Is C3.ai Poised to Be the Next AI Star After Palantir’s Rise?

While major tech giants like Microsoft, Nvidia, and Tesla dominate discussions around artificial intelligence (AI), a lesser-known company, Palantir Technologies, made waves in 2024. With a remarkable 350% increase in share prices, Palantir became the top gainer in the S&P 500 (SNPINDEX: ^GSPC).

This explosive growth has led investors to seek the next Palantir. Enter C3.ai (NYSE: AI). Could this smaller AI software firm capture the same success in 2025?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy now. See the 10 stocks »

Examining C3.ai’s Business Landscape

The enterprise software sector is fiercely competitive. One strategy smaller companies use is forming partnerships with larger players. In its second quarter of fiscal 2025 (ending October 31), C3.ai completed over 60% of its deals through partnerships.

C3.ai collaborates with major cloud services like Microsoft, Amazon, and Alphabet, as well as consulting firms like Booz Allen Hamilton and Capgemini.

This diverse network of partnerships lets C3.ai expand into various markets. Recent financial results showed that nearly half of its new bookings came from aerospace and defense, with another 30% spread across sectors like manufacturing, energy, and life sciences.

The following table shows C3.ai’s annual revenue growth rates over the past few quarters:

| Category | Q1 Fiscal 2024 | Q2 Fiscal 2024 | Q3 Fiscal 2024 | Q4 Fiscal 2024 | Q1 Fiscal 2025 | Q2 Fiscal 2025 |

|---|---|---|---|---|---|---|

| Revenue growth rate % year over year | 11% | 17% | 18% | 20% | 21% | 29% |

Data source: C3.ai investor relations.

In just over a year, C3.ai has significantly improved its revenue growth rate, which now matches Palantir’s. This is an encouraging sign for the company.

With this impressive trajectory, you might assume that C3.ai’s stock is surging. However, that’s not the case.

Image source: Getty Images.

C3.ai’s Relative Valuation

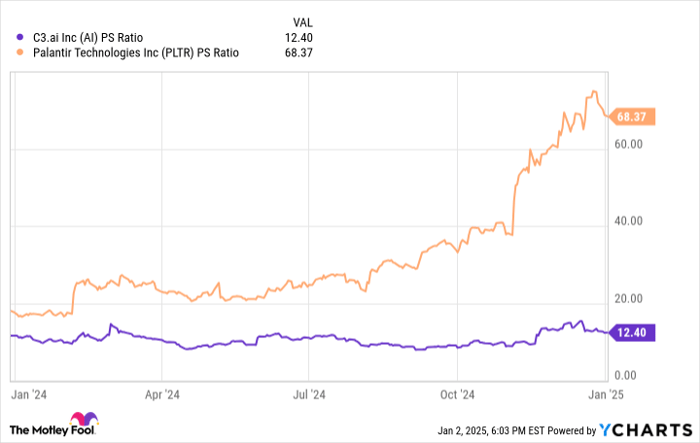

The following chart compares the price-to-sales (P/S) ratios of Palantir and C3.ai:

AI PS Ratio data by YCharts

It’s clear that Palantir’s stock has experienced a significant valuation increase, with its P/S ratio nearly six times higher than C3.ai’s. While Palantir is profitable, C3.ai still operates at a loss. However, Palantir’s price-to-earnings (P/E) ratio stands at nearly 400, indicating it is valued more on sales growth rather than earnings.

Should You Consider Investing in C3.ai?

Palantir has rallied among AI investors, but its high valuation brings concerns. The bar for success is set high, and any missteps could lead to a drop in its stock price.

In contrast, C3.ai is just starting to gain momentum. Its revenues are consistently growing, net losses are reducing, and its partnership model appears effective.

That said, C3.ai won’t truly take off unless it becomes profitable, which management suggests could take a few more years.

While there is potential for C3.ai in the short term, investing here is speculative. For those who can endure some risk and hold their investment for a few years, it may be worth considering. However, it’s advisable to limit any investment in C3.ai at this stage, as the path ahead remains uncertain.

Seize This Opportunity Before It’s Too Late

Have you ever felt like you missed the chance to invest in successful stocks? If so, listen closely.

Sometimes, our analysts identify a “Double Down” stock—a company they think is on the brink of significant growth. If you’re worried about missing out, now might be the perfect time to invest. The following examples demonstrate the potential:

- Nvidia: A $1,000 investment when we doubled down in 2009 would be worth $374,613!*

- Apple: If you invested $1,000 in 2008, you’d now have $46,088!*

- Netflix: Investing $1,000 in 2004 would have turned into $475,143!*

Currently, we are highlighting three extraordinary companies as “Double Down” stocks, and this may be a rare chance.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, Nvidia, Palantir Technologies, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, Nvidia, Palantir Technologies, and Tesla. The Motley Fool recommends Booz Allen Hamilton and C3.ai and holds certain options in Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.