Rollercoaster Ride

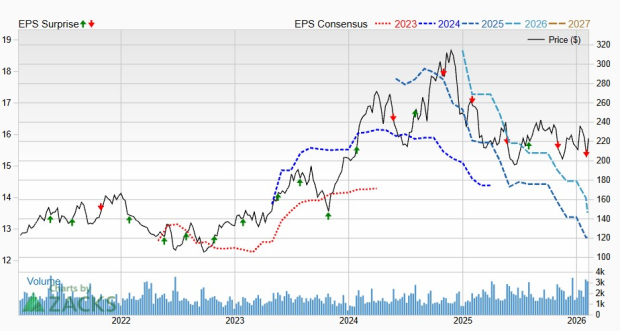

Several months ago, I published an analysis of Block, Inc., suggesting the stock was nearing a bottom:

Following its substantial selloff to its Covid lows, Block stock now trades at a wide margin of safety with substantial upside potential as it hovers near a major support level. It seemed as though the stock had reached its nadir.

(Block: Back To ‘Square’ One).

Indeed, the stock bottomed and surged 100%, from $40 to $80 in just two months.

A triple play of blowout earnings, a strong outlook, and the recent crypto surge catalyzed this rally.

Despite the recent upturn, shares remain attractive. It appears that the resurgence of Block has only just begun, promising long-term growth and value for the stock.

Revitalized Growth

The Q3 Revenue soared by 24% YoY to $5.6B, marking a record high for the company and surpassing analyst estimates by $190M.

This stellar performance was spearheaded by the sustained growth of the Square and Cash App ecosystems, along with a surge in Bitcoin Revenue, which amounted to $2.4B in Q3, up by 37% YoY.

Despite the meteoric rise of Bitcoin Revenue, the company’s financials—without the Bitcoin component—tell their own success story. Q3 Revenue Ex-Bitcoin stood at $3.2B, a 16% YoY increase and a record high, underscoring Block’s unique value proposition and robust execution.

The Revenue Ex-Bitcoin was driven by a 10% YoY increase in Gross Payment Volume (GPV), totaling $60.1B in Q3. Notably, Revenue Ex-Bitcoin outpaced the growth of GPV, signifying enhanced monetization rates across Block’s product portfolio.

Specific metrics that track Block’s overall monetization rate showcase an upward trend, a critical element for long-term shareholder value creation.

- Transaction Revenue as a percentage of GPV [A] has been gradually declining, whereas Subscription and Services Revenue as a percentage of GPV [B] has been on an upward trajectory, leading to an increase in the company’s Overall Monetization Rate.

This enhanced monetization is pivotal for prolonged shareholder value creation, a testament to Block’s sustained business acumen over the last few years.

Closer scrutiny of each segment revealed that Cash App Revenue amounted to $3.6B in Q3, up 34% YoY. Excluding Bitcoin Revenue, Cash App Revenue would have achieved a 26% YoY uptick. Despite a reduction in growth, this segment is expected to stabilize in the high teens in 2024.

The growth in Cash App was boosted by a variety of factors, including higher monetization rates, increased Monthly Transacting Actives, Cash App Pay Monthly Actives, and greater inflows.

Although Cash App GPV lagged, Square GPV expanded by 11% YoY to $55.7B, with International Square GPV growing by 28% YoY and US Square GPV by 9% YoY, resulting in a 12% growth in Square Revenue in Q3, reaching nearly $2.0B and setting a new record high for the segment.

The Cash App and Square ecosystems continue to flourish as fintech applications gain more traction, while legacy financial services wane in popularity.

Notably, Cash App keeps attracting more users to the platform, registering 55M Monthly Transacting Actives as of Q3, presenting a further avenue for monetization.

As more users join the platform and as Overall Monetization Rates improve, Block’s ecosystem of ecosystems will inevitably enjoy powerful network effects, driving robust growth and profitability in the future.

Rising Profitability

Turning to profitability, Q3 Gross Profit was $1.9B, a 21% YoY increase, representing a 34% Gross Margin.

