Analysts See Potential Gains for First Trust NASDAQ Technology Dividend Index Fund ETF

Recent evaluations suggest upside potential for TDIV as analysts set optimistic targets based on underlying assets.

In a detailed analysis from ETF Channel, we examined the holdings of various ETFs in our coverage. Specifically for the First Trust NASDAQ Technology Dividend Index Fund ETF (Symbol: TDIV), the weighted average implied analyst target price has been set at $89.66 per unit. This is in stark contrast to its recent trading price, which hovers around $79.56 per unit, indicating a promising upside of 12.69% based on analysts’ expectations for the ETF’s holdings.

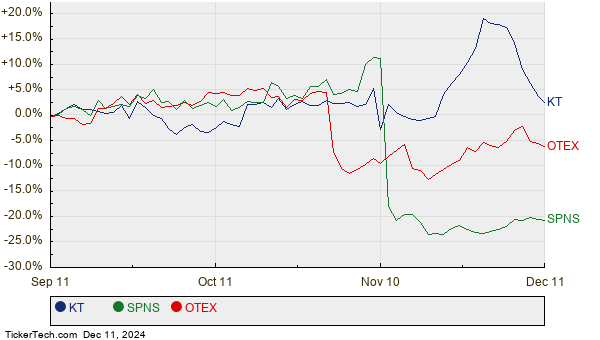

Particularly notable are three stocks within TDIV that analysts suggest may perform well. KT Corp (Symbol: KT) shows a current trading price of $15.72 per share, with an average analyst target of $20.30 per share—signifying a potential rise of 29.13%. Sapiens International Corp NV (Symbol: SPNS) currently trades at $28.11 a share, but analysts predict a target price of $34.00, translating to an upside of 20.95%. Lastly, Open Text Corp (Symbol: OTEX) sees a recent price of $30.28, with a target set at $35.90, suggesting an 18.56% potential increase. The following chart illustrates the twelve-month performance of these stocks:

Here’s a summary of the current analyst target prices for the mentioned stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust NASDAQ Technology Dividend Index Fund ETF | TDIV | $79.56 | $89.66 | 12.69% |

| KT Corp | KT | $15.72 | $20.30 | 29.13% |

| Sapiens International Corp NV | SPNS | $28.11 | $34.00 | 20.95% |

| Open Text Corp | OTEX | $30.28 | $35.90 | 18.56% |

Investors may wonder if analysts are justified in their bullish outlook or if they are being overly optimistic about future price movements. While a higher target relative to a stock’s trading price may indicate confidence, it can also signal potential downgrades if these targets become outdated. These are crucial factors for investors to research further.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Funds Holding FFIE

• Insurance Brokers IPOs

• GLAD Stock Predictions

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.