Introduction: The Brokerage Perspective

Investors often rely on the insight of Wall Street analysts when making decisions about a stock’s potential. The recent recommendations for Jabil (JBL) by brokerage firms indicate a Strong Buy sentiment, making it an enticing prospect for investors. But do these brokerage suggestions hold weight, and should they solely dictate investment decisions?

Jabil’s Brokerage Recommendation Overview

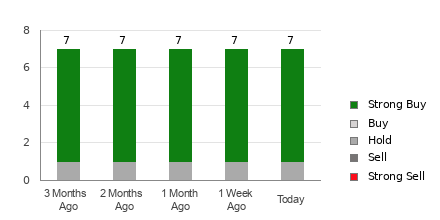

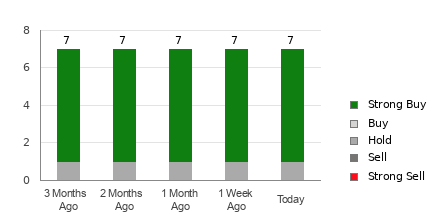

Jabil currently boasts an average brokerage recommendation (ABR) of 1.29, positioning it between Strong Buy and Buy on a scale of 1 to 5. Specifically, six out of seven brokerage firms have issued Strong Buy recommendations, accounting for 85.7% of all endorsements.

Explore Price Target & Stock Forecast for Jabil >>>

The Veracity of Brokerage Recommendations

While the ABR may project a favorable image for Jabil, it’s imperative to recognize the potential bias inherent in these brokerage recommendations. Numerous studies have indicated that brokerage suggestions may not be as adept at identifying stocks with the highest potential for price appreciation as one would hope.

Brokerage analysts operate with a notable positive bias due to their firms’ vested interests in the stocks they cover. As revealed through research, the prevalence of “Strong Buy” recommendations substantially outweighs “Strong Sell” endorsements, signifying a skewed assessment that may not align with retail investors’ best interests.

Equipped with these insights, it becomes evident that investors should view brokerage recommendations as secondary to their own research or complementary to other indicators, rather than relying solely on them for investment decisions.

Validating Through Zacks Rank

One robust alternative for investors is the Zacks Rank, a proprietary stock rating tool renowned for its audited track record. This model leverages earnings estimate revisions to categorize stocks into five categories, aligning them from Zacks Rank #1 (Strong Buy) to #5 (Strong Sell). Comparing the ABR with the Zacks Rank can serve as a pivotal step towards making informed and profitable investment choices.

Distinguishing ABR from Zacks Rank

It’s crucial to discern the disparity between the ABR and Zacks Rank. The former relies solely on brokerage recommendations and is often depicted with decimal values, while the Zacks Rank operates as a quantitative model, driven by earnings estimate revisions, and presented as whole numbers.

With analysts frequently exhibiting an overly optimistic bias in their recommendations, the Zacks Rank, harmonized with earnings estimate revisions, emerges as a more reliable indicator for gauging stock prices.

Furthermore, the Zacks Rank ensures equitability by proportionately applying its grades across all stocks, thereby bolstering its credibility as a timely and effective predictor of future stock prices.

Examining Jabil’s Prospects

An evaluation of Jabil’s earnings estimate revisions reveals a stagnant Zacks Consensus Estimate for the current year, standing firm at $9.11 for the past month. This steadfast consensus estimate reflects analysts’ unwavering perceptions of the company’s earnings outlook, warranting an astute assessment of the stock’s potential in the near term.

An amalgamation of factors has positioned Jabil with a Zacks Rank #3 (Hold) designation. This status, alongside related earnings estimate trends, advocates for a cautious approach to aligning with the Buy-equivalent ABR for Jabil.

Markedly, this underscores the significance of reinforcing investment decisions with supplementary factors beyond brokerage recommendations, elucidating the nuanced nature of market analysis.

Envisioning Growth in Semiconductor Stocks

Unraveling the landscape of semiconductor stocks, Jabil shines as a compelling contender amidst a burgeoning market propelled by robust earnings growth and the proliferation of Artificial Intelligence, Machine Learning, and the Internet of Things.

Its ascendancy parallels the anticipated surge in global semiconductor manufacturing, promising an exponential leap from $452 billion in 2021 to a projected $803 billion by 2028—portraying a thriving landscape for Jabil’s market presence and potential investor yield.

Gain Insider Access to This Stock Now for Free >>

Explore the Latest Recommendations from Zacks Investment Research >>>