Investors frequently lean on the recommendations provided by Wall Street analysts to inform their decisions on whether to Buy, Sell, or Hold a particular stock. Despite the media buzz that follows rating changes by these brokerage-firm employed analysts, the crucial question remains – how much weight do these recommendations truly carry?

Before diving into the veracity of brokerage recommendations and how investors can utilize them to their advantage, let’s delve into the insights from Wall Street regarding MongoDB (MDB).

Wall Street Sings Praises for MongoDB

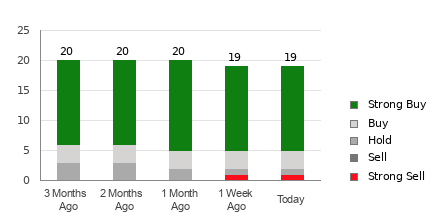

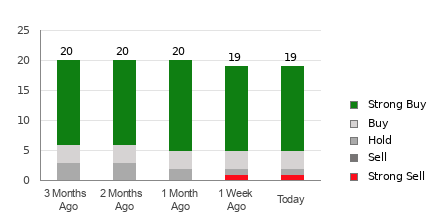

MongoDB presently boasts an average brokerage recommendation (ABR) of 1.56, positioned between Strong Buy and Buy on a scale of 1 to 5 (Strong Buy to Strong Sell). This ABR is calculated based on the aggregate of recommendations (Buy, Hold, Sell, etc.) from 27 brokerage firms. Among these, 19 recommendations stand at Strong Buy, while three are positioned at Buy, representing 70.4% and 11.1% of all recommendations, respectively.

Understanding Brokerage Recommendations: The Reality

Although the ABR signals a Buy for MongoDB, it’s unwise to base investment decisions solely on this metric. Research has demonstrated that brokerage recommendations possess limited efficacy in steering investors towards stocks with the greatest potential for price appreciation.

Why the skepticism? Brokerage analysts have a propensity to favor stocks they cover due to their vested interests, often resulting in a strong positive bias. For every “Strong Sell” recommendation, there are five “Strong Buy” recommendations – indicating that analysts’ interests may not consistently align with those of retail investors.

Hence, it’s prudent to utilize this information to validate one’s own research or consider it an indicator that complements a thorough analysis of a stock’s price movement.

Zacks Rank: A Reliable Yardstick

Contrastingly, Zacks Rank, a proprietary stock rating tool with a commendable externally audited track record, categorizes stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). Investors can leverage the ABR to corroborate the Zacks Rank, paving the way for astute investment decisions.

It’s imperative to note that despite both metrics being displayed within a 1-5 range, they are fundamentally different measures. Broker recommendations solely underpin the ABR and are typically displayed in decimals, while the Zacks Rank leverages a quantitative model to harness the power of earnings estimate revisions, thereby being displayed in whole numbers.

The Reality Check: ABR vs. Zacks Rank

Analysts employed by brokerage firms often exhibit an overly optimistic bias in their recommendations, driven by their employers’ vested interests. In contrast, the Zacks Rank hinges on earnings estimate revisions, demonstrating a robust correlation between trends in these revisions and near-term stock price movements.

Furthermore, the Zacks Rank applies its different grades proportionately across all stocks for which brokerage analysts provide current-year earnings estimates, thereby maintaining equilibrium among its five ranks.

Weighing the Prospects of MongoDB

In terms of earnings estimate revisions for MongoDB, the Zacks Consensus Estimate for the current year has seen a 0.5% increase over the past month, reaching $2.90. This optimistic outlook from analysts, backed by strong consensus in revising EPS estimates higher, forms a compelling argument for the stock’s potential surge in the near term.

With the recent surge in the consensus estimate, along with other earnings-related factors, MongoDB has been awarded a Zacks Rank #2 (Buy). Hence, the Buy-equivalent ABR for MongoDB may indeed offer valuable guidance for investors.

The popularity of MongoDB as an investment option seems to be gaining traction, and it’s essential for investors to consult multiple sources before making an informed decision about the stock.

It’s a game where the wise play cautiously, leveraging insights from multiple quarters to make sure they don’t lose their shirts down the line.

Get detailed insights from Zacks Investment Research before you place your bets.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.