I have identified a stellar global stock with outstanding growth and profitability potential for the upcoming year. My top pick for 2024 is the premier online travel booking provider globally, acknowledged for its exceptional brand recognition and a diversified portfolio of companies. With its cutting-edge AI Trip Planner, Booking integrates the travel planning experience using a travel Chatbot and a visual list of destinations. This vision is the next step in their ongoing journey to enhance the entire trip planning process, according to CEO Glenn Fogel.

While past performance cannot guarantee future results, my top stock pick for 2023, Super Micro Computer (SMCI), has continued to outperform, demonstrating exceptional value and growth, with an impressive rise of over 294% since my initial pick in January 2023.

Booking Holdings Inc. (NASDAQ:BKNG) Stock Overview

-

Market Capitalization: $118.9B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 1/8/2024): 15 out of 530

-

Quant Industry Ranking (as of 1/8/2024): 3 out of 38

Booking Holdings, Inc. (BKNG) presents itself as the world’s leading online travel provider with a vast network of local partners across more than 220 countries and territories. Its solid financials, emphasis on customer service, investment in technology, and expansion into new countries and vacation rentals have contributed to an increasing user base. Strong leisure travel demand led to Booking’s surge in customer bookings of $40B for Q3 2023, a year-over-year increase of 24%.

“I’m encouraged by the strong results we are reporting today and by the strong leisure travel demand environment that we continue to see. In the third quarter, our traveler customers booked 276 million, or more than a quarter of a billion room nights, which was an increase of 15% year-over-year, and we had gross bookings of $40 billion, which was an increase of 24% year-over-year,” said CEO Glenn Fogel.

Tapping into multiple travel segments, Booking’s six primary consumer-facing brands include Booking.com, Priceline, Agoda, Rentalcars.com, KAYAK, and OpenTable. Besides these renowned names, BKNG operates a network of value subsidiaries like Cheapflights, Fareharbor, and Rocketmiles, enhancing its presence in Europe and Asia-Pacific.

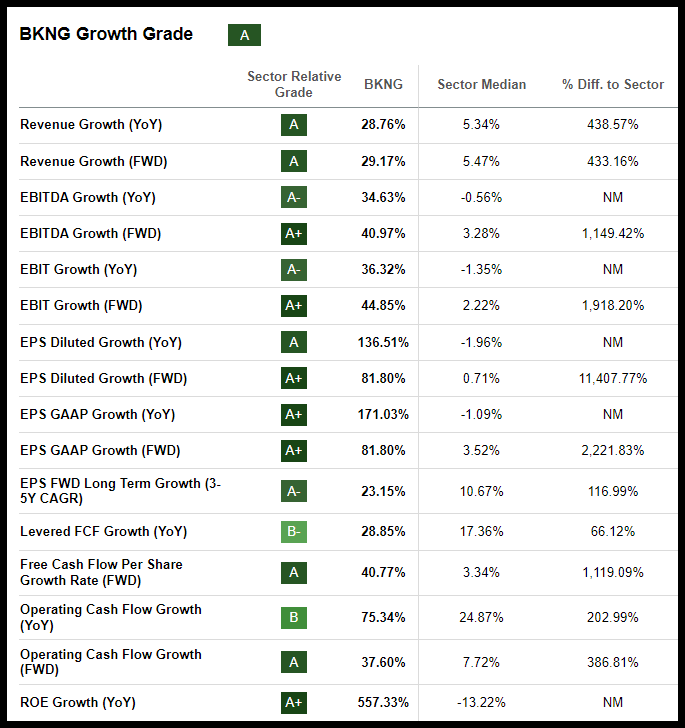

In addition to its strong global presence, BKNG also showcases robust fundamentals, evident in its A’s in growth, profitability, momentum, and consensus earnings revisions, with an overall Quant Rating of 4.87. BKNG is one of the most profitable companies in its sector, with an A+ for Profitability and an ‘A’ Growth Grade, according to Seeking Alpha Factor Grades.

Profitability

BKNG has secured an A+ Profitability Factor Grade, highlighted by a gross profit margin of 86%, significantly exceeding the sector median. The company has consistently delivered a gross profit margin of at least 80% over the last five quarters and 8 of the last ten. In addition, BKNG outperforms the sector median in operating margin, net income, return on total capital, and return on total assets. Its remarkable 348% return on equity is nearly 30 times higher than the sector median of 11.4%. These numbers indicate the efficient utilization of shareholder investments and capital. Booking has chosen to invest cash in growing the business and boosting margins instead of awarding dividends.

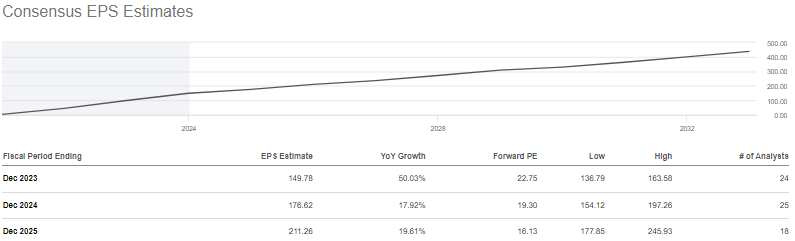

BKNG has surpassed EPS targets in 11 of the past 12 quarters, with its most recent quarter’s EPS of $72.32 beating consensus estimates by $4.40, while revenue of $7.34B exceeded the target by $80M. BKNG’s Q3 earnings beat was among the top upside EPS surprises.

