Investing in the Grayscale Bitcoin Trust ETF: A Safer Way to Potential Riches

You don’t have to identify the next Amazon or strike it lucky with a lottery ticket stock to earn significant money from investing. While some might get fortunate, there are more reliable avenues to financial success. One of these paths involves exchange-traded funds (ETFs), which can help diversify your investments and potentially build wealth.

Bitcoin has been a source of wealth creation for many, but it comes with complexities. This is where the Grayscale Bitcoin Trust ETF (NYSEMKT: GBTC) steps in. Launched in 2013 for institutional and accredited investors, it began trading over the counter in 2015 and made its way to the NYSE Arca in January 2024, officially becoming a spot Bitcoin ETF.

This ETF offers the simplicity of investing, paired with the growth potential of Bitcoin.

Grayscale Bitcoin Trust vs. Direct Bitcoin Ownership

An ETF is essentially a collection of assets, often stocks, traded under a single ticker. Grayscale Bitcoin Trust ETF directly buys Bitcoin, securely holding it in cold storage, with shares reflecting the value of the underlying Bitcoin. This allows investors to gain exposure to Bitcoin without the need to own it personally.

Why opt for this instead of buying Bitcoin directly? The answer often lies in safety and convenience. Purchasing Bitcoin requires setting up accounts with exchanges or wallets, which come with risks like forgetting unique passwords. Many have witnessed issues with exchanges, such as the collapse of FTX.

Conversely, investing in the Grayscale Bitcoin Trust allows you to buy or sell through your stock brokerage account, with the ETF managing the secure storage of Bitcoin for you.

The Value Proposition of Bitcoin and Its ETF

Many individuals are drawn to Bitcoin’s impressive returns over the last decade, even if they’re unsure about its underlying value.

The key reason to invest in Bitcoin is its role as an anti-inflationary digital asset. Think of it as a virtual gold; while you can’t spend gold in many shops, it holds inherent value due to widespread desire.

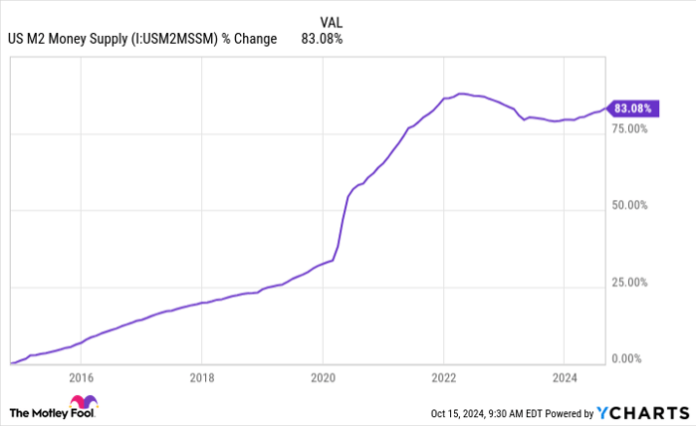

Importantly, Bitcoin has a capped supply. Although mining increases the number of Bitcoins, the maximum limit is 21 million, and the rate of new Bitcoin creation decreases over time. Meanwhile, the amount of U.S. dollars in circulation is expanding rapidly, contributing to recent inflation trends.

US M2 Money Supply data by YCharts.

With the U.S. government running deficits—spending more than it earns in taxes—the resulting borrowing inflates the money supply, which indirectly fuels inflation. As society increasingly adopts Bitcoin, the demand for it, coupled with these economic factors, could continue to drive its price upward.

Can the ETF Help You Build Wealth?

However, investing in the Grayscale Bitcoin Trust ETF does not come without costs. It charges a 1.5% expense ratio for managing Bitcoin assets, which means the ETF may not perform as strongly as Bitcoin itself since it buys Bitcoin regularly at varying prices.

Bitcoin Price data by YCharts.

Despite this, the ETF has outperformed the S&P 500 significantly since trading began, with an astonishing 11,000% return transforming smaller investments into substantial wealth.

Will this trend continue? Speculation remains, but the monetary policy that has benefitted Bitcoin remains in effect. Since deviating from the gold standard in 1971, the U.S. money supply has steadily increased, suggesting a continued upward trajectory for Bitcoin—albeit volatile and unpredictable.

Overall, the potential for significant returns makes the Grayscale Bitcoin Trust ETF an appealing option that offers an easier alternative to direct Bitcoin ownership. Consider adding ETF shares as part of a well-diversified, long-term investment strategy.

Should You Invest $1,000 in Grayscale Bitcoin Trust (BTC) Now?

Before proceeding with an investment in Grayscale Bitcoin Trust (BTC), take this into account:

The Motley Fool Stock Advisor team has recently highlighted what they consider the 10 best stocks to invest in right now… and Grayscale Bitcoin Trust wasn’t included. The selected stocks promise strong potential for returns in the future.

Reflecting on when Nvidia was recommended on April 15, 2005… if you invested $1,000 at that time, you would now have $845,679!*

Stock Advisor offers investors a straightforward guide for building a successful portfolio, providing ongoing updates from analysts, and features two new stock picks monthly. Since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500*.

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Bitcoin. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.