Broadcom Inc. Charts a Path Amid Market Pressures

Broadcom Inc. AVGO is currently in a moderately bullish market trend, despite facing some selling pressure.

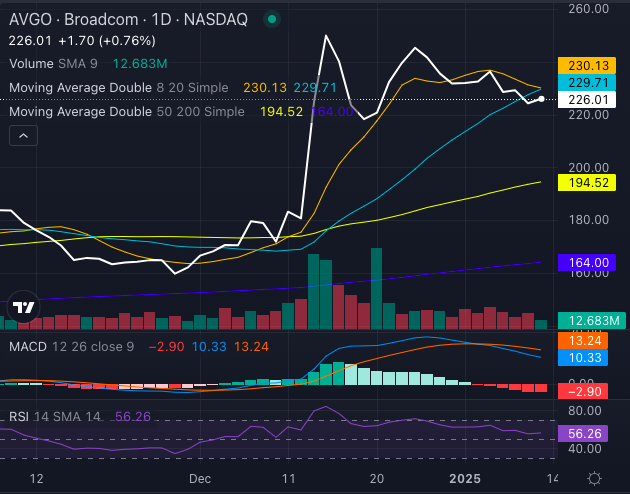

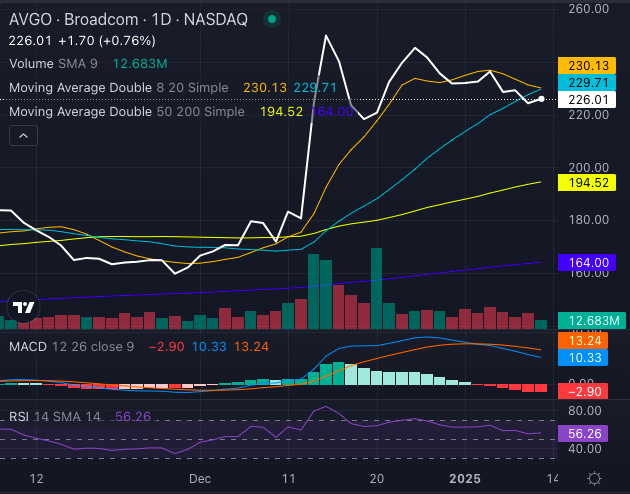

Chart created using Benzinga Pro

At a current price of $226.01, Broadcom’s stock presents a complex scenario when considering its technical indicators. The eight-day and 20-day simple moving averages (SMA) are at $230.13 and $229.71, signaling potential bearish trends.

Nevertheless, the long-term outlook remains positive. The stock is above the 50-day SMA of $194.52 and the 200-day SMA of $164, both of which indicate a solid uptrend.

Supporting this hopeful view, the Moving Average Convergence Divergence (MACD) stands at a bullish 10.33, while the Relative Strength Index (RSI) is stable at 56.26, showing that the stock is neither overbought nor oversold.

Read Also: Nvidia, Broadcom, Marvell Positioned for Growth as AI Demand Drives Semiconductor Momentum

In a strategic financial move, Broadcom recently issued $3 billion in senior notes, led by underwriters Wells Fargo and Citigroup. This issuance includes three different tranches:

- $1.1 billion in 4.800% notes due 2028,

- $800 million in 5.050% notes due 2030, and

- $1.1 billion in 5.200% notes due 2032.

These unsecured notes will rank equally with Broadcom’s existing debts and aim to support general corporate needs, including debt repayment.

Despite having a debt-to-equity ratio of 1.02, Broadcom’s approach to capital management highlights its confidence in maintaining market leadership, especially in the face of AI-driven growth opportunities.

The company’s recent financial performance reflects this resilience, with revenue from AI contributing to strong fourth-quarter results. Broadcom expects to record $14.6 billion in revenue, with an EBITDA margin of around 66% for the next quarter, solidifying its competitive stance alongside NVIDIA Corp NVDA in the AI infrastructure landscape.

As market conditions continue to evolve, Broadcom is focused on its financial strategy, attracting attention from investors who see long-term value in the semiconductor giant amidst changing technological trends.

Read Next:

Photo: Rokas Tenys via Shutterstock

Market News and Data brought to you by Benzinga APIs