C3.ai Faces Challenges but Maintains Strong Growth Potential

C3.ai shares have decreased by 11.6% over the past year, contrasting sharply with a 26.3% increase in the Zacks Computers – IT Services industry and a 36.7% rise in the broader Zacks Computer & Technology sector.

This underperformance can largely be attributed to intense competition in the enterprise AI market, coupled with C3.ai’s aggressive investment strategy to improve market share. Consequently, profit margins are anticipated to remain under pressure for the near future.

Nonetheless, C3.ai’s growing client base and the increasing adoption of its Enterprise AI software provide encouraging signals for potential investors.

These positive trends are evident in the company’s first-quarter fiscal 2025 results, which showcased robust revenue growth with a 21% year-over-year increase, totaling $87.2 million.

Year-to-Date Performance Highlights

Image Source: Zacks Investment Research

Strengthened Partnerships Enhance C3.ai’s Outlook

C3.ai has emerged as a key player in the AI sector, spurred by rising demand for its C3 Generative AI solutions and an expanding partner network that includes major cloud providers like Amazon AMZN, Alphabet GOOGL, and Microsoft MSFT.

In July, the company earned the AWS Generative AI Competency, underscoring its capabilities in enhancing customer experiences and streamlining processes across various sectors. This accolade has bolstered its collaboration with Amazon.

During the first quarter of fiscal 2025, C3.ai partnered with Alphabet’s Google Cloud to complete 40 agreements, representing a remarkable 300% increase compared to the previous year. This surge was fueled by C3 AI’s State & Local Government Suite, which includes applications like C3 AI Property Appraisal and C3 Generative AI for Government Benefits, with 24 agreements finalized with local and state governments.

Furthermore, C3.ai’s collaboration with Microsoft has strengthened its AI offerings via the Azure platform, broadening its reach to various customer sectors.

The expansion of partnerships with these cloud giants bodes well for C3.ai’s future. In the first quarter of fiscal 2025, the company secured 51 agreements through its partner network, accounting for 72% of total agreements, reflecting a 155% year-over-year increase. Bookings driven by these partnerships jumped by 94% compared to the previous year.

Diverse Portfolio Fuels Growth Potential

C3.ai’s expanding AI portfolio has been crucial to its success. In October, the company announced a rebranding of its Asset Performance Suite, a set of AI applications designed to enhance asset value and improve sustainability for enterprises.

In the first quarter of fiscal 2025, C3.ai successfully piloted its newly launched C3 Generative AI for Government Programs with a state in the Northeastern U.S., providing streamlined access to public benefits in areas like healthcare and education. This initiative enhances contact center operations by improving response times and accuracy.

Positive Revenue Projections for Fiscal 2025

For fiscal 2025, C3.ai anticipates revenues in the range of $370 million to $395 million, indicating a year-over-year growth of 19% to 27%. However, the company still expects a non-GAAP operating loss between $95 million and $125 million.

Looking ahead to the second quarter of fiscal 2025, C3.ai forecasts revenues between $88.6 million and $93.6 million, with non-GAAP losses projected between $26.7 million and $34.7 million.

The Zacks Consensus Estimate estimates fiscal 2025 revenues to be $383.04 million, suggesting a year-over-year growth of 28%. Predictions for losses sit at 53 cents per share, consistent over the past month.

For the second quarter of fiscal 2025, the current Zacks Consensus Estimate places revenues at $91.01 million, reflecting a 24.28% increase compared to the same period last year.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

C3.ai, Inc. Price and Consensus

C3.ai, Inc. price-consensus-chart | C3.ai, Inc. Quote

Should Investors Consider C3.ai Stock?

Currently, C3.ai stocks are not considered a bargain, as indicated by a Value Score of F, suggesting a high valuation at this time.

However, strong demand for C3 Generative AI solutions and an expanding partner base support ongoing revenue growth, enhancing future prospects.

For investors already holding the stock, the company’s growth potential could prove beneficial in the long run.

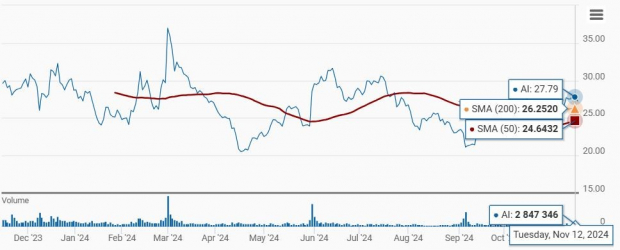

Additionally, technical indicators favor a positive outlook as C3.ai shares trade above both the 50-day and 200-day moving averages, signaling strong upward momentum.

AI Stock Above Key Moving Averages

Image Source: Zacks Investment Research

C3.ai currently holds a Zacks Rank #2 (Buy) and has a Growth Score of A, presenting a compelling investment opportunity based on Zacks’ proprietary methodology. For more insights, see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Explore: 5 Stocks Benefiting from Infrastructure Investment

Trillions in federal funding earmarked for U.S. infrastructure projects are expected to boost sectors including roads, bridges, and AI data centers.

Discover five surprising stocks that are poised to benefit significantly from this investment wave.

Download *How to Profit from the Trillion-Dollar Infrastructure Boom* for free today.

Want the latest recommendations from Zacks Investment Research? Download *5 Stocks Set to Double* for access to this free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

C3.ai, Inc. (AI): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.