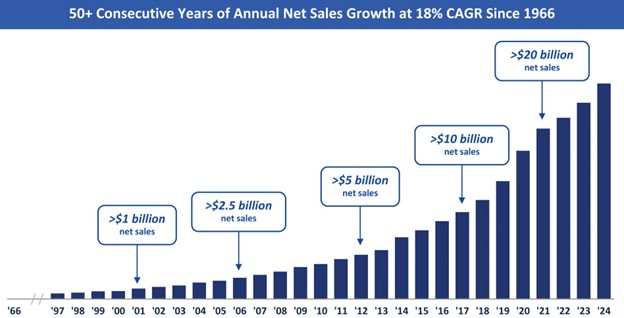

The Evolution of Broadcom

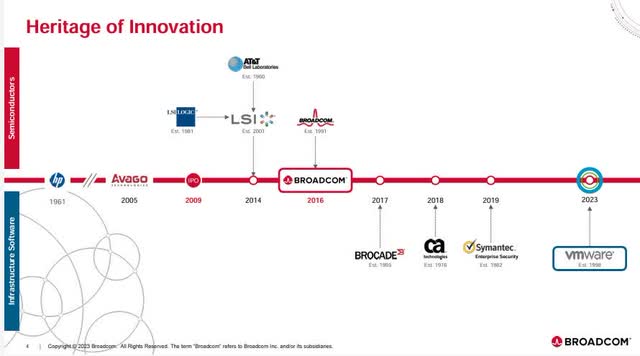

Following the fortuitous market climate of 2023, 2024 heralds a metamorphosis for Broadcom Inc. (NASDAQ:AVGO). With the long-anticipated acquisition of VMware (VMW) receiving the green light, a new era unfolds. Preceding 2024, sales tilted heavily (79%) towards semiconductors/hardware, with software comprising a modest 21%. However, the projected landscape of 2024 showcases a radical shift, with software expected to account for 40% – a pivotal juncture indeed.

The VMware deal has notably mitigated the risk posed by dependency on a handful of key customers, with the top 5 end customers contributing to 35% of net revenues and WT Microelectronics alone accounting for 20%. This maneuver proves particularly prescient in light of Apple’s potential exodus as a customer, given its foray into chip production. Although Apple remains tethered to Broadcom via a long-term contract, the capricious nature of the industry warrants circumspection. Nonetheless, bolstered by new revenue streams from VMware, Broadcom’s reliance on its top 5 customers is considerably assuaged.

The symbiosis between VMware’s mission-critical cloud software, which underpins myriad applications, and Broadcom’s portfolio appears auspicious. Moreover, in the realm of generative AI, wherein NVIDIA (NVDA) and VMware collaborate via VMware’s Private AI Cloud, leveraging NVIDIA’s CUDA software solution, Broadcom stands to benefit. This aligns with NVIDIA’s competitive edge over AMD, yet Broadcom is positioned to thrive, irrespective of the eventual victor in this contest. Anticipating a potential market share theft by AMD from NVIDIA? Dive into my recent article delving into this gripping saga of two GPU behemoths.

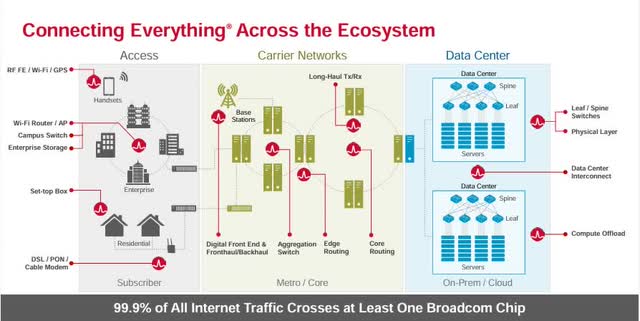

Broadcom, having transitioned from a hardware-centric entity to a semiconductor-focused one, is now poised to achieve equilibrium – a 50-50 split between software and semiconductor/hardware. Its extensive portfolio encompasses an array of inconspicuous electronic components that permeate daily life. The revelation that 99.9% of global Internet traffic traverses at least one Broadcom chip is nothing short of bewildering, underscoring its far-reaching influence – akin to a mammoth moat guarding its domain.

