Wall Street analysts’ endorsements often influence investors’ decisions on whether to Buy, Sell, or Hold a stock. The recent brokerage firm consensus rating for Enphase Energy (ENPH) is 1.88, signaling a stance somewhere between Strong Buy and Buy based on recommendations from 33 brokerage firms.

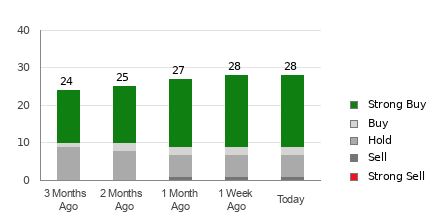

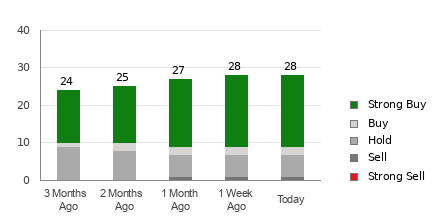

Analysts have overwhelmingly supported the stock, with 18 Strong Buy and 2 Buy recommendations accounting for over 60% of the total recommendations. While such consensus may seem persuasive, investors should be wary of relying solely on this data. Research indicates that brokerage recommendations do not consistently lead to profitable stock picks, possibly due to analysts’ inherent bias.

Brokerage Recommendation Trends for ENPH

Check price target & stock forecast for Enphase Energy here>>>

Therefore, it could be wise to take the Buy-equivalent ABR for Enphase Energy with a grain of salt.

The Zacks Rank, a research-based stock rating tool, provides a different perspective. Analyzing the earnings estimate revisions, it categorizes stocks into five groups, indicating a stock’s potential price performance in the near future. Comparing the ABR with the Zacks Rank can be a reliable method for making investment decisions.

Zacks Rank Should Not Be Confused With ABR

The Zacks Rank measures stock performance based on earnings estimate revisions, displayed in whole numbers from 1 to 5. In contrast, the ABR relies solely on brokerage recommendations, often exhibiting a degree of favorable bias due to analysts’ interests in the stocks they cover.

Freshness and timeliness are crucial elements setting apart the Zacks Rank from ABR. While the ABR may lack real-time updates, the Zacks Rank promptly reflects analysts’ actions and company trends, serving as a more dynamic tool in predicting future price movements.

Given the recent decline in Enphase Energy’s earnings estimate by 22.2% over the past month, resulting in a Zacks Rank #4 (Sell), investors may want to approach the Buy-equivalent ABR cautiously.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential. See New Top 10 Stocks >>

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.