Cardinal Health Reports Q3 Earnings Beat Despite Flat Revenue

Cardinal Health, Inc. (CAH) announced its third-quarter fiscal 2025 results, revealing adjusted earnings per share (EPS) of $2.35. This figure surpassed the Zacks Consensus Estimate of $2.15 by 9.3% and increased by 12.4% year-over-year. Additionally, GAAP EPS rose to $2.10, up from $1.07 during the same period last year.

Revenue Overview

Total sales remained flat year-over-year at $54.89 billion, falling slightly short of the Zacks Consensus Estimate by 0.2%.

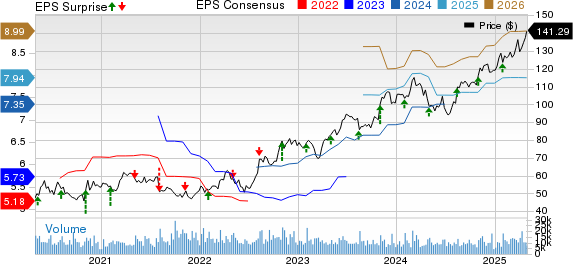

Cardinal Health, Inc. Price, Consensus, and EPS Surprise

Cardinal Health, Inc. price-consensus-eps-surprise-chart | Cardinal Health, Inc. Quote

Segment Performance

Pharmaceutical and Specialty Solutions

In the Pharmaceutical segment, revenues dipped 0.4% to $50.4 billion compared to the previous year. The slight decline was primarily due to a contract expiration with OptumRx in June 2024, though sales from existing and new customers rose by 20% when adjusting for this loss. Profit for the segment reached $662 million, marking a 14% increase year-over-year, fueled by growth in brand and specialty products, as well as favorable performance in generics programs.

Global Medical Products and Distribution

This segment generated revenues of $3.2 billion, a 2% year-over-year increase, primarily driven by volume growth from current customers. Profit improved to $39 million, up from $22 million a year earlier, thanks to cost optimization efforts.

Other Segments

Including at-Home Solutions, Nuclear and Precision Health Solutions, and OptiFreight Logistics, this category saw sales reach $1.3 billion, increasing 13% from the previous year. Profit grew to $134 million, a noteworthy 22% boost from last year, reflecting strong performances across its operational segments.

Margin Insights

Gross profit increased by 9.7% year-over-year, totaling $2.12 billion. The gross margin for the quarter stood at 3.9%, an increase of nearly 30 basis points from the prior year. Distribution and administrative expenses rose to $1.32 billion, a 3.6% increase year-over-year.

Operating income also saw significant improvements, amounting to $730 million, a nearly 98% increase from the previous year. Adjusted operating income rose by 21% to reach $807 million.

Financial Snapshot

At the end of the quarter, Cardinal Health held cash and cash equivalents totaling $3.33 billion, down from $3.81 billion at the end of the previous quarter. Net cash from operating activities amounted to $2.91 billion, a marked improvement compared to a net cash outflow of $27 million a year prior.

Updated Fiscal 2025 Guidance

Cardinal Health revised its fiscal 2025 earnings forecast to an adjusted EPS range of $8.05 to $8.15, up from previous guidance of $7.85-$8.00, against a Zacks Consensus Estimate of $7.94.

The company anticipates Pharmaceutical segment revenues to decline by 4-6% year-over-year, while segment profit is expected to grow by 11.5-12.5%, an adjustment from 10-12%. Medical segment revenues are projected to increase by 3-5%, with segment profits likely reaching $130-$140 million, revised from a prior estimate of $130-$150 million. Revenues from the Other segment are anticipated to grow 10-12%, with profits rising by 16-18%, an upgrade from nearly 10%.

Looking ahead to fiscal 2026, Cardinal Health expects EPS growth in double digits, supported by strong profit growth in its Pharmaceutical and Specialty Solutions segments, along with at-Home Solutions. The Medical segment’s profits are projected to be consistent with the fiscal 2025 levels.

Conclusion

While Cardinal Health’s fiscal third quarter showed mixed outcomes with earnings exceeding estimates but revenues falling short, it continues to observe strong demand for its Pharmaceutical and Specialty solutions. Growth from existing customers nearly compensated for lost sales related to the OptumRx contract expiration, and robust profit increases across all segments appear promising.

Shares of CAH rose 0.5% in pre-market trading post-announcement. To date, the company has seen a share price increase of 19.5% this year, contrasting with a modest 0.9% growth in its industry and a 5.7% decline in the S&P 500 Index over the same timeframe.

Going forward, CAH’s medical products, at-Home Solutions, Nuclear and Precision Health Solutions, and OptiFreight Logistics are expected to drive revenue growth. The recent acquisition of Advanced Diabetes Supply Group is anticipated to enhance CAH’s at-home business presence, while a partnership with GE HealthCare for the Flyrcado PET agent is expected to generate additional revenue. However, concerns about intense competition and customer concentration remain.

CAH’s Zacks Rank and Insights

Key Medical Stocks to Watch: Growth and Earnings Prospects

Currently, Cardinal Health holds a Zacks Rank of #2 (Buy).

Other Noteworthy Stocks in the Medical Sector

Additionally, several highly-ranked stocks within the medical industry include Fresenius Medical Care (FMS), Masimo (MASI), and AdaptHealth (AHCO).

Fresenius Medical, also rated #2 by Zacks, boasts an impressive estimated growth rate of 28.9% for 2025. The company has exceeded earnings estimates in three of the last four quarters, yielding an average surprise of 15.67%. Investors can look forward to the first-quarter results, expected next month. FMS shares have risen 12.1% year-to-date.

Masimo shares, carrying a Zacks Rank of #2, have an estimated growth rate of 20% for 2025. The company has consistently beaten earnings expectations over the last four quarters, achieving an impressive average surprise of 14.41%. Year-to-date, MASI shares have increased by 58.5%, far outpacing the industry average of 3.9%. The first-quarter results are anticipated in May.

On the other hand, Masimo shares have declined 2.6% so far this year.

AdaptHealth, rated #2 by Zacks, has an expected earnings growth rate of 16.7% for 2025. The company has surpassed estimates in three of the past four quarters, yet has delivered an average negative surprise of 4.17%. First-quarter results are also expected next month, though AHCO shares have dropped 10.6% year-to-date.

Additional Stock Insights

Zacks’ Research Chief has recently highlighted a stock with a strong potential to double in value. This stock belongs to a cutting-edge financial firm, which has attracted a growing customer base of over 50 million. The forecasts for this stock are optimistic, drawing comparisons to previous successful stocks like Nano-X Imaging, which surged 129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Stay updated with the latest recommendations from Zacks Investment Research.

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

Fresenius Medical Care AG & Co. KGaA (FMS) : Free Stock Analysis Report

AdaptHealth Corp. (AHCO) : Free Stock Analysis Report

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.