Boeing Faces Challenges in Q3 as Labor Strikes Impact Performance

The Boeing Company BA fell short of expectations in its third-quarter 2024 results, which showed declines in both earnings and revenue compared to the previous year. The figures also missed the Zacks Consensus Estimates. A significant factor behind these disappointing results was a labor strike led by the International Association of Machinists and Aerospace Workers (IAM), which halted production on key programs.

On a positive note, Boeing’s cash and cash equivalents, along with short-term investments, reached $10.47 billion at the end of Q3 2024, well above its current debt of $4.47 billion. This indicates that Boeing maintains a strong solvency position in the near term. Furthermore, the current ratio of 1.13 suggests that BA has enough liquidity to cover its short-term liabilities.

Evaluating whether to invest in Boeing cannot be solely based on its latest quarterly report. Astute investors should consider BA’s overall share price performance, long-term growth prospects, and potential risks involved in investing in the stock.

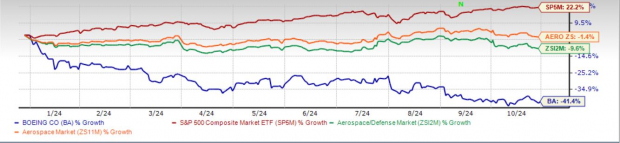

BA Stock Underperforms Compared to Peers

The shares of Boeing, the largest passenger aircraft manufacturer in the U.S., have dropped 41.4% year to date, significantly trailing both the Zacks aerospace-defense industry and the broader Zacks Aerospace sector, which declined by 9.6% and 1.4%, respectively. Additionally, BA has not kept pace with the S&P 500, which rose by 22.2% during the same period.

Image Source: Zacks Investment Research

Year-to-date, other major commercial jet manufacturers like Embraer ERJ and Textron TXT have seen their shares rise by 88.1% and 1.6%, respectively, highlighting Boeing’s considerable struggles.

Factors Behind BA Stock’s Decline

Despite a rise in commercial air traffic leading to increased demand for commercial jets, Boeing’s challenges have persisted, particularly in its commercial airplanes division. The company is grappling with critical internal issues related to product quality, especially with the 737 models, along with the impact of the labor strike and supply chain disruptions in the aerospace sector.

Although Boeing delivered more 737 jets in Q3 compared to last year, all 737-9 aircraft are undergoing enhanced inspections due to an incident involving Alaska Airlines. This inspection process has already slowed production, and the labor strike has further halted production entirely, delaying the delivery of 737 jets as well as progress on other projects, such as the rework on 787 jets and deliveries of 777-9 and 777-8 freighter aircraft.

As a result, revenue growth for Boeing may slow in the coming months, heavily influencing investor sentiment regarding the company’s immediate future.

Additionally, ongoing supply-chain challenges in the commercial aerospace industry are affecting aircraft manufacturers and parts suppliers, limiting the ability to deliver finished aircraft promptly. This broader industry struggle has impacted both Boeing and its main competitor, Airbus Group EADSY, whose shares declined by 1.5% in the current year.

Looking Towards Recovery

Moving forward, there is potential for Boeing to improve its results given its wide array of products and services, including combat jets, missiles, and aviation support for both military and commercial sectors. Notably, the Boeing Defense, Space & Security (BDS) division secured contracts worth $8 billion in Q3, leading to a robust backlog of $61.62 billion as of September 30, 2024. A strong backlog is indicative of promising revenue prospects from Boeing’s defense segment in upcoming quarters.

The company’s services sector also has solid long-term growth prospects. Boeing projects a $4.4 trillion opportunity in commercial aviation support services over the next 20 years, which should positively impact its services division in the long run, supported by a backlog of $20.45 billion.

However, uncertainty looms over the short term, as reflected in its upcoming estimates.

