2024: A Year of Triumph and Trials for Semiconductor Giants

The year 2024 was significant for semiconductor companies in the U.S. tech sector. Those that embraced the artificial intelligence boom, like Nvidia Corp NVDA and Broadcom Inc AVGO, saw considerable rewards. Conversely, companies such as Intel Corp INTC faced significant challenges.

According to Bloomberg, one-third of the ten most valuable companies globally, each worth over $1 trillion, belong to the chip industry.

Also Read: Nvidia Completes Run:ai Buyout: Details

In 2024, Broadcom joined the esteemed ranks of Taiwan Semiconductor Manufacturing Co TSM and Nvidia by entering the Trillion Dollar Club.

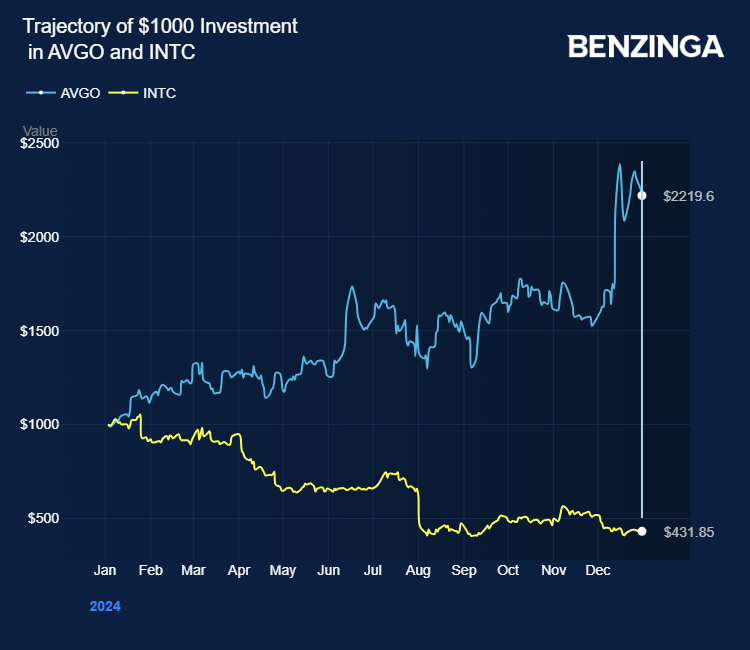

Over the past year, Broadcom’s stock shot up by 114%, while Intel’s share price fell by 58%. This performance starkly illustrates the differing strategies that businesses utilized amidst this technological shift.

Broadcom specializes in creating custom chips for major American tech companies such as Alphabet Inc GOOG GOOGL, Google, Meta Platforms Inc META, and Microsoft Corp MSFT.

Intel, once dominant in the mobile chip market, lost ground to competitors like Qualcomm Inc QCOM, Arm Holdings plc ARM, and Apple Inc AAPL, as reported by CNBC.

Nvidia emerged as a formidable competitor for Intel, as the latter’s graphics processing units (GPUs), once aimed at gaming, became essential for AI development. Meanwhile, Advanced Micro Devices, Inc AMD captured market share in PCs and servers by leveraging Taiwan Semiconductor’s capabilities, further squeezing Intel’s position.

These developments rendered Intel’s central processing units (CPUs), which were historically the most critical part of servers, increasingly irrelevant in AI-driven systems. Notably, Nvidia’s upcoming GPUs for 2025 won’t even require an Intel CPU.

As a result, Broadcom emerged as the second-most valuable chipmaker after Nvidia, which attained a staggering $3.4 trillion valuation fueled by the AI surge, achieving a remarkable 179% increase over the past year.

Intel, which once topped the chipmaker list, saw its market cap drop from $300 billion in 2020 to only $85 billion by 2024. This decline has led to workforce reductions, the dismissal of its long-time CEO Pat Gelsinger, and potential divestitures of key business segments. Nvidia has since taken Intel’s former spot in the Dow Jones Industrial Average.

Investors are favoring Broadcom for offering simpler and more affordable XPUs compared to Nvidia’s GPUs.

During a recent earnings call, Broadcom CEO Hock E. Tan announced plans to double the shipment of its XPUs to major providers like Google, TikTok’s parent company ByteDance, and Meta. He anticipates that these companies will spend between $60 billion and $90 billion on XPU capital expenditures within the next two years. Furthermore, Broadcom expects AI revenue to rise to 65% of its total income by the first quarter, up from 40% in the last quarter.

Tan emphasized that he expects strong AI demand to persist for at least the next decade, largely driven by the ambitions of Big Tech players like OpenAI and Elon Musk’s xAI. Analyst Hans Mosesmann of Rosenblatt believes that Broadcom’s unique custom-chip capabilities will strengthen its competition with both AMD and Nvidia.

Looking ahead, Intel plans to launch a new AI chip called Falcon Shores in 2025. The company is also aiming to restructure its foundry business, although significant sales from external clients are not expected until 2027.

Analysts from major financial firms including Goldman Sachs, Benchmark, Needham, Oppenheimer, and KeyBanc have noted Intel’s struggles with competitive pressures and profitability challenges amid modest revenue growth.

For investors wanting to engage with the semiconductor sector, options include the VanEck Semiconductor ETF SMH and the iShares Semiconductor ETF SOXX.

Price Actions: As of Thursday morning, AVGO stock was trading at $237.51, up 2.45% in pre-market trading, while INTC stock was up 1.20%.

Also Read:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.