BorgWarner Reports Strong Third-Quarter Earnings, But Sales Fall Short

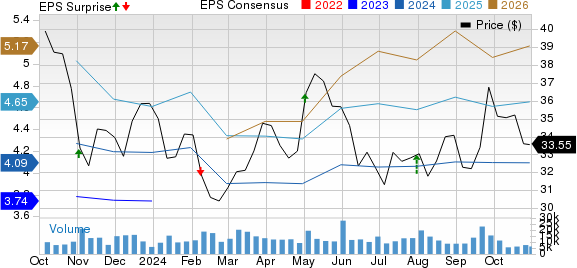

BorgWarner Inc. BWA announced adjusted earnings of $1.09 per share for the third quarter of 2024, an increase from 98 cents in the same period last year. This figure exceeded the Zacks Consensus Estimate of 92 cents. However, the automotive equipment company’s net sales reached $3.45 billion, which did not meet the Zacks Consensus Estimate of $3.53 billion, marking a 5% decline compared to the previous year.

Stay updated with the latest quarterly releases: See Zacks Earnings Calendar.

BorgWarner’s Earnings Performance at a Glance

BorgWarner Inc. price-consensus-eps-surprise-chart | BorgWarner Inc. Quote

Segment Breakdown of Sales

Beginning July 1, 2024, BorgWarner revamped its organizational structure to support its Charging Forward strategy. The company now operates through four main segments: Turbos & Thermal Technologies, Drivetrain & Morse Systems, PowerDrive Systems (previously ePropulsion), and Battery & Charging Systems.

Turbos & Thermal Technologies: This segment reported net sales of $1.38 billion in the third quarter, down from $1.47 billion a year earlier. Adjusted operating income decreased to $202 million from $214 million in the previous year.

Drivetrain & Morse Systems: Sales in this segment reached $1.36 billion, compared to $1.44 billion last year. Adjusted operating income fell slightly to $251 million from $253 million in the same quarter of 2023.

PowerDrive Systems: The segment generated $512 million in sales, down from $571 million a year ago. It recorded an adjusted operating loss of $19 million, an improvement over a loss of $20 million the previous year.

Battery & Charging Systems: Sales increased to $197 million, rising from $146 million in the same period last year. This segment reported an adjusted operating loss of $8 million, an improvement from the $26 million loss experienced a year prior.

Financial Overview

As of September 30, 2024, BorgWarner reported $2 billion in cash and cash equivalents, a notable increase from $1.53 billion at the end of 2023. Concurrently, the company’s long-term debt rose to $4.2 billion, up from $3.7 billion at the beginning of the year.

Net cash from operating activities was $356 million for the quarter. Capital expenditures were at $155 million, while free cash flow totaled $201 million.

2024 Forecast Adjustments

For the full year of 2024, BorgWarner now expects net sales in the range of $14 billion to $14.2 billion, a downtick from the prior estimate of $14.1 billion to $14.4 billion.

The company projects an adjusted operating margin between 9.8% and 10%, up from the previous forecast of 9.6% to 9.8%. Adjusted earnings per share are now anticipated to range from $4.15 to $4.30, higher than the earlier estimate of $3.95 to $4.15. Operating cash flow expectations remain stable at $1.325 billion to $1.375 billion, while free cash flow is projected between $475 million and $575 million.

BorgWarner also anticipates eProduct sales to reach around $2.4 billion, an increase from about $2 billion in 2023.

BorgWarner’s Market Position

Currently, BorgWarner holds a Zacks Rank #3 (Hold). In the automotive sector, some top-ranking peers include Tesla TSLA, Toyota TM, and REE Automotive REE, all holding a Zacks Rank #1 (Strong Buy). Recently, the Zacks Consensus Estimate for Tesla’s EPS for 2024 and 2025 increased by 18 cents and 12 cents, respectively.

Similarly, Toyota’s EPS estimates for 2024 and 2025 have moved up by 56 cents and 65 cents in the last two months. For REE, the estimates show an anticipated growth of 64% and 13.3% year over year for 2024 and 2025, respectively.

Stocks with High Potential

Here are 5 stocks selected by a Zacks expert as the top picks likely to yield +100% or more returns in 2024. In past recommendations, stocks saw impressive gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Most stocks in this list remain under Wall Street’s radar, presenting a unique opportunity for investors. Discover these 5 opportunities today >>

Want the latest recommendations from Zacks Investment Research? Download the report with 5 Stocks Set to Double for free now.

Toyota Motor Corporation (TM): Free Stock Analysis Report

BorgWarner Inc. (BWA): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

REE Automotive Ltd. (REE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.