Block’s Earnings Report: A Deep Dive

Block, formerly known as Square, has delivered its Q3 earnings report, unveiling crucial insights for investors. The report not only showcases financial figures but also lays bare the underlying operational and strategic dynamics that are steering the company’s formidable growth trajectory. Let’s break down the numbers and unravel the implications that they carry for the future.

Gross Margin Performance

The Q3 Gross Margin Ex-Bitcoin for Block stood at 58%, marking a commendable 200 basis point improvement year over year. Such figures speak of economies of scale brewing within the disruptive confines of the Block ecosystem, suggesting an upward battle trajectory.

Breaking the numbers down by segment, the Cash App Gross Profit in Q3 tallied up to $984M, reflecting a Gross Margin of 27%. This might appear unimpressive on the surface. However, delving deeper reveals that Bitcoin, while contributing 68% of Cash App Revenue, churned out a minute 5% of Cash App Gross Profit. Removing Bitcoin from the equation unfolds an entirely different narrative, depicting Cash App as a high-margin business, with a remarkable Gross Margin of 81% in Q3, upheld consistently over time – portraying an indomitable business model.

Moving on to Square Gross Profit, Q3 registered $899M with a Gross Margin of 45%, standing robustly stable. Digging into the roots of this growth, it is evident that Gross Profit from vertical POS solutions and banking products bolstered the numbers, pointing to a growing demand for integrated financial solutions.

Profitability and Efficiency

The Q3 Operating Income was $(10)M, improving to $90M in terms of Adjusted Operating Income. Similarly, the Q3 Net Income reflected a loss of $(34)M, which escalated to an impressive $364M for Adjusted Net Income. The significant sequential improvement indicates the market’s earlier-than-anticipated embrace of GAAP Operating and Net Income profitability, fueling the recent surge in the stock price. GAAP Net Income profitability, culminating in 2024, seems to be the next catalyst for Block’s stock, resonating the management’s unwavering focus on driving efficiencies and streamlining operations.

The implementation of an absolute cap on the company’s headcount signifies a strategic move towards optimizing operations. As the management paves the way for a smaller, more efficient team by the end of 2024, a leaner structure instills confidence in the company’s pursuit of sustained profitability.

Notably, the recent layoffs are anticipated to drive meaningful operating leverage, steering the company towards GAAP profitability. With meticulous headcount management and a steadfast eye on growth and profitability, the management seems to have orchestrated a significant turnaround for the stock.

Financial Health and Outlook

Block’s balance sheet reflects a robust health status. Q3 portrays a picture of $6.3B in Cash and Short-term Investments and $5.4B of Total Debt, nudging its Net Cash position to approximately $0.9B. This strengthening balance sheet, bolstered by a deliberate shift towards cost savings and profitability, signals a promising trajectory.

The Free Cash Flow of $454M in Q3, coupled with a notable FCF Margin Ex-Bitcoin of 14%, signifies significant cash generation potential. With a sturdy Free Cash Flow foundation, Block is poised to fuel expansion, repay debts, and kick off share buybacks – a $1B buyback program already in play, aiming to offset shareholder dilution from Stock-based Compensation.

Looking ahead, management has set a Q4 Gross Profit expectation of around $1,970M, representing a 19% growth YoY. While indicating a slowdown from Q3’s 21% growth, this outlook remains promising, offering shareholders a glimpse into Block’s steady ascent.

Block, Inc. Unveils Promising Path to Profitability and Growth

Block, Inc. has revealed a highly promising trajectory for profitability and growth that has captivated investors following the Q3 earnings releases. The company’s stock has rallied more than 100% from its October low, driven by strong earnings and an optimistic outlook, as well as a series of strategic initiatives by management.

Positive Outlook and Growth Prospects

Despite lower Q4 Adjusted Operating Income and Adjusted EBITDA than Q3, Block raised its full-year 2023 profit guidance, with a strong focus on improving profitability and anticipating a significant upturn in 2024. Management’s forecast of a 300% increase in Adjusted Operating Income and a 50% rise in Adjusted EBITDA YoY, sets the stage for an acceleration in profitability.

With an eye towards the long term, Block has outlined a strategic investment framework aimed at delivering sustained value for customers and shareholders, including reaching the “Rule of 40” in 2026 – reflecting a balanced blend of growth and profit margin.

