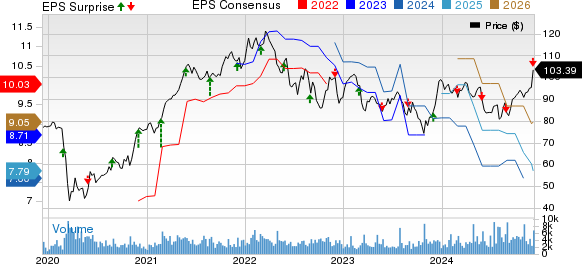

Bank of Montreal Shares Surge After Positive Earnings Outlook

Shares of Bank of Montreal (BMO) rose 8.5% on the NYSE following the release of its fourth-quarter fiscal 2024 results, which ended on October 31. Investors are optimistic, as management indicated that provisions for credit losses may have hit a low point in the reported quarter. This follows a year marked by significantly growing provisions. Looking ahead to fiscal 2025, a decrease in these provisions is expected.

Adjusted Earnings and Revenue Show Mixed Results

In the fourth quarter of fiscal 2024, the adjusted earnings per share fell to C$1.90, a decrease of 35.2% compared to the previous year, primarily due to increased provisions for credit losses. Additionally, net interest income faced a decline. However, non-interest income saw growth, along with an increase in both loans and deposits, alongside reduced expenses, which provided some support to overall performance.

After accounting for one-time items, the net income stood at C$2.3 billion ($1.68 billion), reflecting a significant 34.7% increase from the same quarter a year ago.

Revenue Growth Accompanied by Lower Expenses

Total revenues, adjusted for insurance claims, commissions, and changes in policy benefit liabilities (CCPB), reached C$8.37 billion ($6.13 billion), reflecting a small increase year over year.

Net interest income declined by 2.1% from last year, amounting to C$4.85 billion ($3.55 billion). Conversely, non-interest income rose to C$3.52 billion ($2.58 billion), an increase of 4.2%.

Adjusted non-interest expenses decreased by 2% to C$4.88 billion ($3.57 billion).

The adjusted efficiency ratio (excluding CCPB) improved to 58.3%, down from 59.7% a year prior.

Adjusted provisions for credit losses reached C$1.52 billion ($1.11 billion) in the latest quarter, a significant rise compared to the same quarter last year.

Growth in Loans and Deposits

As of October 31, 2024, BMO’s total assets increased to C$1.41 trillion ($1 trillion), showing nearly a 1% rise from the end of the previous quarter.

Net loans climbed slightly to C$678.3 billion ($487.3 billion), while deposits rose by 1.8%, totaling C$982.4 billion ($705.8 billion).

Profitability and Capital Ratios

In the fourth quarter, BMO’s return on common equity (adjusted) was 7.4%, down from 12.4% a year ago. The adjusted return on tangible common equity also fell to 9.7% compared to 17.1% in the previous year.

The Common Equity Tier-I ratio improved to 13.6%, up from 12.5% a year earlier. The Tier-I capital ratio increased as well, reaching 15.4% compared to 14.1% the previous year.

Looking Ahead: Challenges and Strategies

BMO’s ongoing efforts in organic growth and business restructuring are expected to bolster revenues in the near future. However, rising expenses and a challenging economic environment remain potential obstacles.

Performance Snapshot Across Peer Banks

Toronto-Dominion Bank (TD) reported disappointing results for its fourth quarter of fiscal 2024, with an adjusted net income of $3.2 billion ($2.34 billion), representing an 8% decline from the previous year.

Increased provisions for credit losses and rising expenses negatively impacted TD’s performance, despite growth in net interest income, non-interest income, and higher loan balances.

Canadian Imperial Bank of Commerce (CM) posted adjusted earnings per share of C$1.91, a 21.7% increase from the prior-year quarter. Improvement in revenues and lower provisions contributed to CM’s positive results, although higher expenses posed challenges.

Conclusion

BMO’s stock reflects an optimistic outlook following its latest earnings report and predictions for reduced credit loss provisions in the future. However, the bank must navigate potential hurdles created by rising expenses and uncertain economic conditions.

Currently, BMO holds a Zacks Rank #5 (Strong Sell).

The opinions expressed in this report are those of the author and do not necessarily reflect the views of Nasdaq, Inc.