Egg-citing yet Challenging Times for CalMaine Foods

CalMaine Foods, Inc. CALM recently unveiled its earnings for the third quarter of fiscal 2024, drawing mixed reactions from investors and analysts alike. The numbers revealed a decline in both earnings and sales, a stark contrast to the previous year’s robust performance, signaling the volatile nature of the egg market.

A Crack in the Numbers: Earnings & Sales Plummet

With earnings per share plummeting by 55% to $3.00 compared to the same period last year, it’s evident that CalMaine Foods faced significant challenges in the current market environment. Sales also took a hit, dropping by 29.5% year over year to $703 million in the third quarter of fiscal 2024. This decline can be directly attributed to a sharp drop in egg prices compared to the record-high prices seen in the previous year.

What Goes Up, Must Come Down: Prices & Volumes

The drastic decline in the net average selling price per dozen of eggs, from $3.298 to $2.247, portrays the market volatility in the egg industry. Despite record sales volumes of 300.8 million total dozens, with conventional and specialty eggs both experiencing growth, it was not enough to offset the impact of plummeting prices.

Operational Challenges & Financial Implications

The company’s operational update reflects the strain of the market conditions, with a 53% decrease in gross profit compared to the previous year. Operating profit also took a hit, dropping to $163 million from $408 million in the same quarter of fiscal 2023. The decline in profits was primarily driven by lower market prices, offset only partially by gains from reduced feed ingredient costs.

Shells of Opportunities Amidst Challenges

Not all news is bleak for CalMaine Foods, as the company continues to explore opportunities for growth and expansion. The integration of acquired assets and the recent acquisition of a broiler processing plant demonstrate the company’s strategic initiatives to adapt to changing market dynamics and diversify its operations.

Unforeseen Hurdles: HPAI Outbreak Disrupts Operations

Amidst the financial challenges, CalMaine Foods faced unexpected setbacks with the outbreak of Highly Pathogenic Avian Influenza (HPAI) at its facilities in Kansas and Texas. This led to the depopulation of a significant number of laying hens and pullets, disrupting production and necessitating swift action in accordance with USDA protocols.

Despite the hurdles faced, CalMaine Foods remains committed to its shareholders, as demonstrated by the announcement of a cash dividend of $1.00 per share. The company’s variable dividend policy reflects its dedication to sharing profits with stakeholders whenever quarterly net income allows.

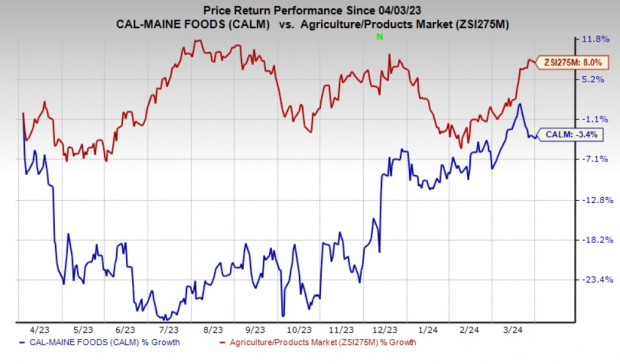

Looking Ahead: Stock Performance & Strategic Moves

Sentiments regarding CalMaine Foods’ performance are reflected in its stock performance, which declined by 3.4% over the past year. Nevertheless, with strategic acquisitions and a focus on operational efficiency, the company aims to navigate through the challenges and emerge stronger in the competitive egg market.

Future Outlook & Stocks to Watch

While the road ahead may be challenging, CalMaine Foods continues to focus on growth and resilience in the face of market uncertainties. Investors eyeing the basic materials sector may also find potential in stocks like Ecolab Inc. and Carpenter Technology Corporation, which have shown promise in the current market landscape.

Conclusion

In conclusion, the tale of CalMaine Foods’ third-quarter results captures the essence of the dynamic and volatile egg market, where prices can fluctuate dramatically, and unexpected challenges can disrupt operations. Through strategic initiatives, operational efficiency, and a focus on shareholder value, the company aims to weather the storm and emerge stronger in the ever-evolving industry.