Growth

Booking is strategically positioned to exploit the global online travel market’s potential growth, projected to reach $1.56 trillion in 2030, with technological advancements such as AI-enabled Connected Trip vision. During the Q3 Earnings Call, Fogel highlighted,

“We have always envisioned AI technology at the center of the Connected Trip, and we have a long history of investing in AI technology and incorporating it in our platforms across our company. I previously spoke about the hard work our teams have been doing to

The Ascent of Booking Holdings: A Journey through Growth and Valuation

Booking Holdings, a leader in the online travel industry, is making significant strides in integrating Generative AI into its offerings. With the introduction of innovative AI travel assistants like Penny for Priceline and Booking.com’s AI Trip Planner, the company is aiming to revolutionize the travel experience for its customers. This strategic move reflects Booking Holdings’ commitment to leveraging cutting-edge technology to enhance its services.

Expanding Market Reach and Accelerated Growth

Booking Holdings is poised to expand its presence in the Asia-Pacific (APAC) market segment, where travel recovery is gaining momentum. The company’s sales have witnessed an impressive year-over-year growth of 28%, with forward Revenue Growth at a remarkable 30%. Additionally, its EBIT forward growth is nearly 2,000% above the sector median, and the EPS GAAP (FWD) stands at +80% as compared to the sector median of 3.52%. These robust figures underscore the company’s remarkable performance and potential for sustained growth.

The growth trajectory of Booking Holdings is further supported by rising consensus estimates, boasting an A- Revisions Grade with 21 upward earnings revisions in the last 90 days. Moreover, the company has announced plans for $24 billion of share repurchases over the next four years, signaling confidence in its future prospects and financial strength.

CFO David Goulden affirmed, “We expect to spend more on buybacks in Q4 than we did in Q3. We remain comfortable with our ability to complete the full $24 billion of share repurchases within 4 years from when we started the program at the beginning of this year, assuming no major downturn in the travel environment.“

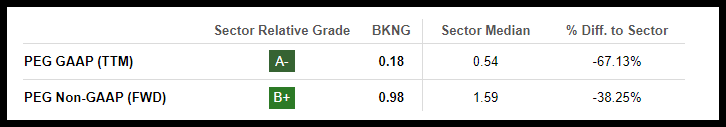

Despite its relative premium valuation, Booking Holdings continues to demonstrate compelling growth prospects, as indicated by its favorable PEG ratio, which accounts for growth drivers and stands as a testament to the company’s potential.

Uncovering Stock Valuation

Booking Holdings has exhibited impressive stock performance, with a 55% increase over the last year. While the company’s overall valuation grade is a ‘D,’ its PEG ratio significantly outperforms the sector, with a trailing twelve-month ratio almost 70% below the sector median. This compelling valuation metric underscores the company’s remarkable growth potential and solidifies its position in the market.

Furthermore, the P/E Non-GAAP forward ratio, though seemingly high at 22.75, becomes more favorable when factoring in the projected EPS growth. Consensus estimates suggest a considerable drop to 16 by fiscal year 2025, reinforcing the company’s optimistic outlook.

Additionally, Booking Holdings has demonstrated a strong commitment to enhancing shareholder value, with repurchases of $7.7 billion worth of shares in the first three quarters of 2023, leaving $16 billion in share buyback authorization. This proactive approach reflects the company’s confidence in its financial position and its ability to generate long-term value for its shareholders.

Concerted Consensus and Recognizing Risks

While Booking Holdings presents a strong outlook for revenue and earnings growth, it is essential to acknowledge the potential risks associated with investing in the company. Operating in the Hotels, Resorts, and Cruise Lines industry exposes the company to cybersecurity threats and operational vulnerabilities. Furthermore, the dynamics of competition and dependencies on partnerships can impact inventory availability and service offerings, potentially affecting revenue and profitability.

“What we’re seeing is a very healthy consumer profile right now…growth rates are strong…If things do slow down, which is kind of what’s on the back of people’s mind, it manifests itself in two ways. People will either trade down from a higher star to lower star property, or they’ll shorten their length of stay. We’re not seeing that in any of our markets, and moreover, we’re actually seeing the length of stay increase.”

Moreover, the company faces external factors such as currency fluctuations, cyclical travel patterns, and macroeconomic events, including natural disasters and health crises, which can impact its business operations.

“Globally, we saw a slowdown starting the second week of October due to cancellations, drop in new bookings after the start of the war in the Middle East,” elucidated Chief Financial Officer David Goulden.

Despite these challenges, Booking Holdings has demonstrated resilience and adaptability, navigating through market fluctuations with a proactive approach.

Envisioning a Thriving Future

As 2024 unfolds, Booking Holdings continues to chart its upward trajectory, with analysts expressing bullish sentiments and projecting an optimistic outlook for the company. Amidst share fluctuations, the stock achieved an all-time high of $3,479 in December, signaling buoyant investor confidence and market support.

Looking ahead, the company’s robust financial performance, global footprint, and strategic initiatives position it as a leading contender in the online travel industry. With its relentless focus on innovation, customer experience, and shareholder value, Booking Holdings stands as a compelling choice for investors seeking long-term growth opportunities in the ever-evolving travel market.

In Conclusion: Navigating the Investment Landscape

In summary, Booking Holdings presents a promising investment opportunity grounded in its strong market position, consistent performance, and forward-looking strategies. Amidst the evolving dynamics of the travel industry, the company is set to play a pivotal role in shaping the future of travel experiences and digital innovation.

As investors navigate the investment landscape, tools like Seeking Alpha’s quant ratings and investment research provide invaluable insights, guiding informed investment decisions. With an array of strong buy recommendations and a compelling growth outlook, Booking Holdings emerges as a potential candidate for inclusion in investment portfolios, offering a blend of stability and growth prospects.

Ultimately, as the travel industry continues to evolve, Booking Holdings remains at the forefront of innovation, poised to seize emerging opportunities and deliver sustained value to its stakeholders. Happy investing!