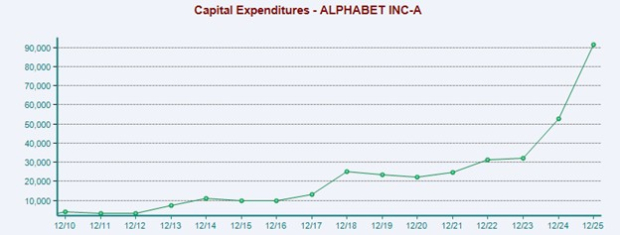

Broadcom (NASDAQ: AVGO) has seen a 125% surge in stock price from $110 in early 2024, raising questions about its potential to exceed $500 in the coming years. The primary driver fueling this growth is the shift towards AI-related semiconductors, now accounting for over 50% of its sales, with a serviceable addressable market estimated between $15-20 billion. The custom chip market is projected to triple by 2028 to approximately $55 billion, as demand for specialized silicon rises among hyperscalers.

Broadcom is establishing partnerships with major players like OpenAI and Apple for AI chip development, indicating a diversified revenue base. With OpenAI’s annual recurring revenue growing to over $10 billion, demand for inference chips is soaring. Additionally, Broadcom’s latest Tomahawk 6 networking chip and co-packaged silicon photonics technology are designed to meet the needs of the evolving AI infrastructure.

Broadcom’s revenue is expected to grow at a high teens average annual rate, possibly surpassing $100 billion by 2029. Currently priced at around $265, Broadcom’s stock trades at 45 times its trailing twelve months earnings. To maintain this valuation multiple, the company would need to achieve sustained 40%+ annual revenue growth in AI sectors and expand its market share in custom silicon, while also managing risks related to customer concentration and macroeconomic vulnerabilities.