Match Group Faces Downgrade as Institutional Sentiment Shifts

On November 7, 2024, B of A Securities adjusted its assessment of Match Group (BRSE:4MGN) from Buy to Neutral. This change follows a broader trend of fluctuating investor confidence.

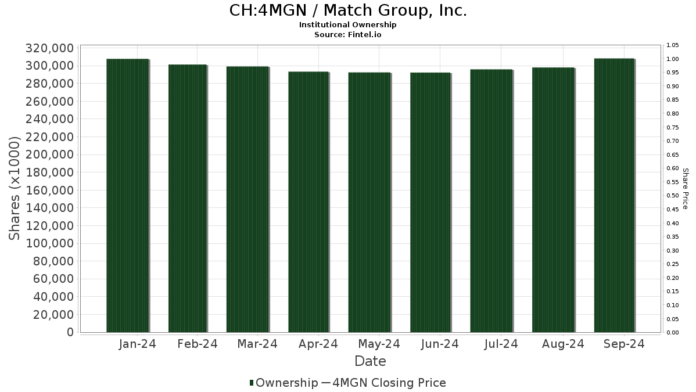

Institutional Ownership Trends

Currently, 1,182 funds and institutions hold shares in Match Group, reflecting a decline of 72 owners, or 5.74%, from the previous quarter. The average portfolio allocation in 4MGN has risen to 0.19%, with a 5.00% increase noted. Additionally, institutional holdings surged by 4.93% over the last three months, bringing total shares owned to 307,753K.

UBS Group increased its holdings to 13,612K shares, now holding 5.28% of the company. This is an increase of 11.37% from their last report, despite an overall decrease in portfolio allocation by 80.05% in the last quarter.

Elliott Investment Management significantly boosted its stake from 4,125K shares to 11,705K shares, now representing 4.54% ownership. This marks a remarkable increase of 64.76%, along with a 121.06% rise in their portfolio allocation in the last quarter.

T. Rowe Price Investment Management raised its position to 10,995K shares (4.26% ownership), up from 10,208K shares, reflecting a 7.15% increase. However, the firm reduced its overall portfolio allocation by 6.97% over the same period.

The Vanguard Total Stock Market Index Fund Investor Shares currently holds 8,371K shares (3.25% ownership), a slight decrease of 2.20% from 8,556K shares in the prior filing. Its portfolio allocation in 4MGN has also decreased by 20.32% in the last quarter.

XLC – The Communication Services Select Sector SPDR Fund increased its holdings to 7,443K shares, contributing to a 2.89% ownership stake. This reflects a growth of 6.02% from the previous report, although the firm cut its portfolio allocation by 14.46% over the last quarter.

Fintel is recognized as a comprehensive investing research platform catering to individual investors, traders, financial advisors, and small hedge funds. The platform provides extensive data, including fundamentals, analyst reports, ownership metrics, and fund sentiment.

This article first appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.