Embracing a pervasive ethos and profound industry acumen, Broadcom commands reliance from a multitude of clientele. Its dominance unfurls in the Wi-Fi domain, where nearly 80% of infrastructure banks on Broadcom, with 1 billion Broadcom DSL connections adorning the global landscape. Furthermore, a substantial portion of enterprise server customers entrust their server storage to Broadcom, drawn by its unwavering dependability, low latency, and power efficiency, all pivotal requisites for mission-critical operations. The company’s accentuation on software, particularly in the domain of data centers, is poised to reap dividends in the ensuing years.

Debt Dynamics and Financial Fortitude

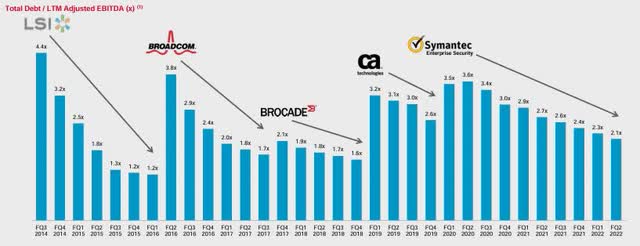

A momentous uptick in net debt, from $25 billion to $70-80 billion, materialized following the VMware transaction. Notably, this surge aligns with Broadcom’s modus operandi – acquiring robust enterprises through leveraging debt, subsequently enhancing margins, and ultimately deleveraging the balance sheet. Historically, this blueprint has yielded resounding success for the company.

Personally, the prevailing debt magnitude exceeds my customary threshold. I typically favor companies with net debt not surpassing 4 times net income. However, with Broadcom’s net income pegged at a meager $14 billion in its latest financial disclosure, this yardstick falls short. Upon factoring in VMware’s prospective income in 2024, estimated to surpass $20 billion, the debt equation assumes a more palatable disposition.

Furthermore, Broadcom’s divestment plans for Carbon Black and EVC can potentially yield revenue, alongside a robust free cash flow of $17 billion. Parsing this, and accounting for SBC to the tune of $2.7 billion, we arrive at an SBC-adjusted free cash flow approximating $15.3 billion – ample to pacify shareholders, fuel expansion, and alleviate the balance sheet straits.

ROIC and Capital Allocation

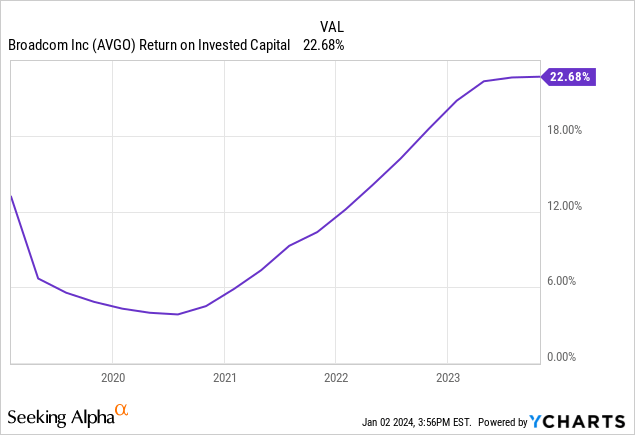

Broadcom has masterfully wielded its stewardship over Return On Invested Capital (ROIC) in recent years, transmuting it from meager depths to an impressive 22%. Broaching the discourse on Broadcom’s Weighted Average Cost of Capital (WACC), estimated at approximately 9%, a robust ROIC-WACC spread of 13% ensues. This robust metric underscores Broadcom’s capacity for value creation, catalyzed by its M&A maneuvers and organic expansion. Conceivably, a marginal moderation in ROIC, during the initial one or two years post the VMware assimilation, is plausible, followed by an envisaged ascent.