Furthermore, the company still has substantial growth potential, remaining under 5% penetrated against a $200 billion total addressable market. As Block continues to launch new products and target new demographics, the growth runway remains expansive.

Accelerated Path to Profitability

Management’s commitment to enhancing profitability is underpinned by three key initiatives – reducing employee count, optimizing corporate overhead spending, and leveraging scale for operational efficiency. These strategic moves are geared towards strengthening the company’s cost structure and driving higher margins.

Notably, the company’s trajectory from shaky profitability in recent years to a clear path for sustained improvement has resonated positively with investors, paving the way for unlocking shareholder value.

Valuation and Investment Considerations

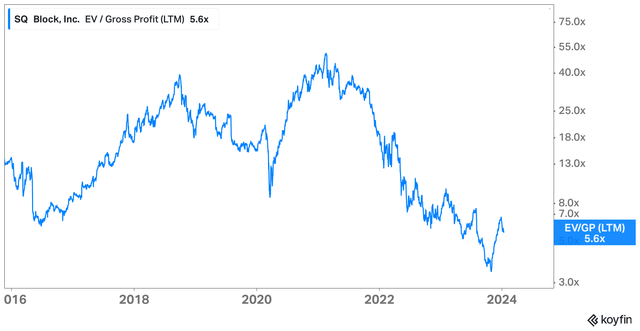

Despite the stock’s substantial rally, Block’s valuation remains compelling from a historical perspective. A depressed EV to Gross Profit multiple of 5.6x, well below previous levels, underscores the potential for further upside, despite recent market headwinds.

Analyzing Block’s fundamentals in contrast to its stock performance, the divergence presents an attractive buying opportunity, particularly considering the recent pullback and the formation of a bullish reversal pattern.

Furthermore, the company’s robust growth and improving gross profit trajectory, alongside an anticipated Rule of 40 achievement by 2026, affirms its position as an enticing investment prospect.

In summary, Block’s strategic initiatives, optimistic outlook, and improving profitability trajectory signal a compelling narrative for investors, highlighting the company’s evolution and its potential to deliver sustained value in the long term.

Block’s Stock Valuation and Market Analysis

I assume a long-term FCF Margin (as a percentage of Gross Profit) of 28% for Block, which is slightly higher than the Operating Margin of 25%.

Using a perpetual growth rate of 2.5% and a discount rate of 10%, I arrive at an intrinsic value per share of $104 for Block, which represents an upside potential of 56% based on the current price of $66.

This is also higher than the average analyst price target of $79 a share.

Here, I’ve also included my bear and bull cases. You can take a look below.

In summary, I believe Block’s stock is still undervalued.

Challenges in the Fintech Landscape

The fintech industry is highly competitive. Payment processing services, in particular, may eventually be commoditized, which may put pressure on Square’s transaction take rate, and ultimately profitability. Competition in this category includes PayPal Holdings, Inc. (PYPL) and Adyen N.V. (OTCPK:ADYEY).

At the same time, Cash App may lose market share to other digital wallet and banking solutions such as SoFi Technologies, Inc. (SOFI), Venmo, Zelle, Chime, Apple Pay (AAPL), and more, which could limit Cash App’s growth.

Another risk to consider would be Bitcoin. If the price of Bitcoin falls, Block stock may likely fall as well.

Analysis and Investment Thesis

Block is at an inflection point.

Sentiment has been poor over the last few years. However, with management’s Q3 update, sentiment has flipped to the upside.

Investors hated Block because of its lack of profitability. However, the tide has turned as management focuses on delivering profitability to unlock value for shareholders.

More specifically, the 12,000-employee cap and the Rule of 40 are major step changes as the company pursues growth in a disciplined and cost-effective manner.

Without a doubt, Block still has a long growth runway as it builds the financial ecosystem of tomorrow through two high-quality financial ecosystems: Square and Cash App.

Furthermore, with GAAP profitability on the horizon, Block’s stock will likely soar higher from here.

That said, despite the sharp reversal in share price, the stock still looks undervalued – in my view, the turnaround story for Block has only just begun.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.