On Monday, the S&P 500 eclipsed the coveted 6,000 mark, banking on the post-election rally. Donald Trump’s election victory has raised hopes of lower corporate taxes and deregulation, which helped the market benchmark to scale upward. The recent interest rate cuts by the Federal Reserve also boosted investors’ sentiment.

Thus, investors should make the most of the S&P 500’s upward trajectory by favoring profitable stocks over unprofitable ones. Investors should consider metrics like accounting ratios for performance assessment. We have selected the most successful and commonly used profitability ratio to evaluate a company’s performance.

To that end, NVIDIA Corporation NVDA, Insulet Corporation PODD and Howmet Aerospace Inc. HWM have been selected as the top picks with a high net income ratio.

Net Income Ratio

The net income ratio shows a company’s profitability level. It reflects the percentage of net income to total sales revenues. Using the net income ratio, one can determine a firm’s effectiveness in meeting operating and non-operating expenses from revenues. A higher net income ratio usually implies a company’s ability to generate ample revenues and successfully manage all business functions.

Screening Parameters Using Research Wizard:

The net income ratio is not the only indicator of future winners. So, we have added a few more criteria to arrive at a winning strategy.

Zacks Rank Less than or equal to 2: Whether the market is good or bad, stocks with a Zacks Rank #1 (Strong Buy) or 2 (Buy) have a proven history of outperformance. You can see the complete list of today’s Zacks #1 Rank stocks here.

Trailing 12-Month Sales and Net Income Growth Higher than X Industry: Stocks that have witnessed higher-than-industry sales and net income growth in the past 12 months are positioned to perform well.

Trailing 12-Month Net Income Ratio Higher than X Industry: A high net income ratio indicates a company’s solid profitability.

Percentage Rating Strong Buy greater than 70: This indicates that 70% of the current broker recommendations for the stock are Strong Buy.

These few parameters have narrowed the universe of more than 7,685 stocks to only 35.

Here are three of the 35 stocks that qualified for the screening:

NVIDIA

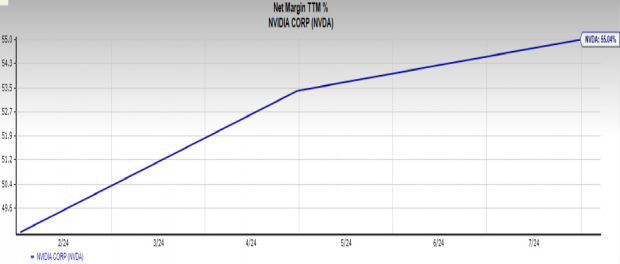

NVIDIA Corporation leads in visual computing technologies and invented the graphic processing unit or GPU. The 12-month net profit margin of NVDA is 55%.

Image Source: Zacks Investment Research

The company’s expected earnings growth rate for the current year is 116.9%. NVIDIA Corporation currently has a Zacks Rank #2 (read more: NVIDIA Tops $3.5T Milestone – Good Time to Buy NVDA Stock?).

Insulet

Insulet is a leading developer, manufacturer and marketer of the Omnipod Insulin Management System. The 12-month net profit margin of PODD is 21.2%.

Image Source: Zacks Investment Research

The company’s expected earnings growth rate for the current year is 12.7%. Insulet currently has a Zacks Rank #2.

Howmet Aerospace

Howmet Aerospace offers engineered solutions for customers in the transportation and aerospace industries. The 12-month net profit margin of HWM is 14.8%.

Image Source: Zacks Investment Research

The company’s expected earnings growth rate for the current year is 41.9%. Howmet Aerospace currently has a Zacks Rank #2.

You can get the rest of the stocks on this list by signing up now for your 2-week free trial to the Research Wizard and start using this screen in your own trading. Further, you can also create your own strategies and test them first before taking the investment plunge.

The Research Wizard is a great place to begin. It’s easy to use. Everything is in plain language. And it’s very intuitive. Start your Research Wizard trial today. And the next time you read an economic report, open up the Research Wizard, plug your finds in, and see what gems come out.

Click here to sign up for a free trial to the Research Wizard today.

Disclosure: Officers, directors and/or employees of Zacks Investment Research may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material. An affiliated investment advisory firm may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material.

Disclosure: Performance information for Zacks’ portfolios and strategies are available at: https://www.zacks.com/performance.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Howmet Aerospace Inc. (HWM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.