By RoboForex Analytical Department

Brent Crude Oil Prices Rise Amid OPEC+ Production Delay

Brent crude oil prices have surged past 74 USD per barrel after OPEC+ decided to postpone a production increase initially slated for December. This marks the second time OPEC+ has deferred production hikes, a response to ongoing global economic difficulties aimed at preventing a surplus in the oil market.

Current Demand Challenges

Economic recovery in Europe remains sluggish, and Asia’s performance, especially China, continues to be underwhelming, even with recent stimulus efforts from the government. Additionally, tensions in the Middle East, particularly threats from Iran towards Israel, are bolstering oil prices. Analysts predict potential intensifications in these tensions following the US presidential elections on November 5.

Fears of possible attacks targeting oil production facilities in the region are heightening concerns over supply disruptions, which, alongside a temporary weakness in the US dollar, are supporting the rise in oil prices.

Technical Outlook for Brent Crude

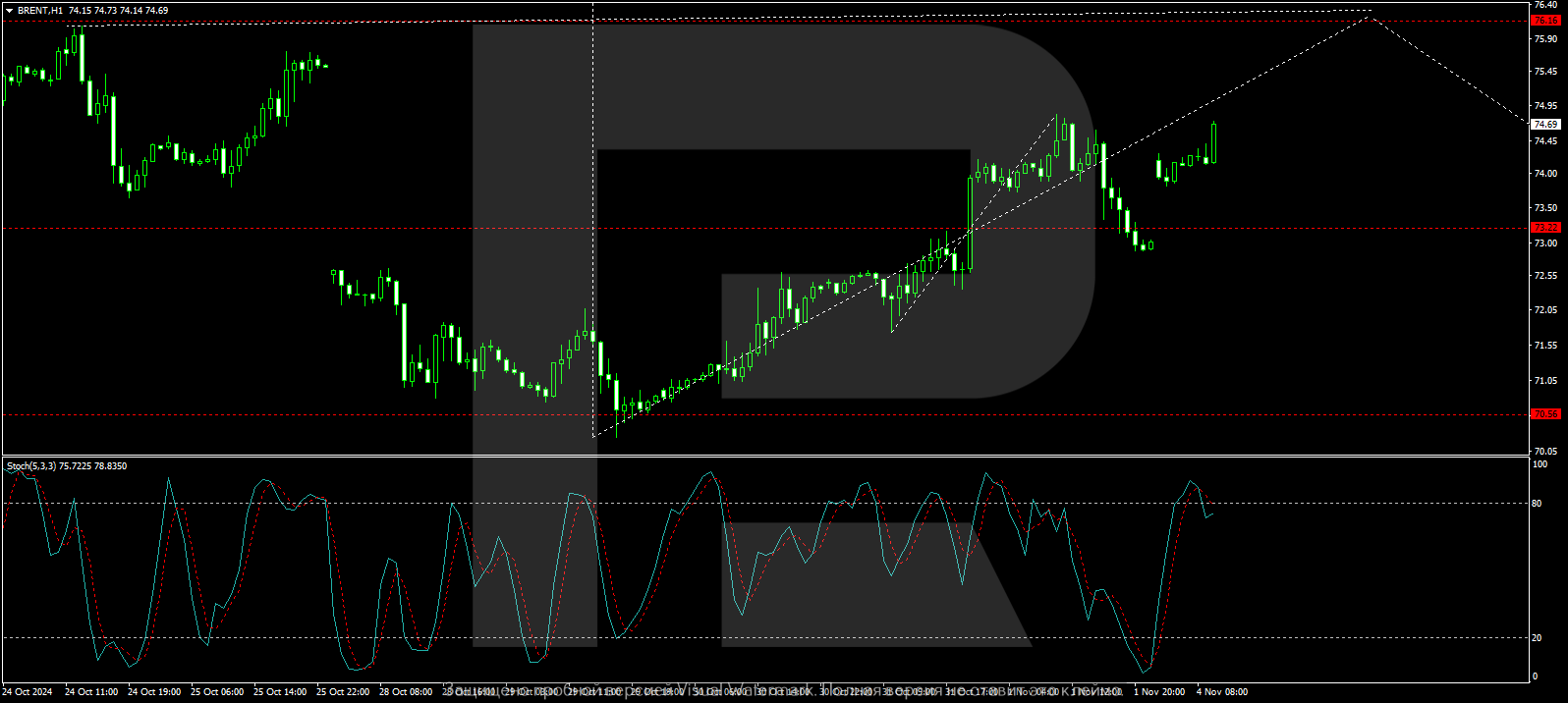

Brent crude oil prices have bounced back from a recent low of 70.55 and are headed upwards toward 76.16. Currently, the market is stabilizing around 73.22, with a possible breakout that may reach 76.16. If this target is reached, a slight retreat to 73.22 could happen before further increases toward 79.20 are attempted. This optimistic perspective is reinforced by MACD indicators, which suggest increasing momentum.

After a potential correction back to 73.22, Brent is expected to rise to 74.90. Successfully exceeding this level could facilitate movement to 76.16. The stochastic oscillator’s position above 50, trending toward 80, supports this possible upward trajectory.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs