Analyst Insights: Upside Potential for iShares Paris-Aligned Climate MSCI USA ETF

In our latest examination of ETFs at ETF Channel, we analyzed the current trading prices of underlying holdings against analysts’ average 12-month target prices. Our findings indicate that the iShares Paris-Aligned Climate MSCI USA ETF (Symbol: PABU) has an implied analyst target price of $73.29 per unit.

Potential Growth for PABU

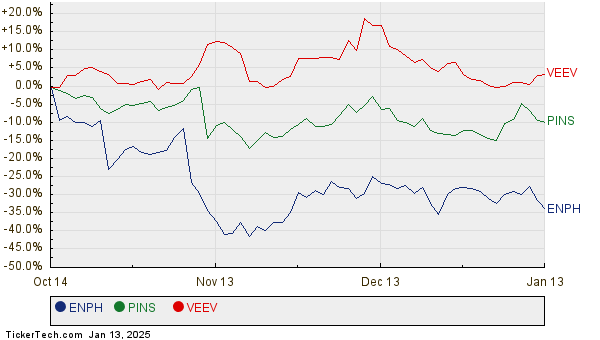

PABU is trading at approximately $63.94 per unit, suggesting a potential upside of 14.63% based on analyst predictions. Among PABU’s underlying holdings, three stand out due to their significant upside potential: Enphase Energy Inc. (Symbol: ENPH), Pinterest Inc. (Symbol: PINS), and Veeva Systems Inc. (Symbol: VEEV). ENPH is currently priced at $66.74 but has an average analyst target of $96.50, representing an upswing of 44.59%. Similarly, PINS, trading at $30.66, could see a 31.78% increase if it reaches the average target price of $40.40. Lastly, analysts expect VEEV to rise to $269.42, which is 23.73% above its recent price of $217.75. The twelve-month price history for these stocks illustrates their performance trend:

Current Analyst Recommendations

Here’s a summary of the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Paris-Aligned Climate MSCI USA ETF | PABU | $63.94 | $73.29 | 14.63% |

| Enphase Energy Inc. | ENPH | $66.74 | $96.50 | 44.59% |

| Pinterest Inc | PINS | $30.66 | $40.40 | 31.78% |

| Veeva Systems Inc | VEEV | $217.75 | $269.42 | 23.73% |

Understanding Analyst Price Targets

Are analysts being optimistic with these targets, or do they hold valid justifications for their forecasts? High price targets can signal optimism but may also lead to potential downgrades if targets become unrealistic over time. Investors need to conduct thorough research to understand these evaluations and the market conditions driving them.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Steven Cohen Stock Picks

• Institutional Holders of Altria Group

• SCHN Price Target

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.