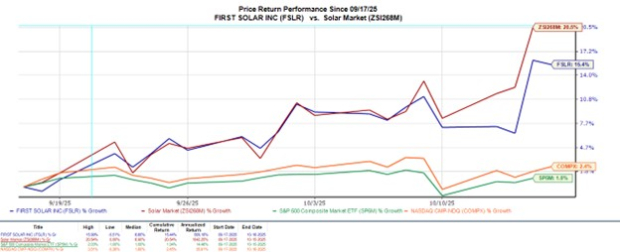

Mixed Financial Outlook for BA

Boeing’s 2024 earnings estimates indicate a decline compared to the previous year, while 2025 projections suggest possible growth. It appears that the stock could recover as we approach 2025.

Sales estimates also portray a mixed outlook. While 2024 sales estimates show a decrease, the 2025 figures suggest improvement.

Image Source: Zacks Investment Research

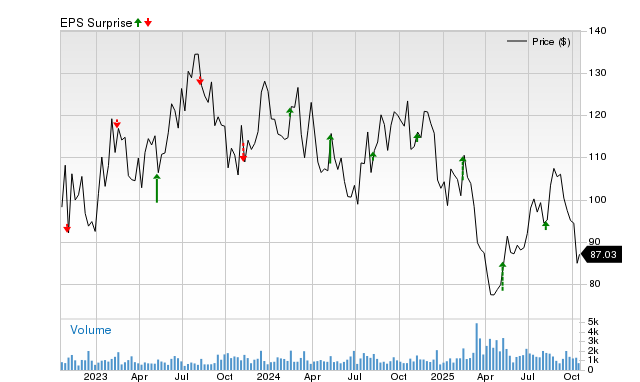

BA’s Troubling ROIC

Boeing’s trailing 12-month return on invested capital (ROIC) not only falls short of industry averages but also shows a negative trend. This suggests that the company’s investments are currently not yielding sufficient returns to cover operational costs.

Image Source: Zacks Investment Research

Should Investors Buy or Wait?

In conclusion, while Boeing has long-term growth potential, it is advisable for investors to hold off on purchasing BA stock at this time. Waiting for a more favorable entry point seems prudent, given the company’s poor ROIC, disappointing year-to-date performance, unclear near-term outlook, and ongoing industry challenges.

New Zacks Ranking Names Top Semiconductor Stock Poised for Growth

Low Rankings Indicate Caution for Other Stocks

With a VGM Score of F, the performance outlook isn’t looking good. Additionally, the company holds a Zacks Rank #4 (Sell), reinforcing concerns over its performance.

For those interested in better investment options, you can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

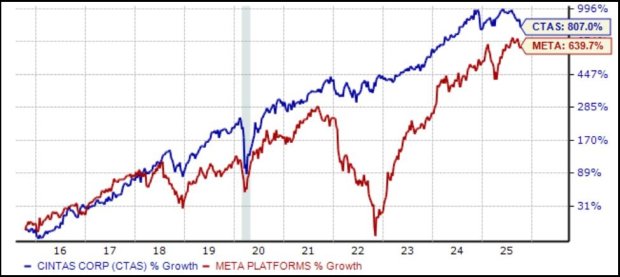

Explosive Growth Projected for the Semiconductor Sector

The spotlight is now on a leading chip stock, which is just 1/9,000th the size of NVIDIA, a company that has soared more than +800% since our initial recommendation. While NVIDIA continues to thrive, this new semiconductor choice has significant growth potential ahead.

As demand for technologies like Artificial Intelligence, Machine Learning, and the Internet of Things surges, this stock is well-positioned to capitalize on the expanding market. The global semiconductor manufacturing industry is expected to grow dramatically, increasing from $452 billion in 2021 to an estimated $803 billion by 2028.

See This Stock Now for Free >>

If you’re interested in the latest recommendations from Zacks Investment Research, you can download “5 Stocks Set to Double” for free today.

Additionally, you can access free stock analysis reports for major companies such as:

- The Boeing Company (BA)

- Embraer-Empresa Brasileira de Aeronautica (ERJ)

- Textron Inc. (TXT)

- Airbus Group (EADSY)

For further insights, check out this article on Zacks.com here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.