Wall Street Analysts Weigh In: Is United Airlines (UAL) a Smart Investment?

Investors often turn to the recommendations of Wall Street analysts when deciding on stocks. Recent news of changes in analysts’ ratings can influence stock prices. But do these recommendations really hold significant weight?

Let’s examine what analysts say about United Airlines (UAL) before delving into the credibility of brokerage recommendations and how to best utilize them.

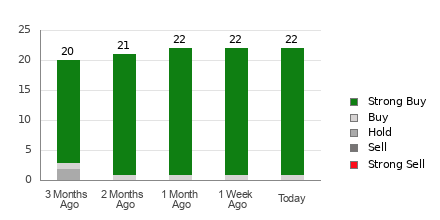

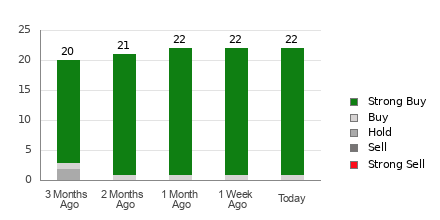

Currently, United Airlines has an average brokerage recommendation (ABR) of 1.05 on a scale ranging from 1 (Strong Buy) to 5 (Strong Sell). This average is based on assessments from 22 brokerage firms and suggests a rating between Strong Buy and Buy.

Out of these 22 recommendations, 21 are classified as Strong Buy and one as Buy, meaning 95.5% of the analysts favor a strong buy position.

Current Trends in Brokerage Recommendations for UAL

Explore price targets and stock forecasts for United here>>>

Despite a positive ABR suggesting it’s a good time to buy United, investors should be cautious. Various studies indicate that brokerage recommendations have limited success in guiding investors toward stocks likely to increase in value.

Why is this the case? Brokerage firms often have biased interests in stocks they cover which leads their analysts to favor favorable ratings. Research suggests that for each “Strong Sell” recommendation, there are about five “Strong Buy” recommendations issued.

This disparity means the interests of these firms may not align with retail investors, providing less insight into a stock’s future price movement. It is advisable to treat this information as a supplement to a personal analysis or utilize a proven tool for stock price prediction.

Among such tools, Zacks Rank stands out with an externally audited track record. This system categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell) and can serve as a useful indicator of short-term price movements. Combining the Zacks Rank with the ABR can enhance your investment decisions.

Distinguishing Between ABR and Zacks Rank

Despite both being rated on a 1 to 5 scale, Zacks Rank and ABR measure different aspects.

ABR is purely based on brokerage recommendations and typically appears in decimal form (like 1.28). In contrast, Zacks Rank is a quantitative model that focuses on earnings estimate revisions and is displayed in whole numbers from 1 to 5.

Historically, analysts from brokerage firms tend to be overly optimistic. Their vested interests often result in more favorable ratings than warranted, misleading investors more often than not.

Conversely, Zacks Rank emphasizes earnings estimate revisions, which empirical research links strongly to short-term stock price trends.

Furthermore, Zacks Rank applies grades evenly across all stocks under scrutiny for earnings estimates, maintaining consistency among its five ranks.

Another difference lies in the timeliness of data. The ABR may not always reflect current conditions, while Zacks Rank updates quickly in response to changes in earnings estimates, offering a more immediate view of potential price movements.

Is United Airlines Worth an Investment?

Regarding earnings estimates, the Zacks Consensus Estimate for United has recently jumped by 9.4% to $12.71 over the last month.

This increase, along with collective support from analysts raising their EPS estimates, bodes well for United’s stock, potentially signaling growth in the near future.

The consensus shift in estimates, bolstered by three additional positive factors, has earned United a Zacks Rank #1 (Strong Buy). For a full list of stocks holding a Zacks Rank #1 designation, you can view it here>>>>

Overall, the Buy-equivalent ABR for United can provide a helpful framework for investors weighing their options.

Zacks Identifies the Top Semiconductor Stock

This stock is notably only 1/9,000th the size of NVIDIA, which has surged over +800% since our recommendation. While NVIDIA remains strong, our latest top stock shows significant potential for growth.

With a robust earnings growth trajectory and a growing customer base, it aligns perfectly with the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is forecasted to grow from $452 billion in 2021 to $803 billion by 2028.

Discover this stock now for free >>

United Airlines Holdings Inc (UAL): Free Stock Analysis Report

To read this article on Zacks.com, click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.