C3.ai: Can This AI Firm Regain Its Lost Value?

Nearly four years have passed since C3.ai (NYSE: AI) made its debut on the stock market. Unfortunately, its performance since the initial public offering (IPO) has been disappointing, with shares plummeting 72% in value.

Initially, the stock saw a boost in early 2023, driven by growing excitement over artificial intelligence (AI) technology. However, those gains have since diminished. The year 2024 has mirrored this pattern for C3.ai investors; after a promising start, the stock is down 8% as of now. In contrast, another AI software firm, Palantir Technologies, experienced a remarkable 162% increase in its stock price this year, fueled by rising demand for its AI software platforms.

So, is there potential for C3.ai to rebound and transform into a worthwhile investment over the next five years? Let’s explore.

Bright Prospects in a Booming AI Market

The demand for AI software platforms is projected to grow at an extraordinary annual rate of nearly 41% over the next five years, as reported by market research firm IDC. Specifically, the market size is expected to soar to $153 billion by 2028, up from $28 billion last year. Therefore, there remains hope for C3.ai’s recovery, especially considering that it operates in a market still in the early stages of development.

The company’s recent struggles can be attributed to a shift in its business model from a subscription-based service to a consumption-oriented model, a move made in August 2022. This transition began impacting growth negatively in the second half of 2022.

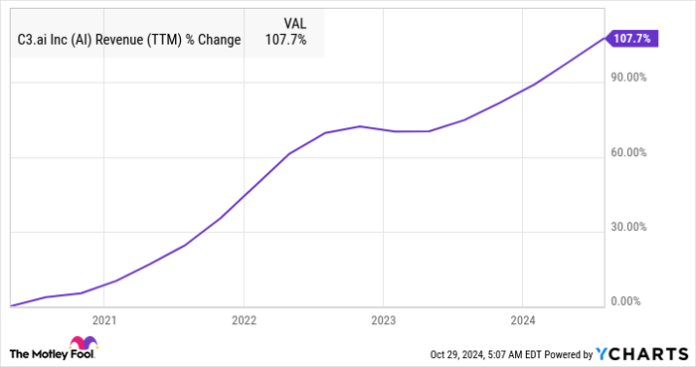

AI Revenue (TTM) data by YCharts

Management indicated during that period that it would take roughly seven quarters for the new business model to gain traction and return to previous revenue growth levels. The company’s recent results show this strategy may be taking effect.

In September, C3.ai reported its fiscal 2025 first-quarter results, which included a 21% year-over-year revenue increase to $87.2 million. This marks an improvement compared to the 16% revenue growth of fiscal 2024, which totaled $310.6 million.

For fiscal 2025, C3.ai’s revenue outlook of between $370 million to $395 million suggests a potential 23% year-over-year increase at the midpoint, indicative of positive momentum resulting from the recent business model shift.

The move to a consumption-based model has lowered barriers for clients interested in deploying generative AI applications. In the past, customers needed to commit to subscription contracts, which required lengthy negotiations. Now, under the pay-as-you-go system, clients only pay for what they use, leading to a spike in pilot projects. In the first quarter of fiscal 2025, C3.ai reported 52 pilot projects, compared to 24 in the same period last year.

Additionally, the number of deals signed has significantly increased. C3.ai secured 71 deals in the latest quarter, a sharp rise from just 32 in the same quarter last year. Notably, a substantial portion of these contracts now comes from federal agencies.

During the September earnings call, management announced several expansion agreements with the United States Air Force, U.S. Navy, U.S. Marine Corps, and U.S. Intelligence Community among others. Federal agencies accounted for over 30% of the company’s bookings, signaling its growing influence in this competitive sector, traditionally dominated by Palantir.

Analysts express optimism about C3.ai’s future, anticipating it will experience healthy revenue growth over the next few years.

AI Revenue Estimates for Current Fiscal Year data by YCharts

C3.ai’s economic indicators appear to be improving as well. Its revenue is growing faster than its expenses, as illustrated below.

AI Total Expenses (Quarterly) data by YCharts

The chart indicates that C3.ai’s expenses are declining, a positive sign for future profitability.

Positive Earnings Growth May Lead to Promising Gains

The combination of strong revenue growth and a more favorable cost structure is likely to help C3.ai move toward long-term profitability. Analysts currently forecast an adjusted loss of $0.54 per share for this fiscal year, but that figure is expected to improve in the next fiscal year.

AI EPS Estimates for Current Fiscal Year data by YCharts

More importantly, C3.ai is projected to reach non-GAAP profitability within a couple of fiscal years. Analysts anticipate that its bottom line will improve at an annual rate of nearly 51% over the next five years. For comparison, Palantir’s earnings are expected to grow at a rate of 57% over the same period.

A significant distinction between these two AI firms lies in their valuations. C3.ai is currently priced at 9.4 times its sales, while Palantir’s price-to-sales ratio is a steep 43.

As a result, C3.ai presents an appealing opportunity for investors. With accelerating growth, a reasonable valuation, and increasing earnings potential, the stock may recover from its past setbacks and provide considerable gains in the coming five years.

Is C3.ai a Smart $1,000 Investment Today?

Before investing in C3.ai, take this into account:

The Motley Fool Stock Advisor analyst team has identified what they consider the 10 best stocks to invest in right now—and C3.ai did not make the list. The selected stocks are expected to yield substantial returns in the future.

For instance, if Nvidia had been on this list back on April 15, 2005, a $1,000 investment would have grown to an astonishing $829,746!*

Stock Advisor simplifies the investment process, offering guidance on portfolio development, regular updates, and two new stock picks each month. Since its inception in 2002, the Stock Advisor service has more than quadrupled the S&P 500’s returns.*

Discover the 10 top stocks »

*Stock Advisor returns as of October 28, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool recommends C3.ai. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.