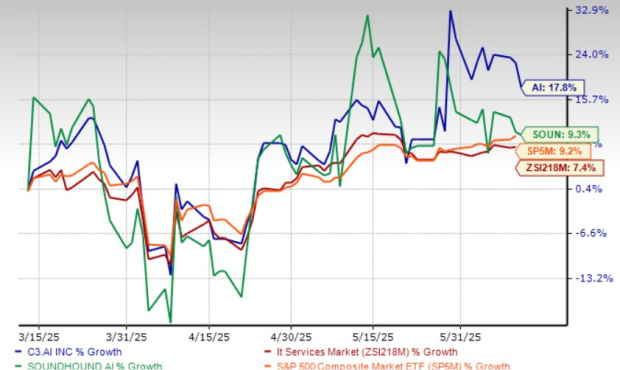

C3.ai, Inc. (AI) and SoundHound AI, Inc. (SOUN) are experiencing notable stock performance, with C3.ai shares climbing 17.8% and SoundHound rising 9.3% over the past three months, surpassing industry growth of 7.4% and the S&P 500 increase of 9.2%. C3.ai has developed a library of over 130 enterprise-grade AI applications and recently secured a $450 million ceiling contract with the U.S. Air Force, enhancing its government partnerships.

In contrast, SoundHound’s revenues surged 151% year-over-year to $29.1 million in Q1 2025, driven by acquisitions and enterprise partnerships. The company holds $246 million in cash with no debt, yet reported an adjusted EBITDA loss of $22.2 million in the same quarter. Analysts project losses per share will narrow for both companies, with C3.ai trading at a lower price-to-sales ratio of 6.87 compared to SoundHound’s 21.25, suggesting a more attractive valuation for C3.ai.

C3.ai holds a Zacks Rank of #2 (Buy), while SoundHound is at #3 (Hold), indicating stronger investment sentiment towards C3.ai as it capitalizes on its enterprise AI market positioning and growing federal contracts.