Broadcom’s Strategic Moves Garner Shareholder Praise

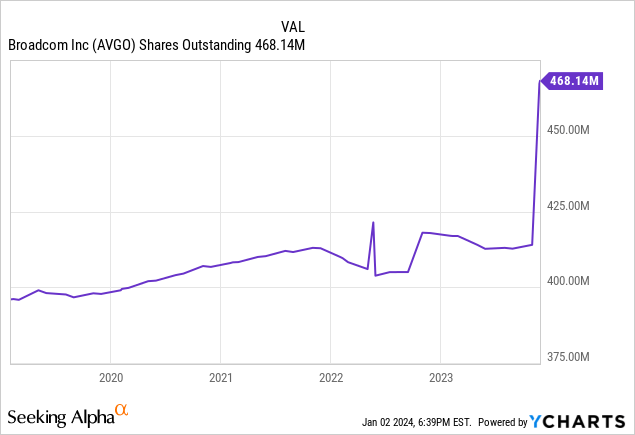

With a large portion of Free Cash Flow (FCF) devoted to dividends and their phenomenal growth, shareholders have been handsomely rewarded. In addition, Broadcom has repurchased a lot of stock, further demonstrating that Broadcom’s management is very shareholder-friendly.

Unfortunately, the buybacks were more to offset the dilution from SBC than to significantly reduce the share count. Still, Broadcom has been able to grow EPS and create shareholder value, even though the share count has increased since 2019. Their capital allocation in the form of M&A has simply been outstanding. Hock Tan’s playbook of buying companies, cutting costs, and making them more profitable has been successful in recent years, but synergies are often overestimated and M&A is a tough playing field. But his track record is extraordinary when it comes to the success rate of his acquisitions. A clear case of exceptional management where most would fail.

However, it will be interesting to see how the large increase in shares outstanding from the VMware deal will affect EPS.

Broadcom’s Reverse Discounted Cash Flow (DCF)

An excellent tool for determining whether a company is fairly valued is a reverse DCF. This involves looking at what is included in the stock price. And if we take the Trailing Twelve Months (TTM) diluted EPS of $32.98, we see that the stock is currently pricing in a 12% EPS growth rate over the next 10 years. But the historical EPS Compound Annual Growth Rate (CAGR) over the last 10 years is a whopping 31.15%. Well above the required target.

I do not think that Broadcom will achieve the same rate in the next 10 years, but I can definitely see them achieving a CAGR between 15% and 20% if the VMware integration goes well. This would make the shares look somewhat undervalued in this context.

What could EPS look like in 5 years?

EPS estimates also see a 16% CAGR over the next 5 years through October 2028, further fueling the positive outlook. If EPS is $80 to $85 in 5 years, the stock could trade over $2000 depending on the multiple. I don’t think Broadcom has that much room for multiple expansion, but even a 25x multiple would give the stock almost 100% upside.

Risks

The risks of Apple producing its chips in the future have been discussed, but I think the two biggest risks are definitely TSMC (TSM) and the M&A activities. TSMC produces 90% of Broadcom’s wafers and also produces for almost every competitor. This gives it unparalleled market power and pricing leverage. Broadcom needs TSMC’s products, and TSMC can almost dictate prices because no other company can currently deliver the same level of quality. The advantage in terms of know-how is simply very large at the moment.

The second risk is that Broadcom is a serial acquirer and will likely need new M&A targets to fuel growth as VMware ages. VMware has brought in significant recurring revenue, but what is the impact of this really big software acquisition? And will there be enough attractive targets left that won’t be blocked by antitrust regulators?

And Hock Tan’s age, 72, is a risk because he is responsible for much of the success. Will the success story continue when he retires? A difficult question to answer.

Conclusion

All in all, the stock looks undervalued from a long-term perspective. Over the next 5 to 10 years, the VMware deal and data center focus should drive strong earnings growth. And given the company’s shareholder-friendly management, the dividend should continue to grow strongly to reward shareholders. Even if the multiple comes down a bit, earnings growth and dividend increases should be enough to support returns.

But it is important to remember that this is the largest and most transformative acquisition in Broadcom’s history. And just because everything worked so well in the past does not mean it will work as well in the future.