Blue Bird Corporation Set to Unveil Q1 Earnings: Insights and Expectations

Blue Bird Corporation (BLBD) is scheduled to release its fiscal first-quarter 2025 earnings on February 5, after markets close. The Zacks Consensus Estimate anticipates earnings of 83 cents per share, alongside projected revenues of $355 million.

Stay updated with the latest EPS estimates and surprises on Zacks Earnings Calendar.

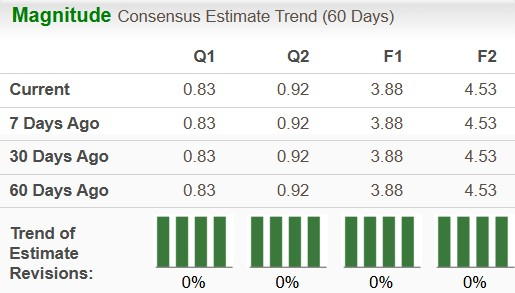

Notably, the earnings estimate for the upcoming first quarter has remained stable over the last two months. The predicted earnings reveal a year-over-year decline of 8.8%. Meanwhile, the revenue estimate points to an anticipated year-over-year increase of 11.8%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

For the full fiscal year 2025, the revenue forecast for BLBD stands at $1.5 billion, reflecting an 11% increase from the previous year. The estimate for earnings per share for fiscal 2025 is $3.88, indicating a 12% rise. In the last four quarters, Blue Bird surpassed EPS estimates in three instances, missing only once, with an average earnings surprise of 85.12%.

Analyzing Blue Bird Corporation Price and EPS Surprise

Blue Bird Corporation price-eps-surprise | Blue Bird Corporation Quote

Current Earnings Predictions for BLBD

Currently, our model does not provide clear evidence of an earnings beat for Blue Bird this quarter. When the Earnings ESP is positive and paired with a Zacks Rank #1 (Strong Buy), #2 (Buy), or #3 (Hold), the chances of a beat are heightened. However, Blue Bird currently shows an Earnings ESP of 0.00% along with a Zacks Rank #3.

You can explore the complete list of today’s Zacks #1 Rank stocks here.

Factors Influencing Blue Bird’s Q1 Results

Demand for school buses is expected to drive Blue Bird’s upcoming results. By the end of the fourth quarter of fiscal 2024, the company held an impressive order backlog of over 4,800 units, with strong deliveries of electric-powered buses. The backlog included around 630 electric school buses, which is promising for their future growth.

In terms of revenue projections, the Zacks Consensus Estimate for bus revenues is $328 million, a notable increase from $242 million in the same period last year. For parts revenues, estimates sit at $27.5 million, compared to $23 million in the first quarter of fiscal 2024.

Positive expectations for fiscal 2025 build optimism for upcoming earnings. Blue Bird anticipates net revenues between $1.4 billion and $1.5 billion, surpassing $1.35 billion achieved in fiscal 2024. Adjusted EBITDA is expected to range from $190 million to $210 million, compared to $183 million reported last year.

Blue Bird’s Stock Performance and Valuation Analysis

In recent months, Blue Bird shares have fallen by 27%, underperforming compared to the industry, sector, S&P 500, and prominent EV companies like Tesla (TSLA) and Rivian (RIVN).

6-Month Stock Performance Overview

Image Source: Zacks Investment Research

Currently, BLBD is trading at a forward sales multiple of 0.81, which is above its 5-year median yet below the industry’s valuation of 2.44. The company bears a Value Score of A.

Investment Outlook for BLBD Stock

Beyond traditional school bus manufacturing, Blue Bird is leading the way in alternative fuel and electric school buses. With over 90% of school buses in the U.S. still operating on diesel, there is considerable growth potential for cleaner options. The company has improved its operations and production efficiency significantly, which solidifies its position as a leader in the alternative-powered bus sector.

While strong fundamentals exist, dependency on government subsidies poses a risk that could affect growth if support decreases. Historically, policies can shift; for instance, former President Trump rolled back Biden’s EV targets early in his administration. This uncertainty suggests that potential investors may want to hold off on new purchases until more clarity emerges.

Current shareholders, however, can remain invested. Despite the risks stemming from policy changes, Blue Bird’s solid execution strategy and financial stability work to alleviate concerns. With $127 million in cash against $90 million in long-term debt and a strong focus on cost management, the company’s resilience appears intact. The electric vehicle market, despite facing fluctuations, is viewed as a key area for future expansion. Thus, Blue Bird’s long-term outlook remains positive.

As it stands, BLBD has a Zacks Rank #3 (Hold). You can review the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

5 Stocks Set for Potential Doubling

Each was selected by Zacks experts as their top choice to gain 100% or more in 2024. Historical picks have surged by +143.0%, +175.9%, +498.3%, and +673.0%.

Most stocks featured in this report remain under the radar of Wall Street, presenting a significant opportunity to invest early.

Discover these 5 potential home run stocks >>

Interested in the latest recommendations from Zacks Investment Research? Download our free report on the 7 best stocks for the next 30 days today.

Tesla, Inc. (TSLA): Free Stock Analysis Report

Blue Bird Corporation (BLBD): Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.