Blue Bird Corporation Hits Earnings Target but Misses Sales Expectations in Q1 2025

Blue Bird Corporation (BLBD) reported earnings of 92 cents per share for the first quarter of fiscal 2025 (ending December 28, 2024). This result exceeded the Zacks Consensus Estimate of 83 cents. In comparison, the company posted earnings of 91 cents per share in the same quarter of fiscal 2024. However, net sales fell 1.2% year over year to $313.8 million, missing the consensus estimate of $355 million.

Stay up-to-date with the quarterly releases: See Zacks Earnings Calendar.

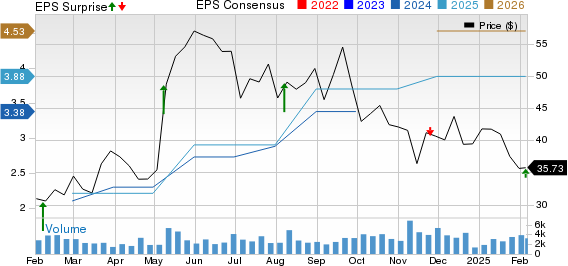

Price Movement and Earnings Surprise Overview

Blue Bird Corporation price-consensus-eps-surprise-chart | Blue Bird Corporation Quote

Highlights from the Quarter

The Bus segment generated net revenues of $288.1 million, falling short of the Zacks Consensus Estimate of $328 million, and saw a year-over-year decrease of 1.8%. Unit sales totaled 2,130 buses, slightly above the 2,129 sold in the same quarter last year. Diesel buses contributed $124.37 million in sales (up 50% year over year), while alternative power buses brought in $148.9 million (down 23.7% year over year). Gross profit from this segment was $47.2 million, lower than $51.3 million in the prior year. Blue Bird concluded the quarter with an order backlog of 4,400 units.

In contrast, the Parts segment experienced a 6.2% year-over-year increase in net revenues, reaching $25.7 million, due to higher prices and improved product mix. This amount still fell below the consensus target of $27.5 million. Gross profit for this segment increased to $13.1 million from $12.2 million a year ago.

Selling, general and administrative (SG&A) expenses rose to $27.3 million, up from $25.6 million in the first quarter of fiscal 2024. As a result, operating profit decreased by 12.8% to $33 million.

By December 28, 2024, BLBD had cash and cash equivalents totaling $136.1 million, an increase from $127.7 million as of September 28, 2024. The company’s long-term debt stood at $88 million, down from $90 million the previous quarter. During the first quarter, BLBD repurchased 243,245 shares at a cost of $10 million, leaving $40 million available under its current share repurchase authorization.

Future Outlook

Blue Bird anticipates fiscal 2025 revenues between $1.4 billion and $1.5 billion. Adjusted EBITDA is projected in the range of $185 million to $215 million, while free cash flow is expected to fall between $40 million and $60 million. The company has reaffirmed its long-term revenue target of approximately $2 billion, with an adjusted EBITDA margin of 15%.

Currently, Blue Bird holds a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Noteworthy Performance from the Auto Industry

General Motors (GM) reported fourth-quarter 2024 adjusted earnings of $1.92 per share, surpassing the Zacks Consensus Estimate of $1.85 and up from $1.24 in the prior year. Revenues reached $47.71 billion, exceeding the consensus of $44 billion and above $42.98 billion from last year.

For 2025, GM anticipates adjusted EBIT between $13.7 billion and $15.7 billion, compared to $14.9 billion last year. Adjusted EPS is expected to range from $11 to $12, rising from $10.60 in 2024.

PACCAR (PCAR) reported earnings of $1.68 per share for Q4 2024, beating the Zacks Consensus Estimate of $1.66 but down from $2.70 per share in the year-ago period. Consolidated revenue, including trucks and financial services, totaled $7.9 billion, a decrease from $9 billion in Q4 2023. Sales from Trucks, Parts, and Others were $7.36 billion.

PACCAR expects capital expenditures and R&D expenses for 2025 to be between $700 million and $800 million and $460 million to $500 million, respectively.

Tesla (TSLA) reported earnings per share of 73 cents for Q4 2024, slightly missing the Zacks Consensus Estimate of 75 cents but up from last year’s figure of 71 cents. Total revenues were $25.71 billion, below the consensus of $27.5 billion but an increase from $25.17 billion in the same quarter last year.

TSLA plans to start producing lower-cost vehicles in the first half of this year and confirmed that volume production of Cybercab will begin in 2026. Its energy storage deployments are also projected to grow by at least 50% this year.

Highlighted Stock Picks for the Upcoming Month

Just released: Analysts have identified 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys, naming them “Most Likely for Early Price Pops.”

Since 1988, this full list has outperformed the market by more than 2X with an average gain of +24.3% annually. Keep these top 7 stocks on your radar.

Want the latest recommendations from Zacks Investment Research? You can download 7 Best Stocks for the Next 30 Days now. Click to get this free report.

PACCAR Inc. (PCAR): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Blue Bird Corporation (BLBD): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.