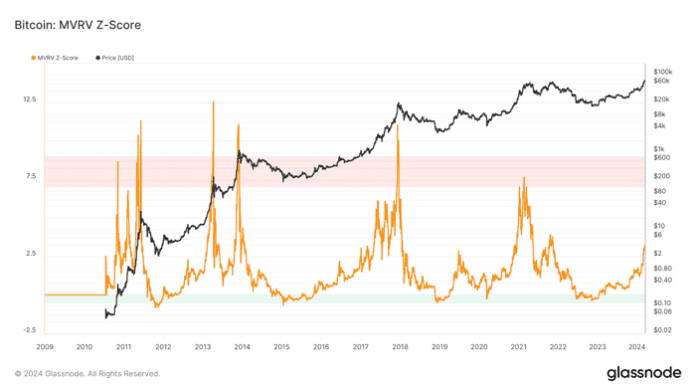

Delving into Bitcoin’s blockchain metrics unveils compelling data. A standout indicator is the Market Value to Realized Value ratio (MVRV). This ratio, crucial in gauging Bitcoin’s cycle position, currently stands at around 3, a far cry from the 7.5 levels associated with market peaks. This suggests that Bitcoin’s climb is far from over.

Image source: Glassnode.

The Long-Term Horizon

Transitioning from immediate gains, let’s shift focus to the enduring appeal of Bitcoin. Amid personal beliefs and crypto philosophies, data points to the timeless investment allure of Bitcoin, especially for long-term investors.

A Pattern of Resilience

Research by noted analyst Willy Woo highlights Bitcoin’s consistent four-year price cycle, showcasing profitability for investors who hold onto Bitcoin for such periods. Even amidst occasional steep drops, Bitcoin has recorded an average annual return of about 30%, bolstered by factors like limited supply and diminishing coin creation rates.

Evolution and Legitimacy

The recent green light for spot Bitcoin ETFs signifies a significant stride towards legitimizing Bitcoin as an asset. As these ETFs gain acceptance, the demand for Bitcoin is poised to surge, intensifying pressure on its capped supply. This evolution, coupled with Bitcoin’s unique attributes, could spur widespread adoption across various sectors.

With the world’s premier cryptocurrency still in its early growth stages, seizing the moment to invest in Bitcoin now appears opportune.

Considering a $1,000 investment in Bitcoin?

Before diving into the Bitcoin market, it’s worth noting that the Motley Fool’s Stock Advisor team has identified the 10 best stocks for future growth – Bitcoin not included. These top picks offer potential for sizable returns over the upcoming years.

Stock Advisor guides investors on portfolio construction, delivers analyst insights regularly, and reveals two new stock picks each month. Since 2002, the service has outperformed the S&P 500 threefold.

Discover the top 10 stocks now!

*Stock Advisor returns as of March 11, 2024

RJ Fulton has investments in Bitcoin. The Motley Fool holds and endorses Bitcoin. The Motley Fool abides by a disclosure policy.

The views and opinions presented here are the author’s own and may differ from those of Nasdaq, Inc.